WEEKLY FUNDAMENTAL REPORT – METALS & ENERGY

Overview

Market Overview

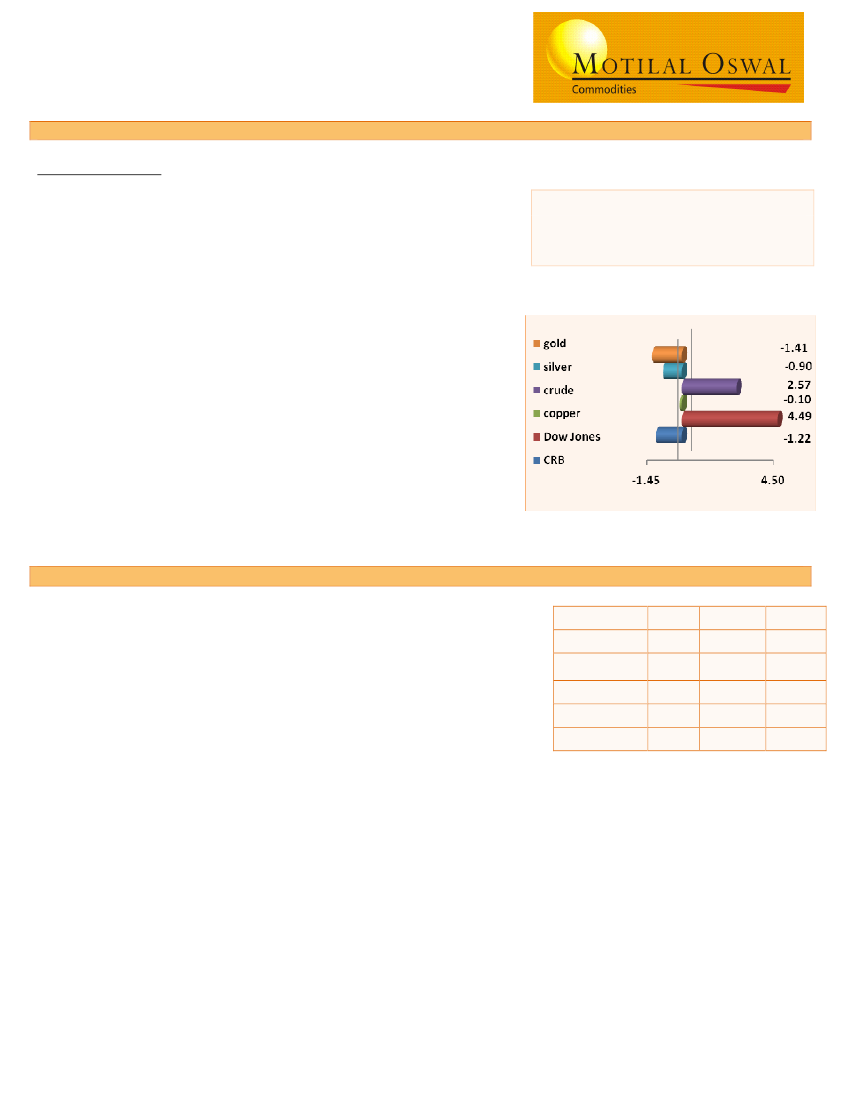

Gold futures on the COMEX Division of the New York Mercantile

Exchange bounced off, as recent price pullbacks are viewed as

favorable opportunities for investors to continue to diversify into

safehaven assets amid worsening concern over euro zone debt

problems.

Crude oil dropped the most in a week in New York, trimming a fourth

consecutive weekly gain, on concern that European leaders meeting

today haven’t taken sufficient steps to contain the region’s debt crisis.

Base metals were higher on the London Metal Exchange, encouraged

by more buoyant equity markets, although market players remain

skeptical of the stability of gains, given extremely illiquid market

conditions and persisting macroeconomic risk. But at the end

speculators booked profit at higher levels amid a concern about the

global economy and weak dollar mainly influenced the prices here

.

KEY EVENTS

Sept 19

th

– Sept 23

rd

, 2011

USD Unemployment Claims

USD Building Permits

USD Housing starts

GLOBAL ECONOMIC UPDATE

The Euro was lower against the U.S. Dollar after the release of U.S.

data on Michigan Consumer Sentiment Index. According to the leaders of

the EU, the conditions for the 8 billion euro tranche have not been

fulfilled yet. But perhaps this isn't the Greeks this time -it might be due

to the demand for collateral made by Finland.

The Nikkei stock average rose more than 2 per cent, clearing some recent

Forex Major

INR

ICE Dollar

Index

Euro

Yen

British Pound

%CHG

1.50

-0.78

1.06

-1.02

-0.60

CLOSE

47.265

76.6

1.38

76.77

1.58

resistance levels, as coordinated action from central banks calmed fears of a European credit freeze and sent

financial shares surging. It has also been influenced after four central banks coordinated to provide more short term

dollar liquidity to European banks.