9 February 2012

3QFY12 Results Update | Sector: Financials

Dena Bank

BSE SENSEX

S&P CNX

17,707

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

M.Cap. (INR b)

M.Cap. (USD b)

5,368

DBNK IN

333.4

114/48

37/-7/-15

26.8

0.5

CMP: INR81

TP: INR144

Buy

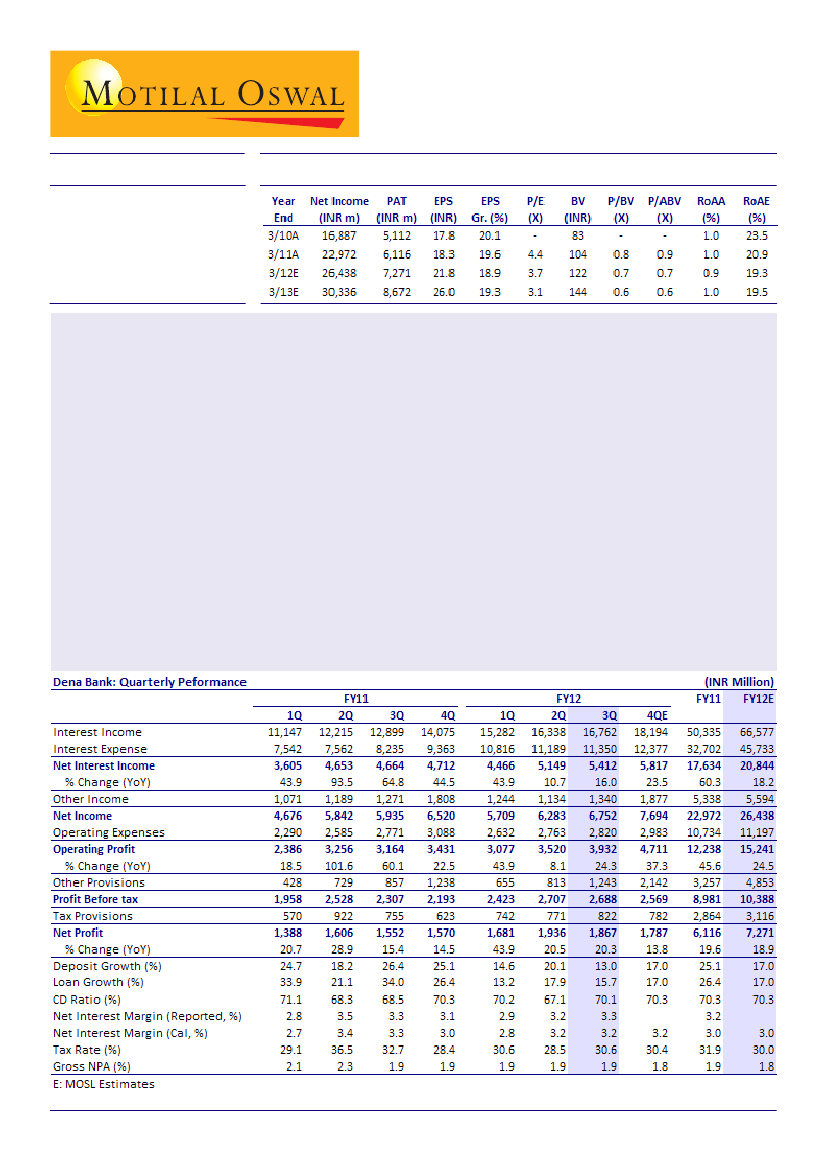

Dena Bank (DBNK) reported a PAT of ~INR1.9b for 3QFY12, up 20% YoY. Reported NIM improved 11bp QoQ to 3.3%,

led by ~300bp improvement in CD ratio and higher yield on loans (+22bp QoQ). Further, core fee income was

strong at 13% QoQ and 27% YoY, driving PAT.

Key highlights:

Strong loan growth:

Loans grew 11% QoQ and ~16% YoY to INR480b whereas deposits grew 6.4% QoQ and 13%

YoY to INR683b. CD ratio improved 300bp QoQ to 70%. Management has guided loan growth of 20%+ for FY12.

Slippages remain under check:

Slippages during the quarter stood at ~INR1.7b (annualized slippage ratio of

1.7% - stable QoQ). Slippages were broad-based and the bank expects asset quality to remain healthy.

Restructured loans at 3.8% of overall loans:

DBNK restructured loans of INR3.1b, of which INR1.3b can be

attributed to the restructuring of the Uttar Haryana SEB account. The management expects restructuring to

increase in 4QFY12, led by two large accounts - GTL (exposure of INR4b) and Rajasthan SEB. The bank has not

booked any NPV losses on the loans restructured during 9MFY12.

Likely to raise capital:

DBNK expects to raise capital by selling ~5% stake to LIC and expects the government to

infuse more capital. Cumulatively, it expects to raise INR5b from both sources. We have not yet factored this

into our estimates. CAR stood at 12.9% (including 9MFY12 profits), of which tier-I capital stood at ~9.8%.

Valuation and view:

We expect DBNK to report an EPS of INR21.8 in FY12 and INR26 in FY13. BV would be INR122

in FY12 and INR144 in FY13. The stock trades at 3.7x FY12E and 3.1x FY13E EPS, and 0.7x FY12E and 0.6x FY13E BV. RoA

and RoE are likely to be ~1% and 19%+, respectively over FY12/13. Maintain

Buy.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); Tel: + 91 22 3982 5415

Sohail Halai

(Sohail.Halai@MotilalOswal.com); Tel: + 91 22 3982 5430