27 January 2012

3QFY12 Results Update | Sector: Financials

Union Bank of India

BSE SENSEX

S&P CNX

17,077

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

M.Cap. (INR b)

M.Cap. (USD b)

5,158

UNBK IN

524.3

359/156

15/-24/-29

108.4

2.2

CMP: INR207

TP: INR320

Buy

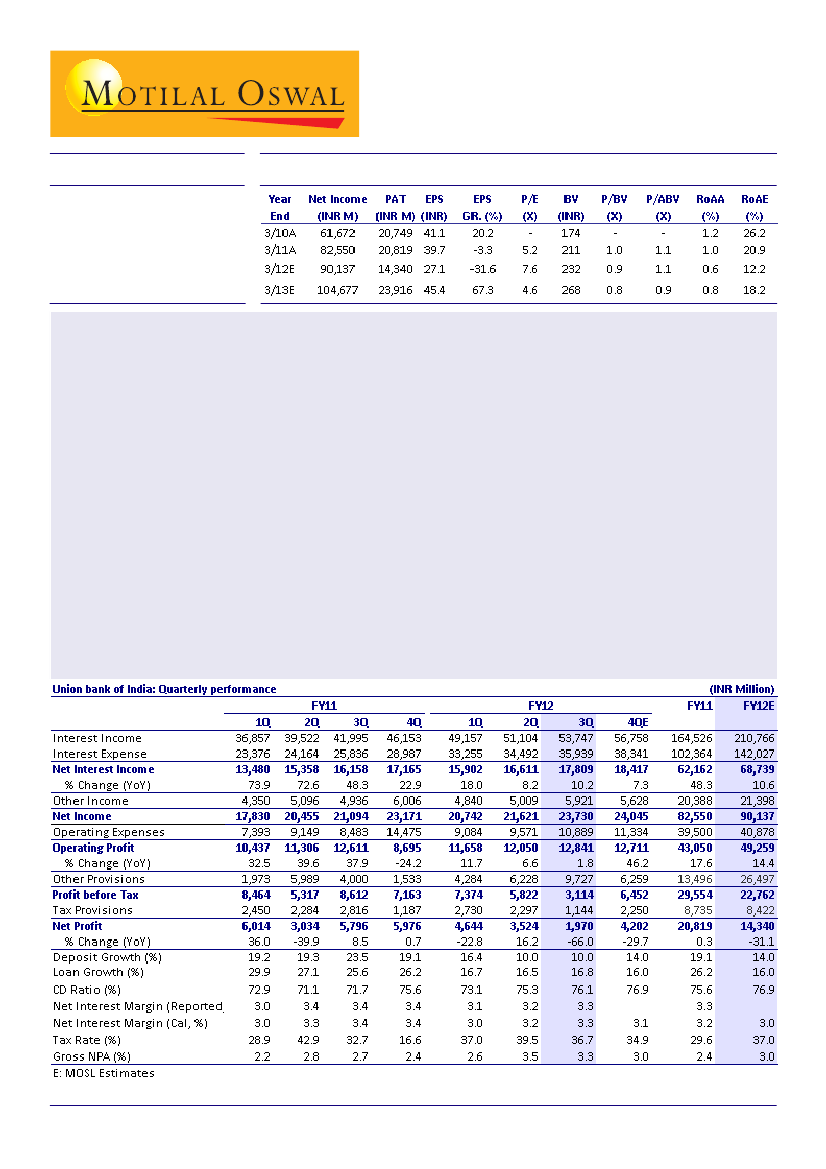

Union Bank of India 3QFY12 PAT stood at ~INR2b (v/s est. of 5.1b). While operating profit was 4% above est.,

higher than expected provisions (INR9.7b v/s est. of 4.9b) due to provision of ~INR3.5b on restructured loans (of

which one large account constituted 80%+) led to lower than est. PAT.

Slippages at 5.7b v/s INR18b a quarter ago - a positive:

Gross slippages stood at INR5.7b (annualized slippage

ratio of 1.7%) v/s INR18b in 2QFY12 and INR29.2b in FY11. In absolute terms, GNPA was flat QoQ.

Overall restructured loan book at 5.5% of overall loan:

In 3QFY12, bank restructured loan of INR20.4b (130bp

of overall loans) of which INR14b was on account of one large account in telecom segment.

Margin up 10bp QoQ at 3.3%:

NII grew 7% QoQ and 10%YoY to INR17.8b (v/s. est. of INR17.1b), however it

included INR900m on account of interest on IT refund adjusted for which NII was in-line with est.

Business improves QoQ:

Loan grew 17% YoY (up ~6% QoQ) to INR1.6t. YTD loan growth stood at just 2%;

however management guided for FY12 loan growth of 16%. CASA ratio improved marginally to 32.5% as

against 32.1% a quarter ago.

Strong fee income growth:

In 3QFY12 core fee income growth was strong (+28% QoQ and 16% YoY) leading to

10% higher than est. non-interest income.

Valuation and View:

We expect RoA to be 0.6% for FY12 and improve to 0.8% for FY13 whereas RoE is expected to

be 12.2% and 18.2% over FY12/13, EPS of INR27.1 in FY12 and INR45.4 in FY13. BV is expected to be INR232 in FY12

and INR268 in FY13. Stock trades at 0.9x BV FY12 and 0.8x BV FY13. Maintain

Buy.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com) + 91 22 3982 5415

Sohail Halai

(Sohail.Halai@motilaloswal.com)+ 91 22 3982 5430