5 August 2011

Update | Sector: Infrastructure

Roads

NHAI: Accelerated pace of project awards; competition intense

Premium received in YTD FY12 at INR12.4b v/s INR3.5b each in FY10/11

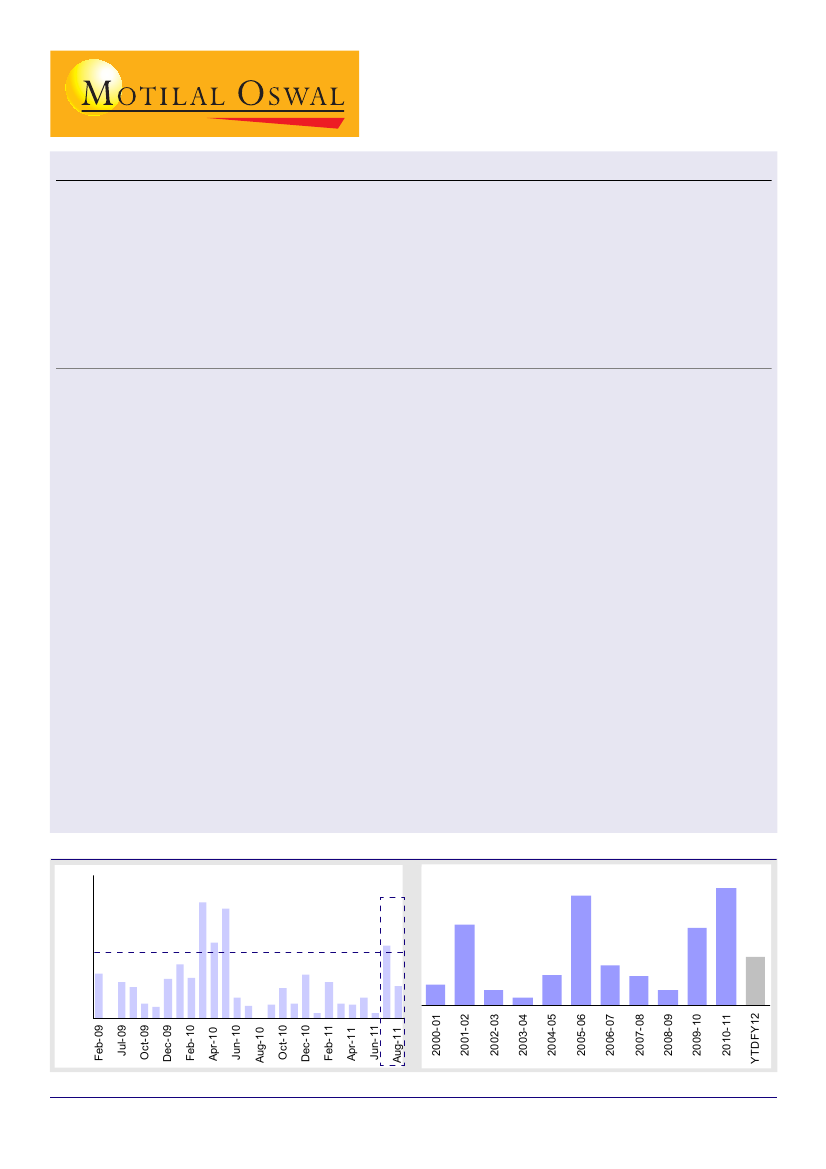

Project awards in YTD FY12 stands at 2,114km v/s 5,068km in FY11 and 3,357km in FY10. Project awards in

July 2011 were 1,011km (the fourth highest in a month ever) and in the first week of August 2011 already

stands at 455km. This represents significant acceleration.

Competitive intensity has increased and even for the four large projects awarded (INR24b+), 10-40 bidders

were pre-qualified. A higher than expected premium/lower Viability Gap Funding (VGF) has eased pressure

on NHAI finances.

YTD FY12 annual premium on project awards was INR12.4b, and is up meaningfully, against INR3.5b each

in FY10 and FY11.

2,114km awarded in YTD FY12 v/s 5,068km in FY11, 3,357km in FY10; accelerated pace

National Highway Authority of India's (NHAI) project awards in YTD FY12 stands at 2,114km v/s 5,068km in FY11 and

3,357km in FY10. Project awards in July 2011 were 1,011km (the fourth highest in a month ever) and already stands at

455km in first week of August 2011. This indicates a meaningful acceleration, driven by initiatives such as (i) annual pre-

qualification norms cutting procedural delays (ii) cells developed for land acquisition leading to a bank of ~20,000km in

which critical milestones were achieved (iii) monthly program and project monitoring. In FY12, targeted project awards

are 7,300km. Of the total NHDP length of 50,405km, 25,441km are completed / under implementation and 24,803km

balance to be awarded over next three years, entailing continuous award momentum.

Bid parameters surprise, competitive intensity increases

Competitive intensity has increased, with new players entering the fray, and has eased pressure on NHAI finances, as

80% of the remaining projects are now expected to be awarded on a toll basis. This is surprising as 57% of the remaining

projects are part of Phase 4 (two-laning) entailing poor traffic density. Several local players have joined the fray, leading

to a crowding effect for smaller projects. Even for the four large projects awarded (project size of over INR24b), 10-40

bidders pre-qualified, and thus bidding for even large sized projects continues to be intense.

Funding more comfortable; cumulative annual premium income INR20b

YTD FY12 annual bid premium on project awards stands at INR12.4b, which is up meaningfully compared with INR3.5b

each in FY10 and FY11. There were several instances of projects intended to be awarded on VGF being quoted at an

annual premium. The bid parameters in all 11 project awards were significantly better than NHAI's internal estimates.

NHAI is also testing projects on toll where VGF as per internal calculations are 50-55% of the project cost (cap is 40%).

Increased competition in recent bids eased pressure on funding to an extent. Further, raising incremental resources

through bonds will be an important strategy. In FY12 NHAI will raise INR100b through tax-free bonds and the quantum is

expected to increase going forward. This compares with cumulative market borrowings of INR134b over the past decade.

2,114km awarded in YTD FY12 v/s 5,068km in FY11

2,000

1,500

1,000

1,466 km of project awards

over July-August 2011

Yearly project awards (km)

4,740

3,476

5,083

3,360

1,740

1,234

643

2,112

895

500

0

1,305

671

342

Nalin Bhatt

(NalinBhatt@MotilalOswal.com) +91 22 39825429

Satyam Agarwal

(AgarwalS@MotilalOswal.com) /

Pooja Kachhawa

(Pooja.Kachhawa@MotilalOswal.com)