15 February 2012

3QFY12 Results Update | Sector: Automobiles

Tata Motors

BSE SENSEX

17,849

Bloomberg

Diluted Eq.Shares (m)

52-Week Range (INR

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

S&P CNX

5,416

TTMT IN

3,347.7

272/138

18/61/13

896.9

18.2

* Consolidated; ^ Normalized for capitalized expenses

CMP: INR268

TP: INR323

Buy

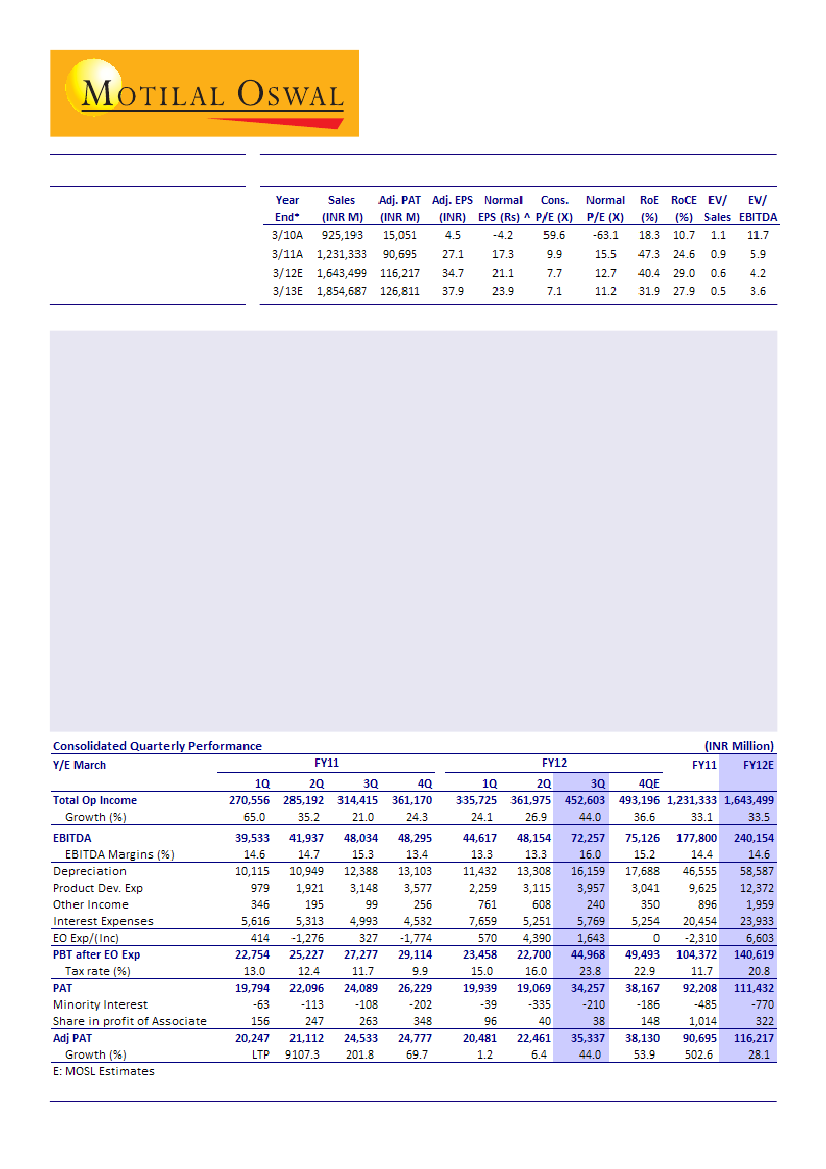

Tata Motors (TTMT) posted better than expected results for 3QFY12. Consolidated EBITDA margin for the

quarter was its best ever at 16% (v/s our estimate of 13.1%). Recurring PAT was INR35.4b (v/s our estimate of

INR29.3b). While JLR surprised positively, with its highest ever EBITDA margin, the performance of the domestic

business did not meet expectations.

Consolidated sales grew 44% YoY (25% QoQ) to INR453b (v/s our est. of INR451b). EBITDA margin was 16%

(+270bp QoQ, +70bp YoY). PAT grew 44% YoY to INR35.4b (v/s our est. of INR29.3b); growth was restricted due

to higher than estimated depreciation and tax rate. TTMT posted net MTM forex loss of INR1.6b, after reversal

of 1HFY12 loss of INR6.6b.

JLR's revenue grew 41% YoY (28% QoQ) to GBP3.7b (v/s est. of GBP3.7b). EBITDA margin expanded by 520bp

QoQ and 270bp YoY to 20.1% (v/s est. of 15.8%), led by favorable currency movement (+90bp QoQ), better

product and market mix, higher operating leverage and revaluation of forex liability (+160bp QoQ). JLR's PAT

grew 85% QoQ and 60% YoY to GBP440m (v/s est. of GBP336m, and GBP238m in 2QFY12) despite higher tax.

Standalone volumes grew 19% YoY (9% QoQ). However, realizations declined ~1% YoY (5.8% QoQ) due to

adverse product mix, resulting in revenue growth of 18% YoY (3% QoQ) to INR133b (v/s our estimate of

INR141b). Further, higher marketing spend led to margin contraction of 410bp YoY and 50bp QoQ. Lower

interest and tax boosted adjusted PAT to INR2.5b (v/s estimate of INR3b) - a decline of 42% YoY and 11% QoQ.

We upgrade our consolidated normalized EPS estimates by 13% for FY12 to INR21.1 and by 8% for FY13 to

INR23.9. The stock trades at 7.1x FY13E consolidated EPS and 11.2x FY13E normalized consolidated EPS. Maintain

Buy

with revised target price is INR323 (FY13E SOTP-based).

Jinesh Gandhi

(Jinesh@MotilalOswal.com) + 91 22 3982 5416

Mansi Varma

(Mansi.Varma@MotilalOswal.com) + 91 22 3982 5418