21 October 2011

2QFY12 Results Update | Sector: Engineering

Thermax

BSE SENSEX

S&P CNX

16,786

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,050

TMX IN

119.2

927/407

14/-22/-29

50.4

1.0

CMP: INR425

TP: INR472

Neutral

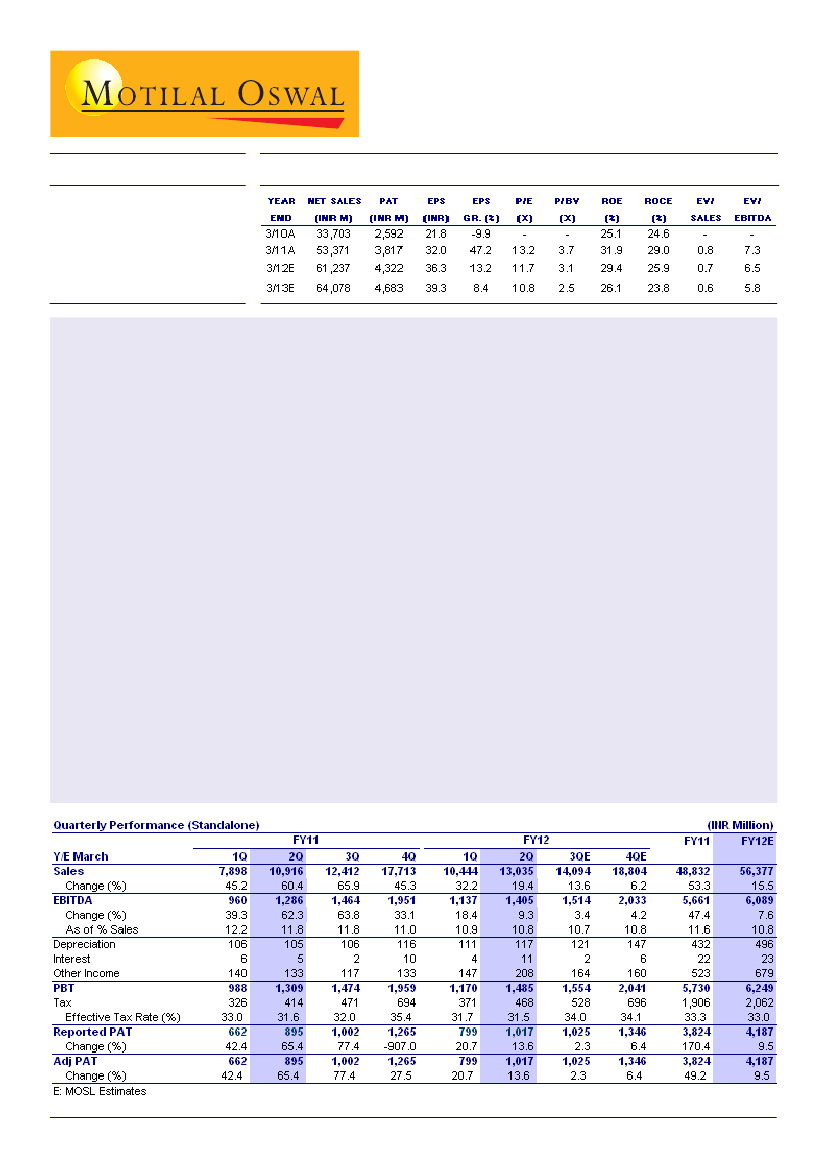

Thermax (TMX) reported 2QFY12 net profit growth of 14% YoY, marginally higher than our estimate. Sales grew a strong

19%, ahead of expectations. EBITDA margins declined 100bp due to a rising share of EPC projects and input cost

pressure. Order book was down 10% YoY and the order pipeline looks weak. The management indicated an uncertain

outlook over the next 2-3 quarters and this might impact order intake in the near term. We believe TMX's growth will

moderate in FY13. We maintain a Neutral rating on the stock.

TMX 2QFY12 PAT in line; top-line beats our estimate:

In 2QFY12, Thermax (TMX) reported standalone PAT of

INR1,017m, up 14% YoY, marginally higher than our estimate of INR1,007m. Revenue increased by 19% YoY to

INR13b (against our estimate of INR12.2b, up 12% YoY). EBITDA margin declined by 100bp YoY to 10.8%, which

was significantly below our estimate of 11.9%, (flat YoY). Consolidated PAT grew by 19% to INR1.1b.

Execution healthy, revenue up 19% YoY:

The energy segment posted healthy revenue growth of 16% YoY, driven

by strong execution of the order backlog. The environment business revenue grew a healthy 20% YoY. The energy

business continues to experience longer execution cycles due to large utility orders being executed by TMX. Revenue

growth was supported by execution of the power EPC. Adjusting for this, revenue grew by ~9%.

Margin pressure apparent, down by 100bp YoY at 10.9%:

2QFY12 EBITDA margins were 10.8%, down 100bp

YoY, impacted by a rising share of power EPC business and rise in raw material prices. RM/sales ratio increased

196bp YoY in 2QFY12. However, the impact of high raw material prices was partially offset by flat staff costs (7.6%

of sales, down 151bp YoY). SG&A expenses were 11.6% of sales, up 54bp YoY).

Orders slow down:

A slowdown in orders remains the biggest concern for TMX. Consolidated order intake in

2QFY12 was INR12.84b, down 9% YoY and 24% QoQ. Order intake was driven by the environment segment, which

grew 25% YoY and accounted for 27% of the intake. The energy segment's order intake declined by 17% YoY. We

expect order intake to be muted in FY12, growing marginally by 8% YoY.

Valuation & view:

Our FY12 estimates assume 15% revenue growth, due to stronger project execution. We

estimate EPS of INR36.3 (up 13%) and INR39.3 (up 8%) in FY12 and FY13, respectively. We maintain a

Neutral

rating on the stock.

Dhirendra Tiwari

(Dhirendra.Tiwari@MotilalOswal.com); Tel: +91 22 3029 5127

Deepak Narnolia

(Deepak.Narnolia@MotilalOswal.com); Tel: +91 22 3029 5126