23 January 2012

3QFY12 Results Update | Sector: Infrastructure

Hindustan Construction

BSE SENSEX

S&P CNX

16,739

Bloo mberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,049

HCC IN

606.6

43/16

17/-27/-36

12.7

0.3

CMP: INR21

TP: INR25

Neutral

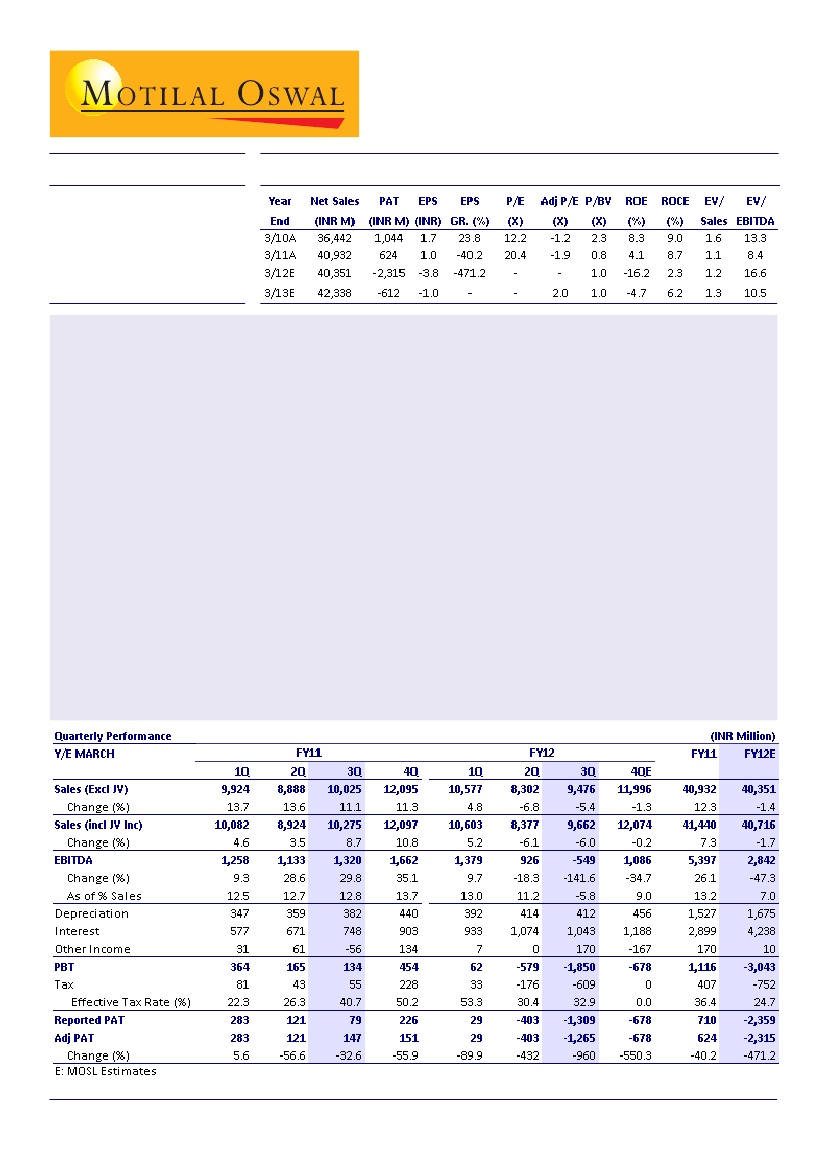

HCC's 3QFY12 revenue was down 5.4% YoY

at INR9.6b (v/s est INR10b). Revenue de-grew due to slow order

booking during the last four quarters, execution bottlenecks, and payment delays by clients.

Reported EBITDA at INR1.1b was in line with estimate.

In the current quarter management has considered an

accumulated loss of INR1.6b, pertaining to future expected losses and the pending claims from various

ongoing and completed projects. We have accounted these cumulative losses as operating expenses, so we

have arrived at EBITDA loss of INR549b. According to the management booking of these exceptional expenses

would reduce the company's operating loss for the next 3-4 quarters. Therefore, going forward, it does not

expect to register any cash losses in the standalone business.

Reported net loss stood at INR1.3b

v/s net profit of INR79m in 3QFY11; after adjusting for forex loss of

INR67.9m, net loss stood at INR1.26b. This is significantly lower than our net loss estimate of INR397m.

3QFY12 order book stands at INR162.4b

(v/s INR165b in Mar-11). Intake for the quarter was INR5b, and for

YTDFY12 INR15b (down 44% YoY). BTB has declined to 4x now v/s 4.2x in 3QFY11.

Lavasa is still an overhang.

Construction work on the site has resumed, with 500-600 workers deployed at the

site. However, overall development work is moving at a very slow pace.

On the BOT front, HCC has already invested ~INR6.5b and additional investments of INR3.5b would be required

in FY12 and FY13.

We cut our FY12 and FY13 revenue estimates by 2% and 4%. We have also taken an additional loss of INR1.2b

in FY12 and INR314m in FY13. Revised net loss for FY12 stands at INR2.3b (INR1.15b earlier) and for FY13 at

INR612m (INR300m earlier). Maintain

Neutral.

Dhirendra Tiwari

(Dhirendra.Tiwari@motilaloswal.com ) +91 22 3029 5127

Pooja Kachhawa

(Pooja.Kachhawa@MotilalOswal.com) +91 22 3982 5585