26 July 2011

1QFY12 Results Update | Sector: Real Estate

Godrej Properties

BSE SENSEX

S&P CNX

18,518

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,575

GPL IN

69.8

845/545

14/39/23

55.5

1.3

CMP: INR794

TP: INR744

Neutral

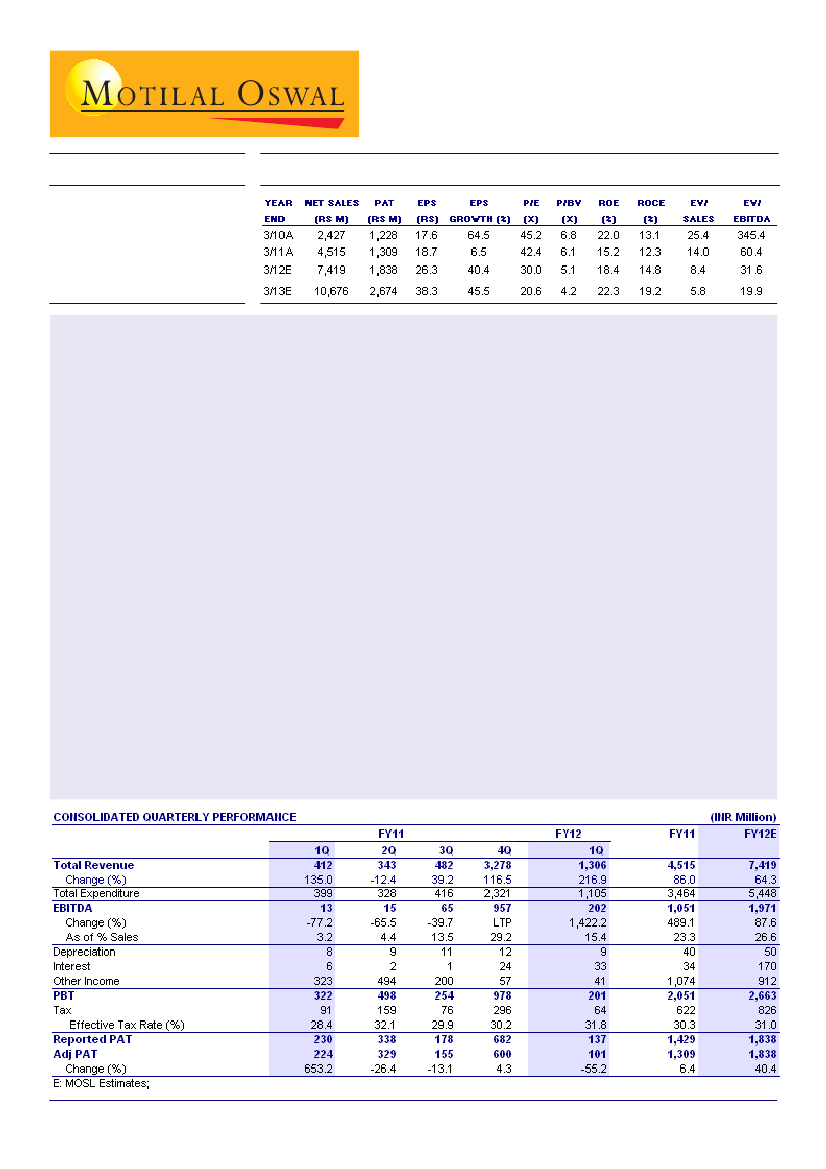

Revenue up 217% YoY, down 60% QoQ:

GPL has reported 217% YoY jump (60% QoQ decline) in revenue to INR1.3b,

as several additional projects began contributing to revenue over FY11. The QoQ drop in revenue is attributable to one-off

boost in recognition during 4QFY11, with Frontier (Gurgaon) and Prakriti II (Kolkata) crossing 20% threshold in that

quarter. During 1QFY12, the key revenue contributors were (a) Garden City (Ahmedabad) - INR380m, (b) Waterside

(Kolkata) - INR323m, (c) Prakriti (Kolkata) - INR232m, (d) Frontier (Gurgaon) - INR176m, (e) Genesis (Kolkata) - INR114m,

and (f) Eternia (Chandigarh) - INR53m.

EBITDA margin declined from 29.2% in 4QFY11 to 15.4%:

EBITDA grew 1422% YoY to INR202m, while EBITDA

margin dropped from 29.2% in 4QFY11 to 15.4%. Higher contribution (~25% of total revenue) from low margin commercial

projects in Kolkata and lower contribution from higher margin Gurgaon projects (Frontier accounted for just 13% of

revenue v/s 23% in 4QFY12) are the key reasons for the decline in EBITDA margin.

Sales booking strong, up 70% YoY; robust launch plan for FY12:

GPL maintained strong growth in sales booking

during the quarter, with ~70% YoY jump to INR2.3b (0.56msf) as against INR1.3b (0.53msf) in 1QFY11. This includes

~0.24msf of sales in Garden City III (Ahmedabad), ~0.12msf in Prakriti (Kolkata), 0.07msf in Frontier (Gurgaon), and

0.14msf in commercial projects at Kolkata and Chandigarh. The management has for a slew of new launches of 7-8msf

over FY12, including new locations such as Hyderabad, Chennai, Kochi and recent acquisitions in Chembur (Mumbai).

Net debt-equity up to 1x; reduction plan linked to commercial monetization:

As at June 2011, GPL's gross/net

debt stood at INR104b/INR9.4b, implying a net DER of 0.1x v/s 0.86x as at March 2011. While a significant portion of

GPL's debt is towards commercial assets in Kolkata and Chandigarh, its deleveraging plan is largely linked to the pace

of monetization of these commercial properties.

Valuation and view:

We estimate GPL's NAV at INR744/share, with core NAV at INR592/share and probability-weighted

option value at INR152/share. The stock trades at ~7% premium to our NAV estimate and at 4.2x FY13E BV of INR189

and 22.7x FY13E EPS of INR38.3. Maintain

Neutral.

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); Tel: +91223982 5436