20 December 2011

Update | Sector: Healthcare

Divi's Laboratories

BSE SENSEX

S&P CNX

15,175

4,544

CMP: INR738

TP: INR910

Buy

Strong relationships to drive CRAMS growth; generic API

business a cash cow

Expect 18% earnings CAGR over FY11-13; Buy

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

DIVI IN

132.7

843/582

11/12/45

97.9

1.8

Y/E March

2011 2012E 2013E

16.4

6.0

36.4

4.7

4.7

35.7

19.9

7.6

38.3

6.0

6.0

45.4

Revenue (INR b) 13.1

EBITDA (INR b)

4.9

EBITDA mar. (%) 37.6

Rep. PAT (INR b) 4.3

Adj. PAT (INR b)

4.3

EPS (INR)

32.4

Strong relationships with global innovator companies should enable Divi's

CRAMS business to record 25% revenue CAGR over FY11-13.

Worldwide leadership in some of its generic API products enables Divi's

to maintain high profitability; we expect this business to record 19% revenue

CAGR over FY11-13.

Divi's features among the most profitable companies in the Indian

Healthcare sector, with EBITDA margin of 35-40%.

Management guidance for FY12 and FY13 remains strong. We expect 18%

earnings CAGR over FY11-13; Buy.

EPS Gr. (%)

25.7 10.3 27.2

BV/Share (INR) 135.6 158.8 190.2

RoE (%)

25.9 24.3 26.0

RoCE (%)

P/E (x)

P/BV (x)

EV/EBITDA (x)

EV/Sales (x)

28.2

22.8

5.4

19.9

7.5

30.1

20.7

4.6

16.4

6.0

32.0

16.2

3.9

12.9

4.9

Frontrunner in Indian CRAMS sector:

Being an early entrant, Divi's Labs has become

a key outsourcing partner for some of the largest innovator companies. It services all

the top-10 global innovator companies. It is now a prominent player in providing custom

synthesis services from India and collaborates with innovator companies all through

the drug development stage to the commercialization stage.

Strong relationships with innovators to drive growth:

Given its strong relationships

with global innovator companies, we believe that Divi's would be a key beneficiary of

increased outsourcing from India. We expect Divi's CRAMS business to record 25%

revenue CAGR over FY11-13.

Among the most profitable companies in Indian Healthcare:

Divi's features among

the most profitable companies in the Indian Healthcare sector, with EBITDA margin of

35-40%, backed by its strong chemistry skills and custom synthesis presence.

Strong capex imparts visibility to future growth:

Divi's has undertaken a capex of

INR2b (spread over FY11-12) on an SEZ. Past track record indicates that the company

generally does not undertake large capex without visibility of customer contracts.

The capex on the SEZ is likely to come up for utilization from FY13 onwards and will

fully ramp up in FY14, driving topline growth.

Strong guidance:

The management has guided 25% topline growth for FY12 and

20%+ growth for FY13, while retaining EBITDA margin at historic levels of 36-38%.

We believe that the strong guidance is partly based on the management's expectation

of revenue contribution from the new SEZ. We estimate topline CAGR of 23.4% for

FY11-13 and average EBITDA margin of 37.4% in this period, led mainly by 25%

revenue CAGR in the CRAMS business.

Expect 18% earnings CAGR over FY11-13; Buy:

Divi's will be a key beneficiary of

increased outsourcing from India, leading to 18% earnings CAGR for FY11-13. EPS

growth would be lower than topline growth due to significant increase in effective tax

rate from 9% in FY11 to 19% in FY13. We estimate RoCE and RoE of 25%+ for the

next few years, led by traction in the high-margin CRAMS business and incremental

contribution from the Carotenoids business. The stock trades at 20.7x FY12E and

16.2x FY13E earnings. Reiterate

Buy,

with price target of INR910 (20x FY13E EPS).

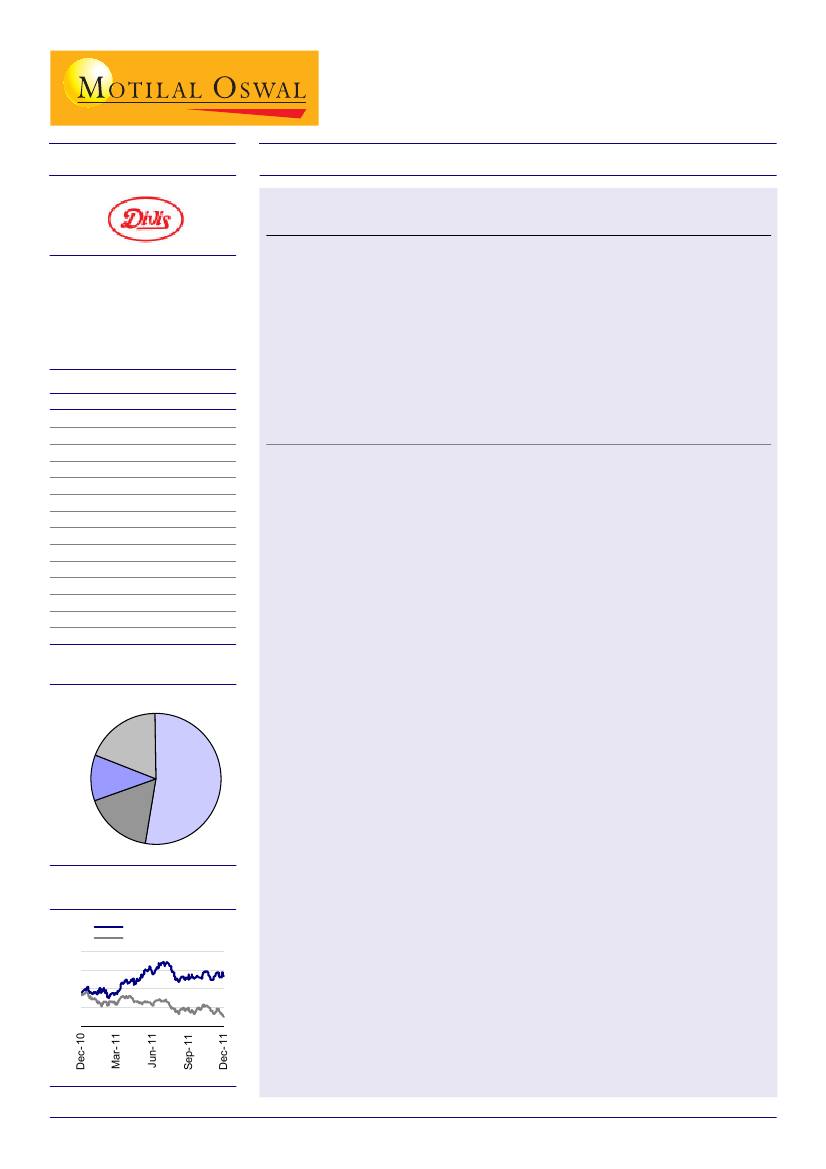

Shareholding pattern % (Sep-11)

Others,

19.1

Promoter

52.2

Foreign,

11.8

Domestic

Inst, 17.0

Stock performance (1 year)

Divis Labs

Sensex - Rebased

900

775

650

525

400

Nimish Desai

(NimishDesai@MotilalOswal.com); +91 22 3982 5406

Amit Shah

(Amit.Shah@MotilalOswal.com); +91 22 3982 5423