14 February 2012

3QFY12 Results Update | Sector: Utilities

CESC

BSE SENSEX

17,773

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

S&P CNX

5,5390

CESC IN

125.6

364/186

9/-22/-9

33.9

0.7

CMP: INR270

TP: INR454

Buy

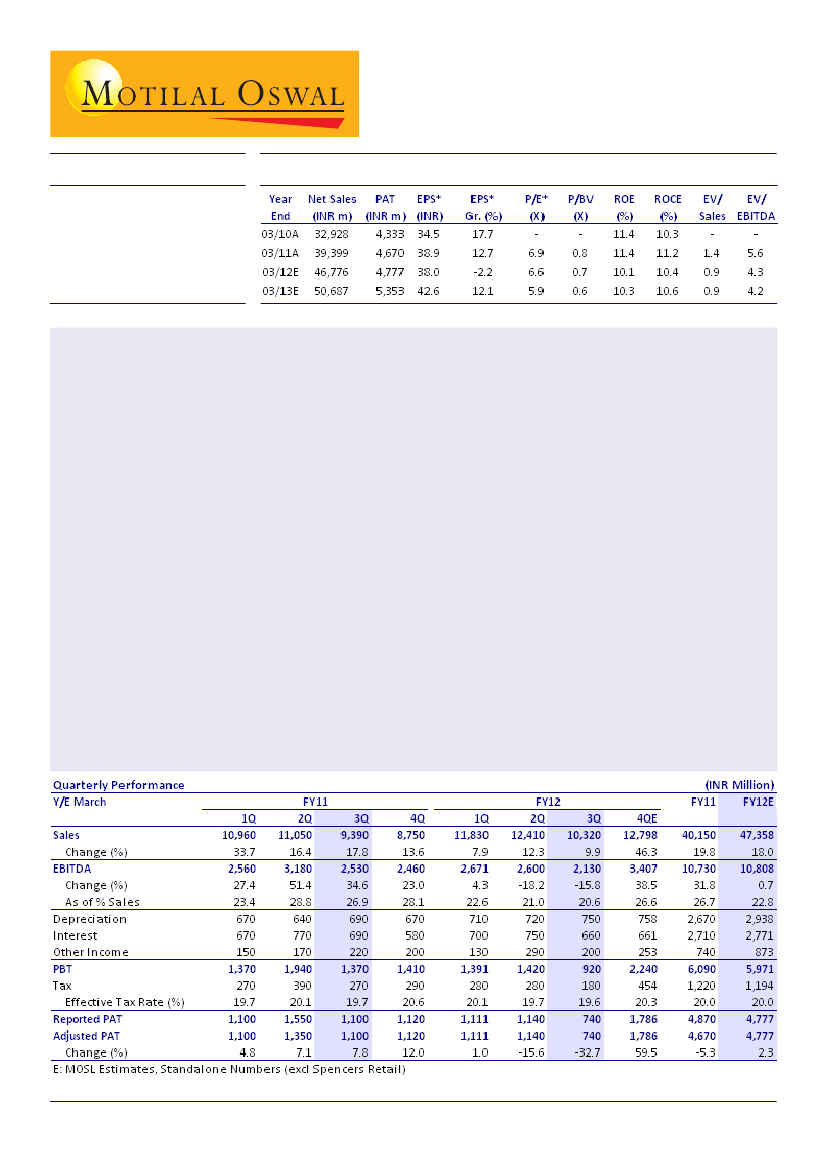

* Excl Spencers; fully diluted

Results below estimates:

CESC's reported 3QFY12 PAT at INR740m (down 33% YoY) was much lower than our

estimate of INR1.5b. We had factored in a hike in tariff rates, which is not yet approved and to that extent

recurring PAT would have been lower by INR0.8-1b. Our interaction with the management indicated under-

recoveries of "non-fuel" items (fuel increase is passed through on monthly basis). Pending tariff order (TO)

approval, management has created a provision to the extent of INR350m, on the back of conservative policy

and prudence.

Consolidation at Spencer continues:

Spencer's total area under operation stood at 1.02msf, up 0.02msf MoM.

For YTDFY12, Spencer has added 0.07msf, despite closing 21 daily and express stores. Sales increased during

the quarter as indicated by robust revenues of INR1,087/sf/month in 9MFY12 compared to INR1,066/sf/month

in 1HFY12. Store-level EBIDTA has also registered an increase 3QFY12, deduced from 9MFY12 EBIDTA of INR35/

sf/month compared 1HFY12 EBIDTA of INR31/sf/month. For 9MFY12, store-level EBITDA was INR311m against

INR194m in 9MFY11.

Steady progress for projects under construction:

CESC is currently constructing 1.2GW of power projects (current

installed capacity of 1.2GW) and has obtained major clearances/placed equipment orders for the entire

capacity. It is also working on ~6GW of projects. It has consolidated its power business holdings through a

wholly-owned subsidiary, CESC Infrastructure, which in turn owns Haldia Energy (600-MW coast-based project).

Haldia Energy owns Dhariwal Infrastructure (which operates the 600-MW Chandrapur project in Maharashtra).

This provides the company a platform to induct a financial investor for meeting the funding requirements of

the power business.

Valuations and view:

We expect CESC to report a standalone PAT of INR4.8b in FY12 (up 2% YoY) and INR5.3b in

FY13 (up 12% YoY). The stock quotes at PER of 6x FY13E on a standalone basis. Maintain

Buy.

Nalin Bhatt

(NalinBhatt@MotilalOswal.com) +91 22 3982 5429

Satyam Agarwal

(AgarwalS@MotilalOswal.com)

/

Vishal Periwal

(Vishal.Periwal@MotilalOswal.com)