4 November 2011

2QFY12 Results Update | Sector: Media

Sun TV Network

BSE SENSEX

S&P CNX

17,482

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,266

SUNTV IN

394.1

557/215

14/-29/-33

107.7

2.2

CMP: INR273

TP: INR350

Buy

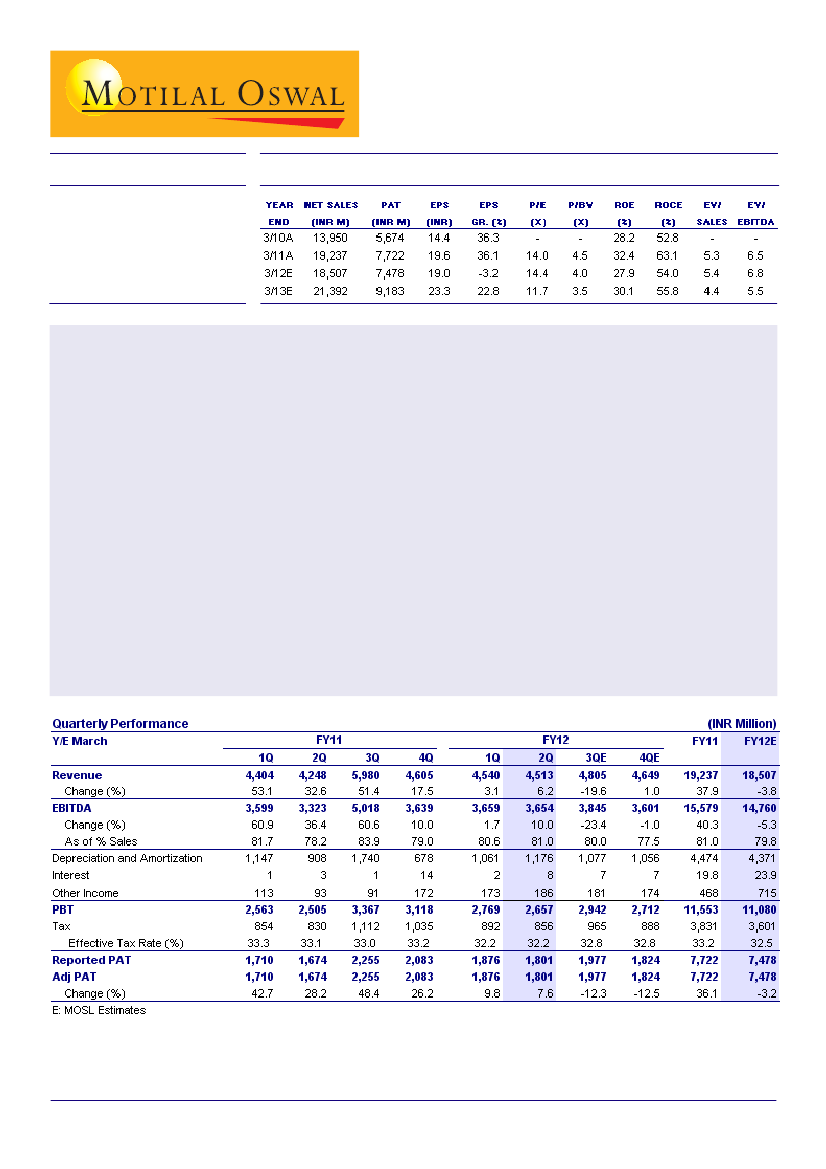

Sun TV (SUNTV) reported 2QFY12 PAT of INR1.8b, up 8% YoY but down 4% QoQ (10% below our estimate due to

lower revenue growth and higher D&A).

Revenue of INR4.5b was 6% below our estimate and EBITDA of INR3.65b was 5% below our estimate. EBITDA

margin was 81% v/s our estimate of 80.3%.

Advertising and broadcast revenue grew only ~1% YoY and QoQ to INR2.74b. While ad revenue environment improved

in 2QFY12 due to festive demand, the management remains cautious on sustenance of the improvement. We have

downgraded our FY12 advertising and broadcasting revenue growth estimates from 4% YoY to 2% YoY, implying 0%

growth in 2HFY12.

While international and DTH revenue grew by 13% YoY, domestic cable revenue declined by 13% YoY due to

ongoing pressure in Tamil Nadu after the launch of state-run Arasu cable.

SUNTV announced interim dividend of INR3.75 per share taking the total dividend to INR6.25 in 1HFY12.

Gross debt increased from nil in 4QFY11 to INR1.7b in 2QFY12, largely due to short-term loans taken against fixed

deposits due to bunching-up of payments related to advance tax, dividend, and directors' compensation.

We are downgrading earnings by 7-11% for FY12 and FY13 led by a downgrade in advertising and subscription

revenues.

We expect EPS CAGR of 9% over FY11-13. The stock trades at 14.4x FY12E EPS of INR19 and 11.7x FY13E EPS

of INR23.3.

Maintain

Buy

with a target price of INR350 (15x FY13 EPS).

Shobhit Khare

(Shobhit.Khare@MotilalOswal.com); Tel: +91 22 3982 5428