WEEK IN A NUTSHELL

WIN-dow to the week that was

Week In a Nutshell (WIN)

Week

ended

rd

3 Feb

Key WIN-dicators

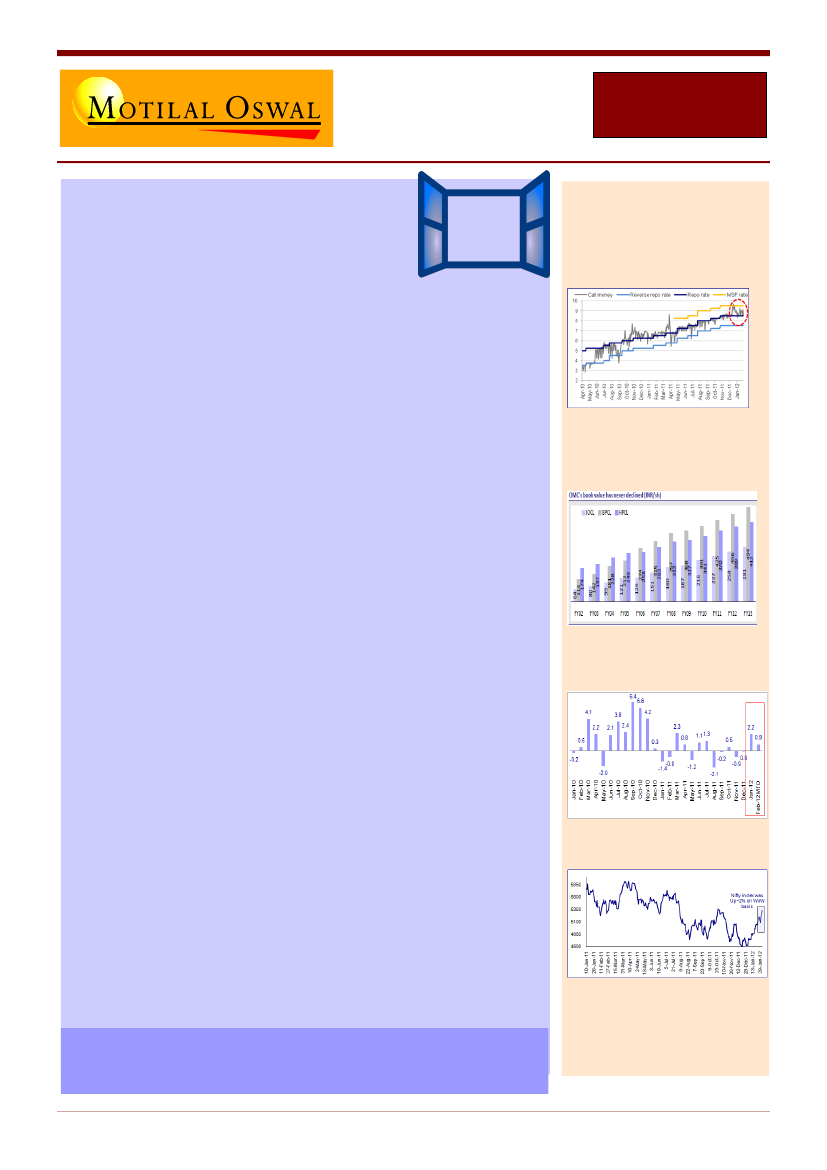

Call money rates still in the upper

corridor

Indian Equity Market continues to be the best performing market in

2012

with Nifty clocking its 5th consecutive weekly gain, led by YTD FII

inflows in excess of USD3bn. While this rally is not India specific, India

benefitted the most from rising flows into Emerging markets, coming out

of one of the worst months ever in December. The week also saw

Supreme Court deliver a landmark judgment cancelling ~120 telecom

licenses issued by government in 2008. This would likely reduce

competitive intensity and the sector would finally be served up the much

awaited consolidation. Banking Secretary clarified that the Banking sector

exposure to the affected parties is INR 100 Bn.

Monthy Auto Numbers:

Have the car volumes bottomed out? The

numbers seem to be indicating that; with both Tata Motors and Maruti

surprising positively. 2 Wheelers are trading market share but clearly this

year will be different and tougher. Can the 2 Wheeler stocks go the same

fate as the PV stocks? Inventory levels seem different for different

companies ranging from 15 to 40 days.

While the earnings have been largely in line with expectations till now

with

Nifty Companies reporting a PAT growth of 9.4% YoY,

we highlight a

few that stand out for the right and the wrong reasons:

-

ICICI Bank:

6% lower than est Opex, 19% lower than est provisioning

and higher Other Income (maiden dividend of INR1.5b from life

insurance sub) were the 3 key reasons for PAT (INR117.3b +20%YoY)

being 10% above our est. Adjusting for dividend, PAT was in line. 30bps

QoQ improvement in International NIM’s were a +ve surprise.

-

Titan:

PAT was impacted by by 5% decline in jewelry volumes and a

steep 590bp decline in watch business margins.

-

Crompton Greaves:

Worst possibly over, but wouldn’t jump in yet. Build

up of orders is a +Ve (Consol order-book stands at INR82b, up 17% YoY

on back of strong order flows in domestic power business).

We would also like to bring focus on Indian OMCs (BPCL, HPCL and IOC)

where there has been no erosion in BV but the stocks are trading at

significant discount to their 10-year historical averages. Also, in our

view, the Govt/ upstream will eventually compensate OMCs, ensuring

no erosion of BV. We have Buy ratings on the OMCs.

OMC book Values have never

declined

Monthly FII Investments

US$B

WoW - Nifty Change (+2.3%)

WWW – WIN Weekend Wisdom

Four most dangerous words in investing: “Its different

this time”.

WIN – Week In a Nutshell

1

3 Feb

2012