24 November 2011

Update | Sector: Capital Goods

T&D Equipment

Powergrid awards accelerate; likely to meet 11th Plan target of INR550b

Competitive intensity to restrict margins of equipment suppliers; maintain Neutral

Powergrid's YTD FY12 project awards at INR79b, up 41% YoY; expect momentum to continue. 12th Plan

capex target at INR1t+, ~2x the 11th Plan capex.

Competitive intensity remains high. Transformer segment sees worst of it, with prices declining by 35-40%

in past two years.

Ordering to improve in next few quarters, but profitability to remain under pressure. Maintain Neutral on

T&D equipment suppliers.

Powergrid's YTD FY12 project awards at INR79b,

up 41% YoY; expect momentum to continue for the

rest of the year:

Power Grid Corporation of India's

(Powergrid) project awards in YTD FY12 (April - October)

totaled INR79b, up 41% YoY. After a lull in the beginning

of the year, ordering has picked up lately, with orders worth

INR40b placed in October alone. In the last one month,

Powergrid has further approved investments worth INR39b,

which will ensure healthy ordering towards the year-end.

We expect Powergrid to place orders of over INR150b in

FY12, which will result in total awards of ~INR550b during

the 11th Five Year Plan. This represents an impressive

growth of ~3x over the 10th Five Year Plan.

Ambitious targets for 12th Five Year Plan:

Powergrid

plans to install ~65,000 circuit km (ckm) of transmission

lines during the 12th Plan, nearly twice the likely installation

in the 11th Plan (~30,000ckm, target of 37,000ckm) with a

targeted capex INR1t+, ~2x the 11th Plan capex. While

the target appears ambitious, it will be necessary to meet

growing transmission needs in the country, especially after

commissioning of 80-100GW of generation projects under

construction.

Competitive intensity remains high; but unlikely to

deteriorate further

Aggressive bidding by Chinese and Korean players, who

together commanded ~60% of the EHV transformer/

reactor market during FY08-11, beat down prices by

30-40% over the last 2-3 years. Recent trends suggest

that pricing in the segment has bottomed out and should

not deteriorate further because of non-sustainability of

very low prices. Increasing thrust by Powergrid on local

manufacturing and decreasing proportion of mandatory

import content will benefit domestic players.

We expect competitive intensity in the tower segment to

remain high, though smaller players that were aggressive

in FY08-10 appear to be focusing more on execution.

The big-7 players commanded ~70% of the market over

FY08-10, which increased to 96% in YTD FY12.

Powergrid now excludes switchgear from substation

package ordering. We believe this has reduced entry

barriers for non-T&D equipment manufacturing

companies in bidding for substation execution business,

thereby enhancing competitive intensity in a segment

otherwise dominated by MNCs.

Our view:

Competitive intensity in the Indian T&D

equipment sector remains high, which continues to impact

pricing. We believe that low product prices coupled with

rising input costs will keep margins under pressure in the

near term. Stocks of T&D equipment suppliers are trading

at significant discount to their long-term average valuations,

implying significant risk to near-term earnings. We believe

that while ordering will improve in the next few quarters,

profitability will remain under pressure. We remain

Neutral

on the T&D equipment sector, with preference for

Siemens

over

ABB

/

Crompton Greaves.

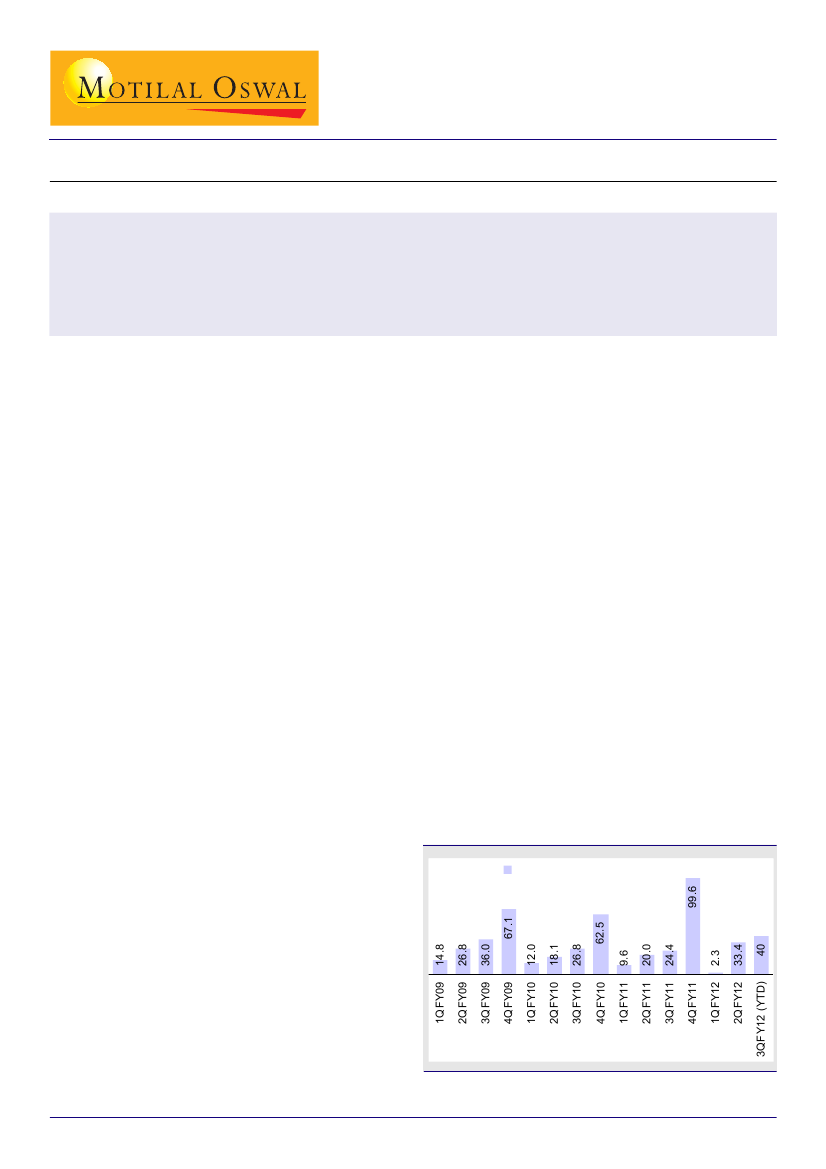

Quarterly project awards by Powergrid (INR b)

Pow ergrid Quarterly orders (INR b)

Source: Powergrid/MOSL

Dhirendra Tiwari

(Dhirendra.Tiwari@MotilalOswal.com) +91 22 3982 5127

Deepak Narnolia

(Deepak.Narnolia@MotilalOswal.com) +91 22 3982 5126