26 July 2012

2QCY11 Results Update | Sector: Information Technology

Patni Computer Systems

BSE SENSEX

S&P CNX

18,871

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,680

PATNI IN

130.4

510/306

-7/-30/-34

42.0

0.9

CMP: INR459

TP: INR337

Neutral

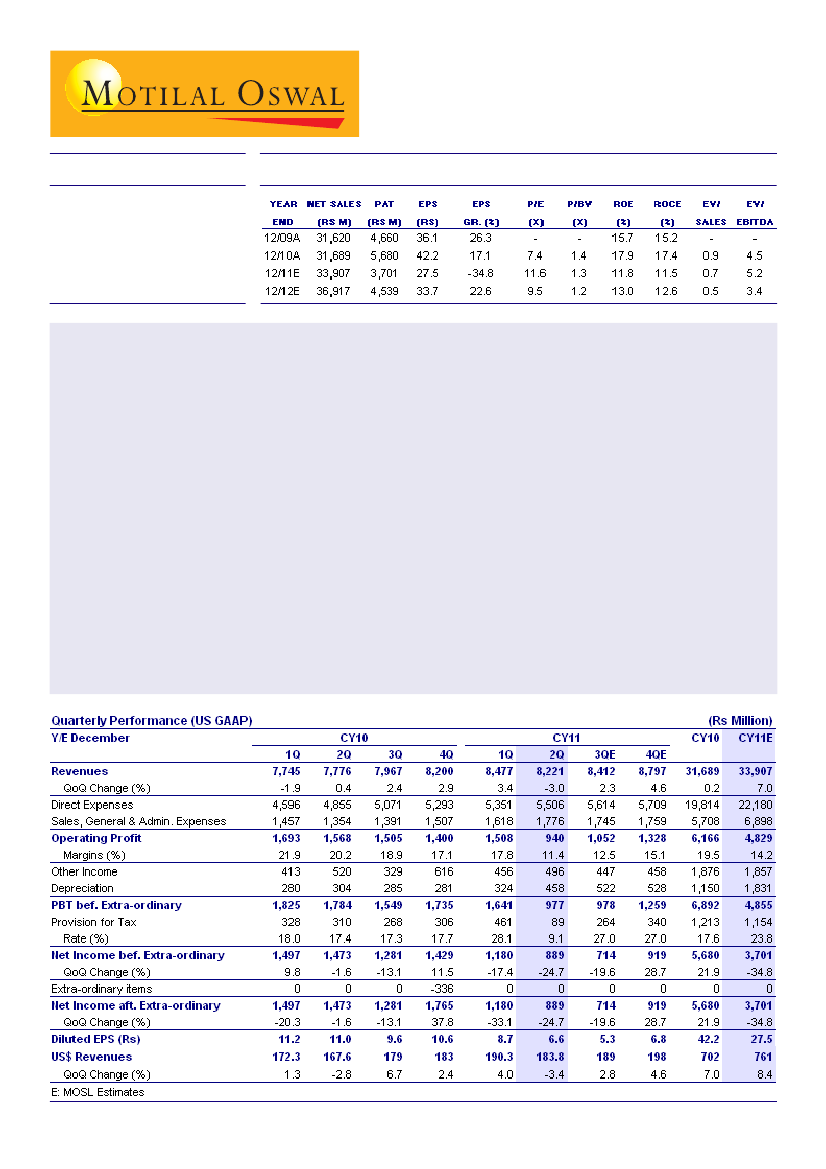

Patni's 2QCY11 operating numbers were way below estimates, with USD revenues declining 3.4% QoQ to USD

183.8m (v/s our estimate of 2.3% QoQ increase to USD194.7m). The decline was led by broad-based sluggishness

in volumes and drop in onsite pricing.

Though the management indicated that 2QCY11 revenue may be the bottom, it expects only a modest growth going

forward from current levels. This is corroborated by the fact that Patni's top client, who was also the only common

client for the two entities (iGate and Patni) has expressed interest in moving future projects from new programs to

iGate.

SGA costs (excluding one-time severance charge of USD17.5m) increased 250bp to 21.6%, USD39.6m (up from

USD35.5m in 1QCY11), and are expected to stay in that range. Even depreciation and amortization increased to

USD10.3m, up from USD7.3m in the previous quarter, and is expected to be higher by USD2m in the next three

quarters. Higher costs and lower revenues drove the plunge in PAT, which declined 25% QoQ to INR0.9b (excluding

one-time severance costs, v/s estimate of INR1.1b).

With higher expenses here to stay and growth to remain modest over the near-to-medium term for Patni, we believe

that the ambitious targets of the management (25% EBITDA margin by 2HCY13 and revenue of USD1.6b for the

combined entity) are unlikely to gain much ground over the next few quarters. We have cut our CY11-12 USD

revenue growth estimates by 3.1-4.8pp and earnings estimates by 11-21% on lower growth and higher costs. Our

revised target price is INR337, based on 10x CY12E earnings.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); Tel: 3982 5424