DAILY FUNDAMENTAL REPORT - AGRO

Nov 24

th

, 2011

Market Overview

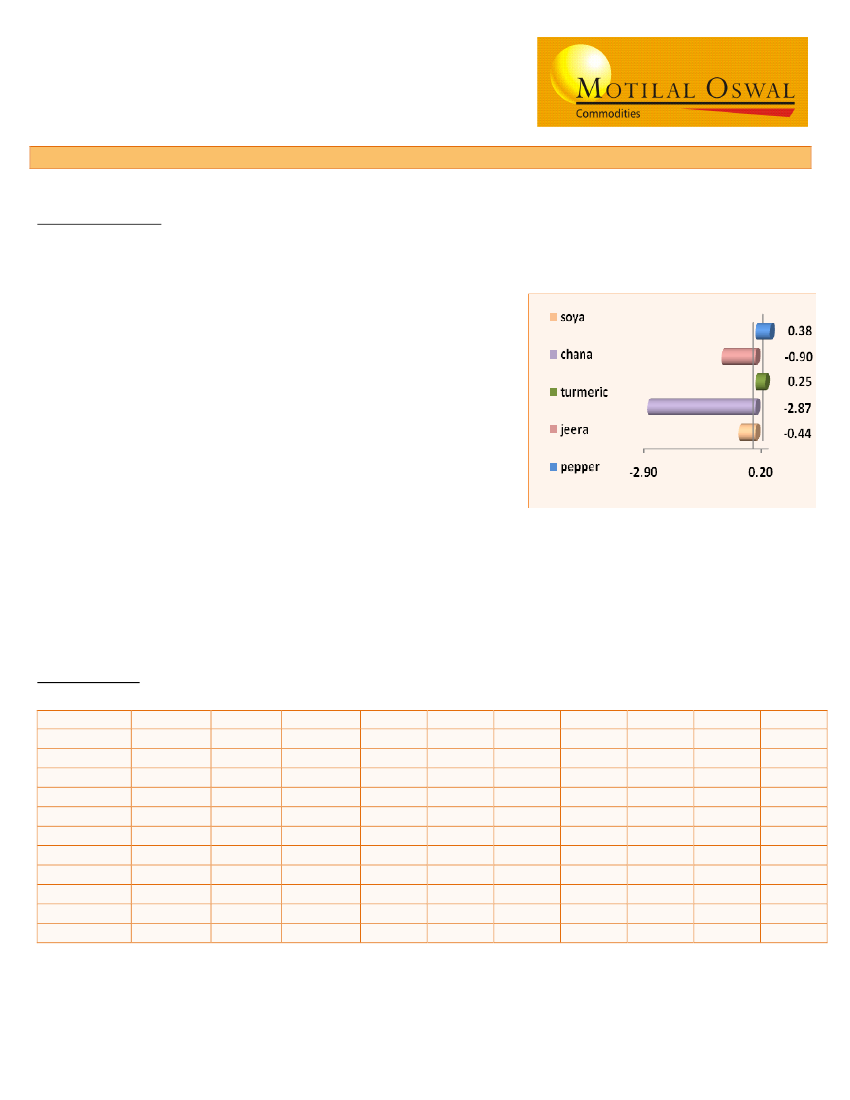

Turmeric futures gained as traders created fresh positions on

the back of rising demand in the domestic markets. Though

higher arrivals from the fresh crop limited the upside.

Pepper futures traded sideways in the initial session amid

absence of fresh Fundamental and anticipate exports to rise

by December. But at the end speculators short covered their

position and settled the prices on positive note.

Chana futures plunged in the last session on the back of

strong rabi sowing progress in major producing states along

with strong supplies in major mandies.

Jeera futures extended its profit booking consecutive for

second session amid higher arrivals and weak spot demand.

.

Higher sowing in the producing regions amid weak export

demand. Higher stocks from the fresh crop also put pressure

on Jeera futures.

Watch

Market Watch

AGRO

CHANA

CHILLY

GUAR GUM

GUAR SEED

JEERA

PEPPER

R M SEED

SOYA BEAN

OIL

SOYA OIL

TURMURIC

WHEAT

CONTRACT

20-Dec-11

20-Dec-11

20-Dec-11

20-Dec-11

20-Dec-11

20-Dec-11

20-Dec-11

20-Dec-11

20-Dec-11

20-Dec-11

20-Dec-11

OPEN

3467

7338

14250

4577

13702

34550

3179

2271.5

644.3

4752

1208

HIGH

3489

7338

14425

4622

13810

34790

3210

2284

649.5

4870

1208

LOW

3345

7190

14140

4523

13561

34145

3173

2260

644.25

4710

1184

CLOSE

3383

7220

14270

4555

13613

34650

3182

2262

645.8

4792

1196

CHG

-97

-48

-43

-25

-122

130

-3

-10

0.2

12

-12

% CHG

-2.790

-0.66

-0.30

-0.55

-0.89

0.38

-0.09

-0.44

0.03

0.25

-0.99

OI

188170

5135

14360

150030

14106

10304

111880

129170

98410

14785

23270

CHG

29850

1550

3040

9500

2751

1047

33170

24100

37680

2940

2760

%CHG

15.9

30.2

21.2

6.3

19.5

10.2

29.6

18.7

38.3

19.9

11.9