24 January 2012

3QFY12 Results Update | Sector: Metals

Sterlite Industries

BSE SENSEX

S&P CNX

16,752

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,046

STLT IN

3,361.2

190/86

11/-26/-28

362.3

7.2

CMP: INR108

TP: INR151

Buy

Consolidated

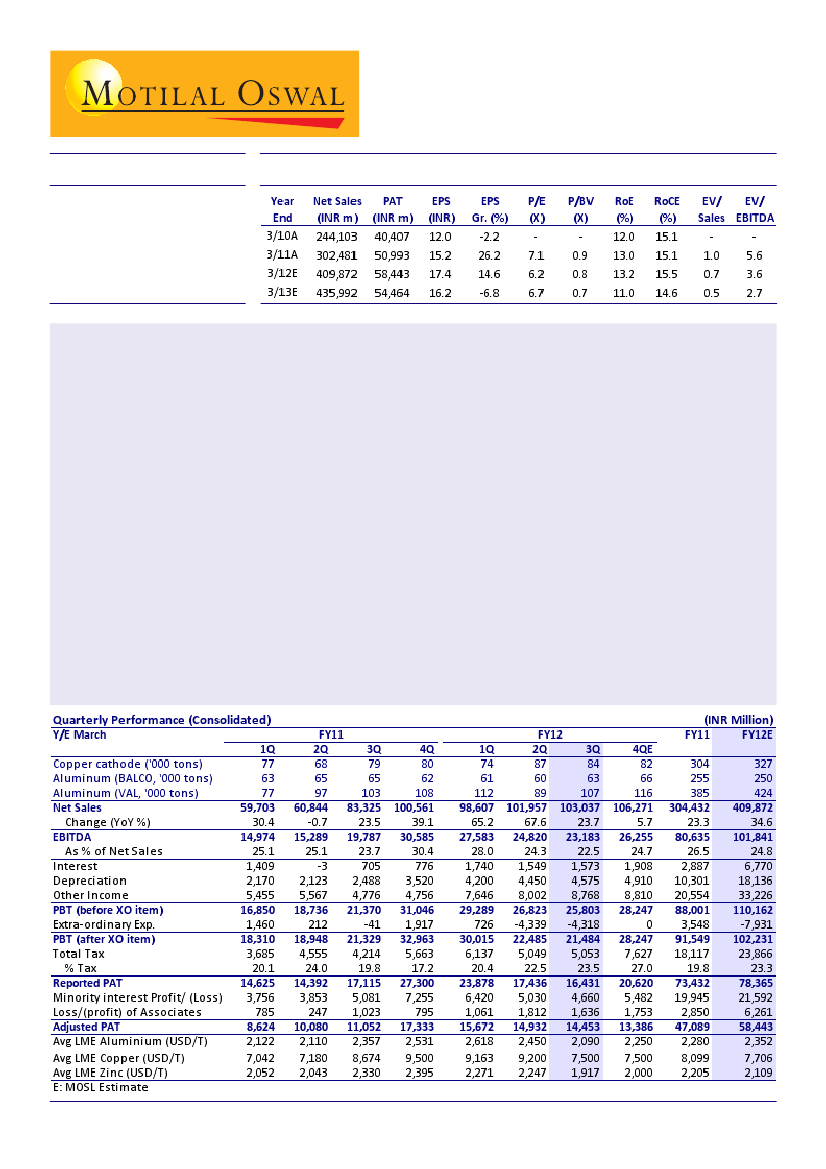

Sterlite Industries (STLT) posted 31% YoY growth in adjusted PAT for 3QFY12 to INR14.5b (v/s our estimate of

INR13b). Reported consolidated PAT was INR9.14b, including forex loss of INR4.25b in STLT standalone and

subsidiaries, and 29.5% of INR3.4b in associate, Vedanta Aluminium (VAL).

The operating performance of zinc, lead, silver and copper TcRc was robust and along expected lines. Zinc and

lead mine production was down 6% due to temporary deterioration of ore grade at Rampura-Agucha. This has

been reported for the second time in the last couple of years.

Sterlite Energy's 2x600MW generated 1,559mkwh at a PLF of 59%, with 428mu generation under trial production.

Cost of production (CoP) of aluminum for Balco and VAL reduced 12% to USD1,880/ton and 22% to USD2,004/

ton, respectively, due to strengthening of USD against INR and improvement in operating efficiencies due to

better availability of coal and absence of 1HFY12 breakdown losses. Balco's new smelter and CPP are further

delayed by six months to 2Q and 1QFY13, respectively due to delays in starting the coal mines.

ICD to VAL from STLT has increased by INR6.7b to INR96.12b. With complete erosion of equity, the restructuring

of VAL's capital structure is overdue. STLT bought out Vedanta Plc investment in Lakomasko BV for USD37.7m,

which holds 8.5% investment in Hudbay Minerals, to align all zinc businesses under the umbrella of STLT.

STLT has initiated action to dissolve SPVs for efficiencies in dividend distribution. STLT has merged with SOVL

(which holds its 64.5% in Hindustan Zinc and THL Zinc Holding BV, which holds 8.5% investment in Hudbay).

STLT is in discussions with the Government of India for buying call options in Hindustan Zinc and Balco.

The stock is trading at 6.7x FY13E EPS and 0.7x FY13E BV. Maintain

Buy.

Sanjay Jain

(SanjayJain@MotilalOswal.com);Tel:+9122 39825412/

Pavas Pethia

(Pavas.Pethia@MotilalOswal.com); +9122 39825413