20 October 2011

2QFY12 Results Update | Sector: Financials

HDFC Bank

BSE SENSEX

S&P CNX

17,085

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

M.Cap. (INR b)

M.Cap. (USD b)

5,139

HDFCB IN

2326.1

520/396

-1/15/18

1,144.2

23.1

CMP: INR491

TP: INR515

Neutral

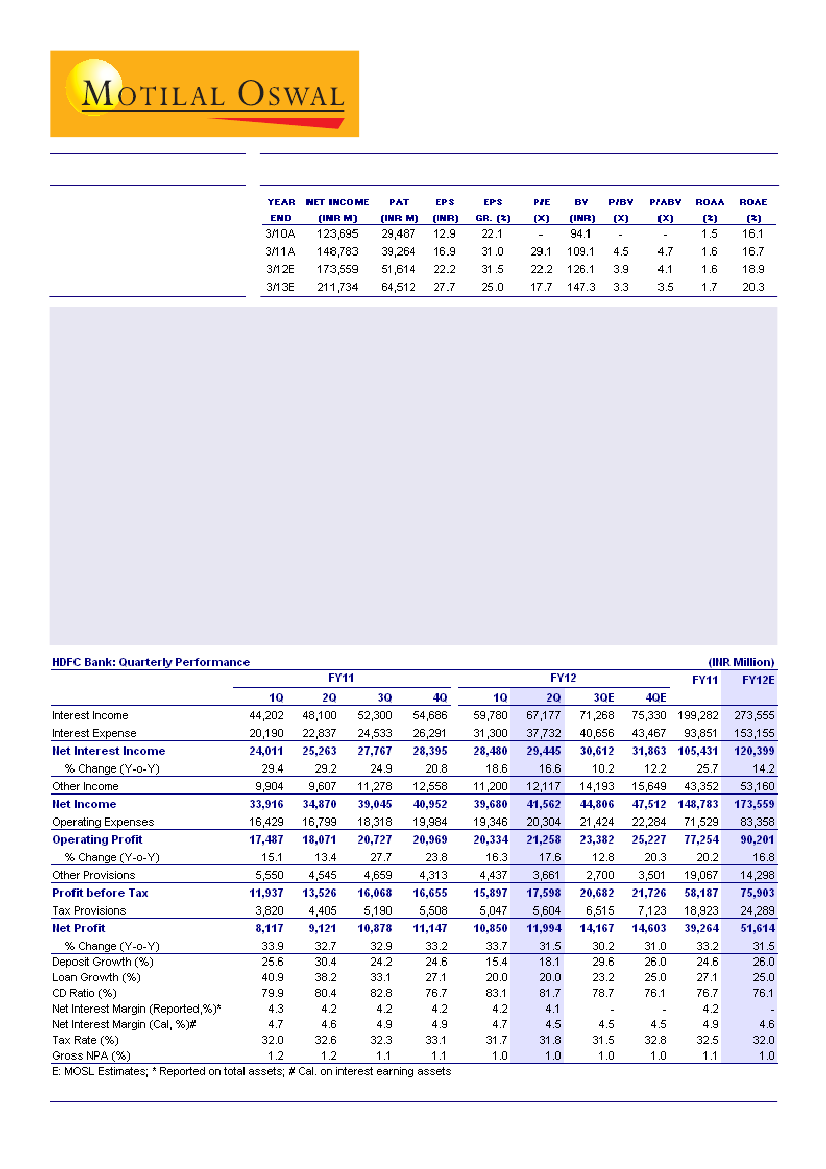

HDFC Bank (HDFCB) posted in-line PAT of INR12b for 2QFY12, up ~31% YoY. Reported margin declined 10bp QoQ to

4.1%, led by 140bp decline in CD ratio, 180bp decline in CASA ratio and full impact of deposit re-pricing. Strong growth

in high yielding retail segment and improvement in yield on investment cushioned the margin decline.

Reported loans grew 20% YoY; adjusted loans up 26% YoY:

Incremental loans during the quarter were driven by

the retail segment (up 11% QoQ and 34% YoY) across segments. HDFCB reported strong growth of 25% QoQ and

63% YoY (~40% YoY adjusted for sell down in 4QFY11) in CV and CE loans. It also bought back INR12b of home

loans from HDFC to fulfill PSL requirements.

Strong deposit growth; CASA declines QoQ:

Deposit growth gathered momentum, with 9% QoQ and 18% YoY.

CD ratio declined to 81.7% from 83.1% a quarter ago. Core CASA ratio declined to 47% from 49% a quarter ago.

Commendable performance on asset quality:

Gross slippages during 1HFY12 were INR7.5b (INR4b in 2Q), of

which ~INR2.5b were towards the MFI segment. Annualized slippage ratio in 2QFY12 was ~1% (largely stable QoQ).

Core credit cost at 0.5%:

NPA provisions for 2QFY12 were INR1.1b. The bank utilized excess provisions worth

INR1.3b made in earlier quarters, adjusted for which core credit cost would have been 0.5%. In 2QFY12 HDFCB

made floating and general provisions of INR2.4b. Total floating provisions on the balance sheet stood at ~INR10b.

Valuation and view:

We expect EPS to grow at a CAGR of ~28% over FY11-13 against 25% over FY05-10. While we

remain positive on the bank’s business, we believe valuations are rich. The stock trades at 3.3x FY13E BV and 17.7x

FY13E EPS. Maintain

Neutral.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com) + 91 22 3982 5415

Sohail Halai

(Sohail.Halai@motilaloswal.com)+ 91 22 3982 5430 /

Umang Shah

(Umang.Shah@MotilalOswal.com) + 91 22 3982 5521