15 November 2011

2QFY12 Results Update | Sector: Metals

Adhunik Metaliks

BSE SENSEX

S&P CNX

17,119

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,148

ADML IN

123.5

115/40

-19/-42/-46

5.3

0.1

CMP: INR43

TP: INR96

Buy

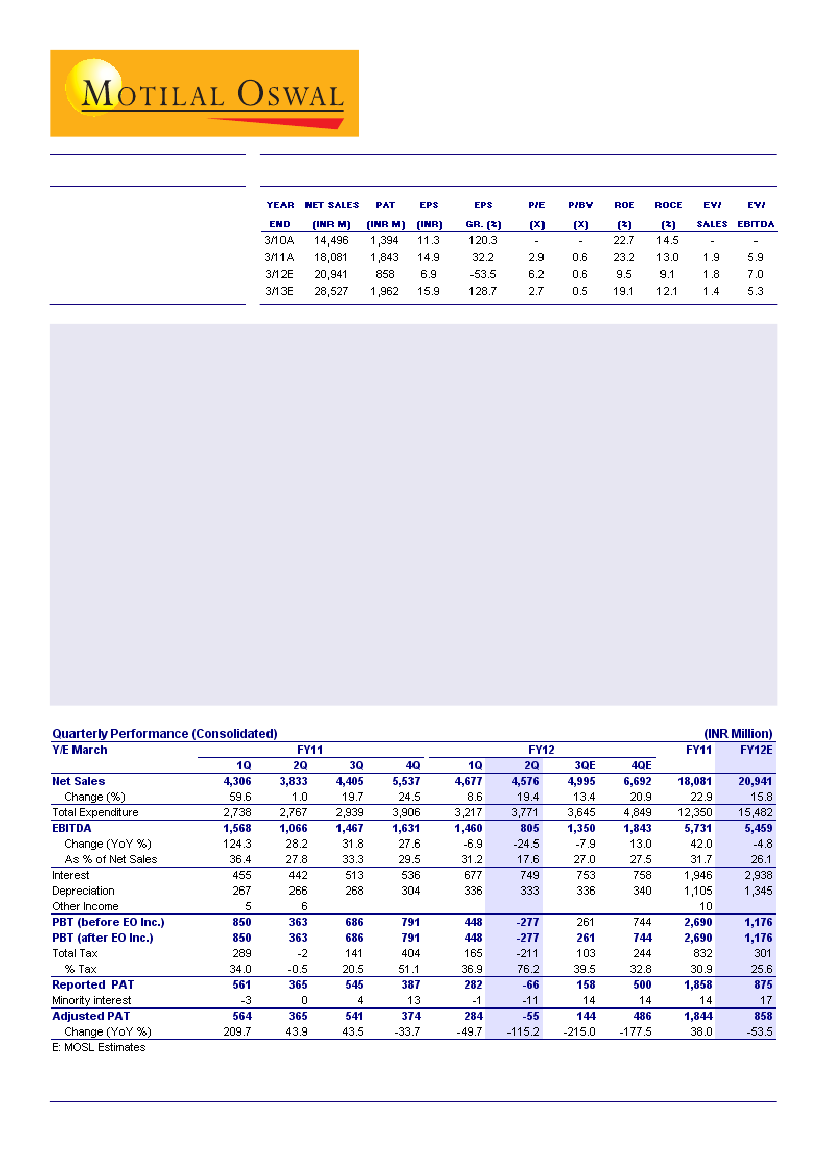

Adhunik Metaliks (ADML) reported consolidated post tax loss of INR55m for 2QFY12 (v/s our estimate of INR241m

profit) due to high input cost in standalone steel business, and lower volumes and realizations in OMM manganese

operations.

Orissa Manganese & Minerals (OMM) EBITDA declined 52% QoQ (3% YoY) to INR354m. Adjusted PAT decreased

74% QoQ (67% YoY), as both manganese and iron ore volumes suffered due to heavy monsoon. Though mining has

started in Kusumdihi manganese mines, dispatch approval is still pending, leading to build up of 5k tons of inventory

at the mine site.

Manganese volumes were down 57% QoQ to 19k tons while realization declined 10% QoQ to INR6,874/ton.

Iron ore volumes declined 32% QoQ to 210k tons while realization improved 2% QoQ to INR2,875/ton.

Suleipat iron ore mine, a 50:50 joint venture between OMM and Dagara Mines, is expected to start in the current

quarter.

1.2mtpa pellet plant is currently under trial run and is expected to contribute 150k-200k tons of pellet volumes in

FY12.

Standalone adjusted loss of INR268m was on high input cost and flat realizations. External iron ore cost increased

by 15% QoQ to INR4,600/ton while power cost was up ~25% at INR5.10-5.20/unit. Raw material as percentage of

sales increased to 58% from 44% in 1QFY12.

We are downgrading our FY13 EPS estimate by 20% to INR15.9 on muted steel demand (especially from the auto

sector), high interest cost and margin pressure in iron ore and manganese mining. The stock trades at 2.7x FY12E

EPS and at an EV of 5.3x FY12E EBITDA. Maintain

Buy.

Sanjay Jain

(SanjayJain@MotilalOswal.com);Tel:+9122 39825412/

Tushar Chaudhari

(Tushar.Chaudhari@MotilalOswal.com); +9122 39825425