25 January 2012

3QFY12 Results Update | Sector: Financials

Kotak Mahindra Bank

BSE SENSEX

16,739

S&P CNX

5,049

CMP: INR495

TP: INR429

Neutral

Bloomberg

Equity Shares (m)

52-Week Range

1,6,12 Rel.Perf.(%)

M.Cap. (Rs b)

M.Cap. (US$ b)

KMB IN

689.3

515/333

0/12/31

340.5

6.7

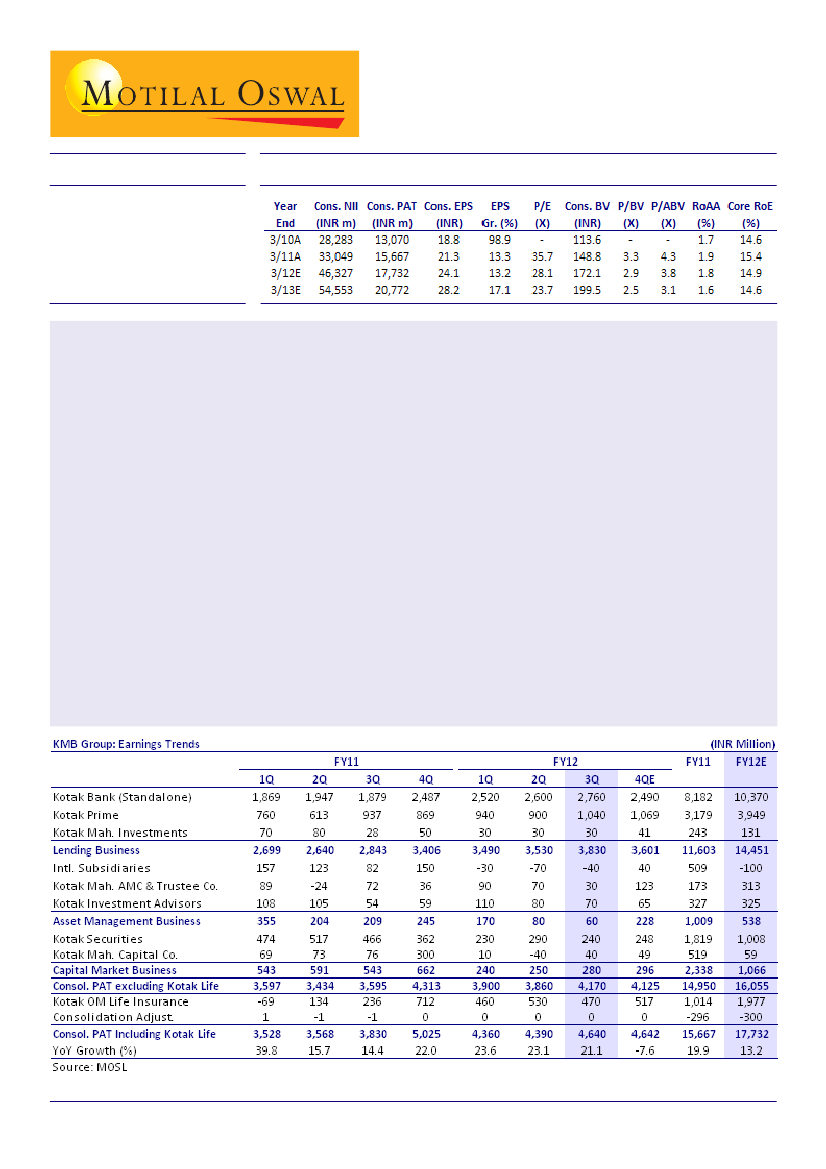

Kotak Mahindra Bank (KMB) posted 21% YoY (7% QoQ) growth in 3QFY12 consolidated PAT to INR4.6b. Excluding

profit from the life insurance business, PAT grew 16% YoY (8% QoQ) to INR4.2b.

Profitability of lending business remained strong, with robust loan growth and superior asset quality

performance. Contribution of lending operations to consolidated profit increased further to ~83% (as compared

with ~80% in 1HFY12).

Consolidated loans grew 31.8% YoY and 4.5% QoQ to INR528b, driven by strong sequential growth in personal,

agriculture and home loans. Reported margin contracted by 10bp QoQ to 4.7%.

KMB's (standalone bank) deposits grew 36% YoY and 6% QoQ to INR384b. CASA ratio improved to 27.7% from

25.7% on account of healthy 24% QoQ increase in savings bank balances boosted by high interest rates offered

on savings bank deposits post deregulation of savings bank rates.

Profit from the life insurance business continued to grow on a YoY basis, but declined QoQ to INR470m from

INR530m in the previous quarter. In line with the industry scenario, profitability of capital market related

businesses remains under pressure.

Valuation and view:

KMB is likely to remain on a strong growth path, led by corporate, home and CV loans. We

expect the bank to report ~29% CAGR in loan growth over FY11-13. Cost-to-income ratio is likely to remain above

50%, led by aggressive branch expansion and marketing campaign for savings deposits. Lending business will

continue to drive profitability and we expect the contribution of lending business to remain high at 80%+. The

stock trades at 2.4x FY13E consolidated BV and 17x FY13E consolidated EPS. Given the rich valuations, we maintain

Neutral,

with an SOTP-based target price of INR429.

; Quarterly numbers may vary from annual numbers due to difference in reporting

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com) + 91 22 3982 5415

Umang Shah

(Umang.Shah@MotilalOswal.com) + 91 22 3982 5521