7 February 2012

3QFY12 Results Update | Sector: Consumer

Pidilite Industries

BSE SENSEX

S&P CNX

17,622

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,335

PIDI IN

506.1

183/123

-11/-20/17

72.4

1.5

CMP: INR143

TP: INR181

Buy

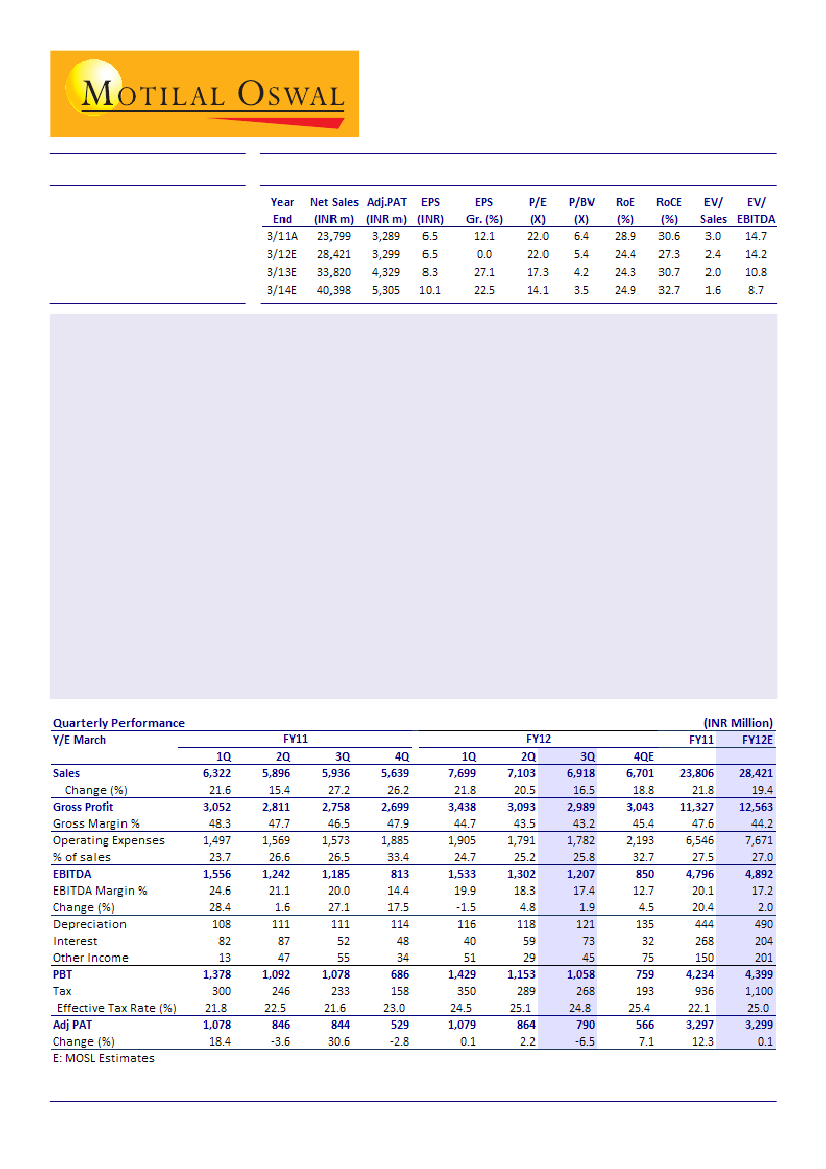

3QFY12 results below expectations:

Pidilite Industries (PDID) 3QFY12 results were disappointing with

adjusted PAT declining 7% YoY to INR790m (vs our estimate of INR920m). Sales grew 16.5% YoY to INR6.9b led

by ~14-15% volume growth in consumer and bazaar product segments.

INR depreciation impacts gross margins:

Gross margins declined 330bp to 43.2% due to steep INR depreciation

and higher VAM (Vinyl Acetate Monomer) prices on a YoY basis. Industrial products segment reported 2%

decline in sales and 43% decline in profits due to poor export demand and inventory de-stocking.

Estimates lowered:

We have lowered our FY12 EPS estimates by 5% and FY13 EPS estimates by 2.6% to factor

in lower margins in the consumer business due to high input costs and declining sales in industrial chemicals.

However, going forward, we believe the company would gain from appreciating INR as VAM prices have

eased to USD1,000/MT.

Positive on volume growth in consumer and Bazaar products:

We remain positive on volume growth in the

consumer and Bazaar segments despite the management's cautious outlook. We also believe margins in the

consumer and Bazaar segments would start expanding from 1QFY13; however, the industrial chemicals

segment's margins would take time to recover.

Valuations and View:

We introduce our FY14 EPS estimate at INR10.1/share and forecast 25% PAT CAGR over

FY12-14. The stock price has reacted from INR190 levels due to concerns over falling margins and growth

outlook. It trades at 17.3xFY13E EPS of INR8.3 and 14.1xFY14E EPS of INR10.1. Maintain

Buy

with target price

of INR181, 27% upside from the current level.

Amnish Aggarwal

(AmnishAggarwal@MotilalOswal.com); Tel:+9122 3982 5404