26 September 2011

REAL ESTATE

Ground

Reality

NCR: Seasonal slowdown in Gurgaon; Noida hit by farmers’ protest

Commercial rentals strengthen in prime markets; near-term outlook stable

Gurgaon:

Residential absorption has moderated in 2Q and 3Q CY11, due to slowdown

in new launches and inauspicious buying season. Major price correction is unlikely,

but festive season could see discount offerings to boost demand.

Noida:

Both launches and sales have sharply declined due to farmers' protest over

land acquisition, and concerns of oversupply.

Commercial leasing:

Expect to remain strong at least till 4QCY11. Broadbased

vacancy level remains high, but prime markets in Gurgaon have witnessed rental

uptick.

Sector strategy:

Prefer stocks with prudent balance sheets and strong business models

such as Oberoi Realty, Prestige, Phoenix and Mahindra Lifespaces, or stocks with near-

term triggers like DLF, which offers play on deleveraging theme with valuation comfort.

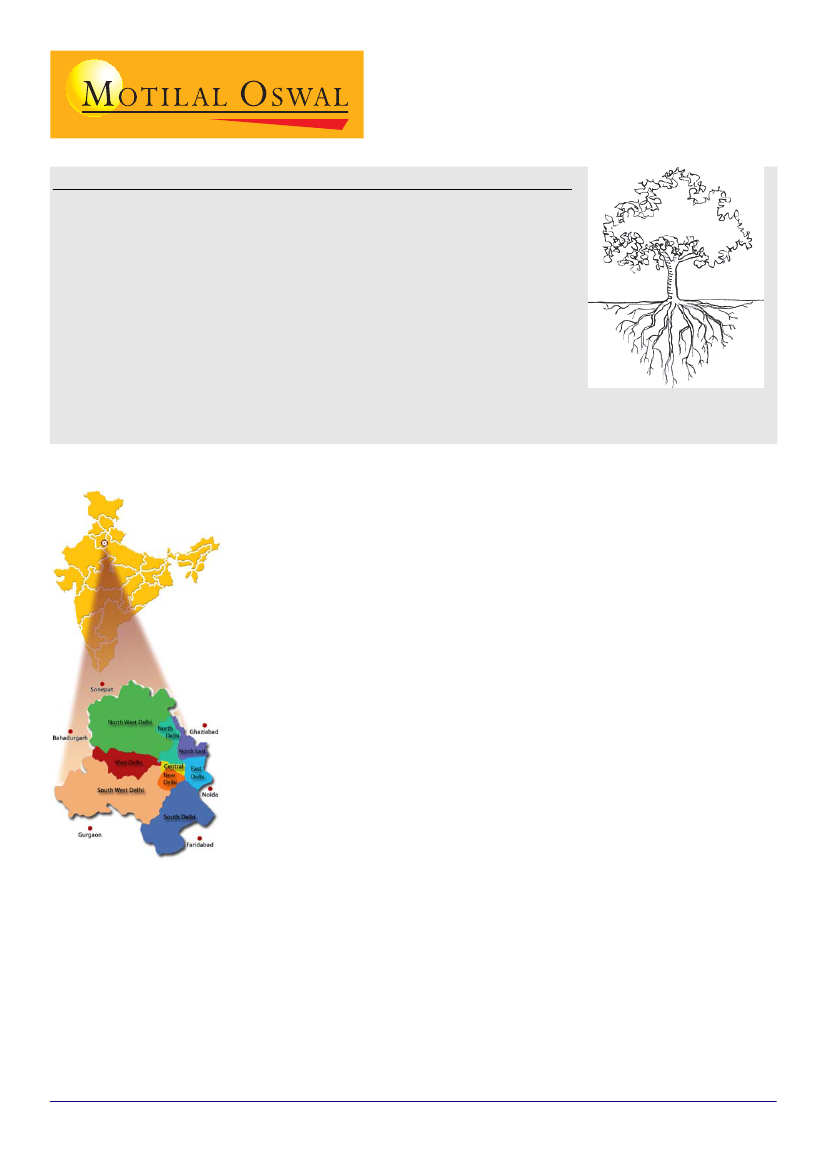

NCR

In CY11, the real estate sector has been hit by several headwinds, both operational and

regulatory in nature. The outlook for many key markets has been dented due to (1)

plummeting sales volume, (2) delay in construction of existing projects, and (3) slower

launch of new projects.

NCR is a key real estate market. It (a) accounts for 30-40% of total sales volume/value of

top 7 cities, and (b) is home to major developers such as DLF, Unitech, Jaypee Infratech and

Anant Raj. For a 360

o

assessment of the prevailing ground reality in NCR, we met reputed

real estate consultants like JLL, a few real estate brokers, and sales team of a local developer.

We present our key takeaways.

Gurgaon: Residential absorption has moderated due to seasonal impact

Gurgaon witnessed moderation in residential sales volume in 2Q and 3Q CY11 after a

strong 1Q. This is largely due to slowdown in new launches and 2/3Q being seasonally

weak quarters due to inauspicious buying season, vacation, monsoon, etc. Nonetheless,

launches and sales are expected to witness revival over festive season.

Recent launches did reasonably well

e.g. DLF (plotted projects), BPTP, Unitech (South

Park, Anthea, etc). This is despite moderation in investor demand given multiple interest

rate hikes. (Typically, investor participation in Gurgaon is high at ~55% of total sales.)

Within residential projects,

demand for built-up floors has gained momentum recently

after transactions under this asset class have been brought under registration norms.

Infrastructure developments such as progress in Dwarka Expressway and proposed shifting

of toll base beyond Manesar augur well for upcoming projects in these locations.

Price correction is unlikely in existing projects;

still, newer launches during festive

season could offer discount to boost demand.

Sandipan Pal

(Sandipan.Pal @MotilalOswal.com); Tel: +91 22 3982 5436