28 January 2012

3QFY12 Results Update | Sector: Capital Goods

BHEL

BSE SENSEX

S&P CNX

17,234

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,205

BHEL IN

2,447.6

463/225

2/-21/-31

669.8

13.6

CMP: INR274

TP: INR258

Neutral

Operational performance above expectations:

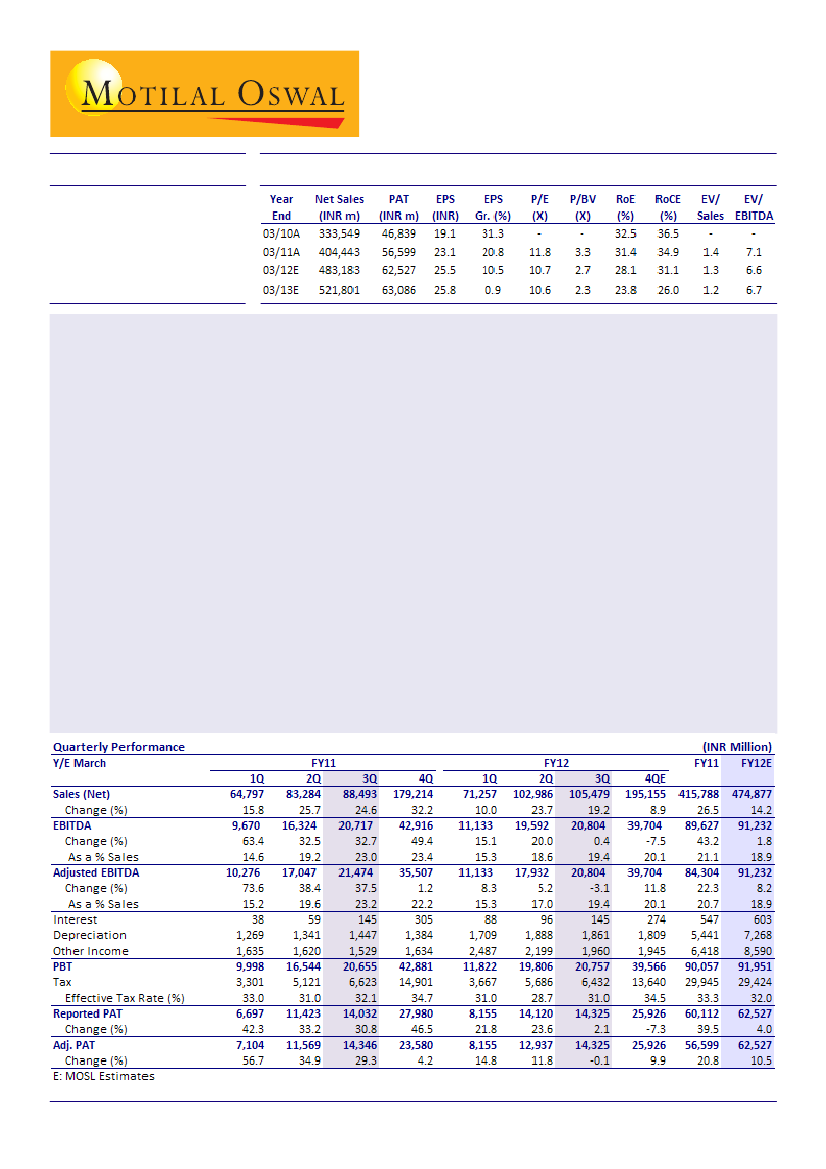

BHEL's 3QFY12 revenue grew 19% YoY to INR105b (v/s our

estimate of INR102b), driven by strong execution. Reported PAT of INR14.3b, up 2% YoY, was above our est. of

INR13.1b, driven by slightly better EBITDA margins at 19.4% v/s our est. of 18.5% and lower tax rate.

Orders see cancellations; order book declines 9% QoQ:

Order intake for the first nine months of FY12 was

down 59% YoY at INR152b (v/s intake of INR168b in 1HFY12). During the quarter, orders worth INR58.5b were

cancelled, or their scope was changed. Order book stood at INR1,465b, down 9% QoQ and 7% YoY.

EBITDA margin hit by higher provisions:

Adjusted EBITDA margin declined 380bp YoY, led by Power segment.

EBITDA margin was impacted by sharp rise in other expenditure, up 65% YoY (12.2% of sales v/s 8.8% in

3QFY11) which, in turn, was driven by much higher provisions mainly relating to contractual obligations and

liquidated damages.

Working capital deteriorates due to rise in debtors and decline in advances from customers:

Working capital

deteriorated further due to rising receivables and declining advances from customers, given decline in fresh

order inflow. Net working capital (ex cash) increased from 17% of TTM revenue as at the end of 2QFY12 to 20%

at 3QFY12 end.

Maintain Neutral with target price of INR258:

BHEL's stock price corrected significantly over the last one year.

We still remain Neutral on the stock, as we believe BHEL's valuations will remain under pressure due to

multiple de-rating triggers: (1) Possible downside to our order intake assumptions in FY12/13 due to worsening

external environment in the power sector, (2) Downside risk to FY13 earnings estimate due to execution

constraints and deteriorating working capital, and (3) Uncertainty around the company's proposed follow-on

offer (FPO).

Dhirendra Tiwari

(Dhirendra.Tiwari@MotilalOswal.com); Tel: +91 22 3029 5127

Deepak Narnolia

(Deepak.Narnolia@MotilalOswal.com); Tel: +91 22 3029 5126