15 February 2012

3QFY12 Results Update | Sector: Healthcare

Sun Pharmaceuticals

BSE SENSEX

S&P CNX

17,849

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,416

SUNP IN

1,035.6

566/404

-3/10/31

573.7

11.6

CMP: INR554

TP: INR614

Neutral

* Including Para-IV/one-off upsides

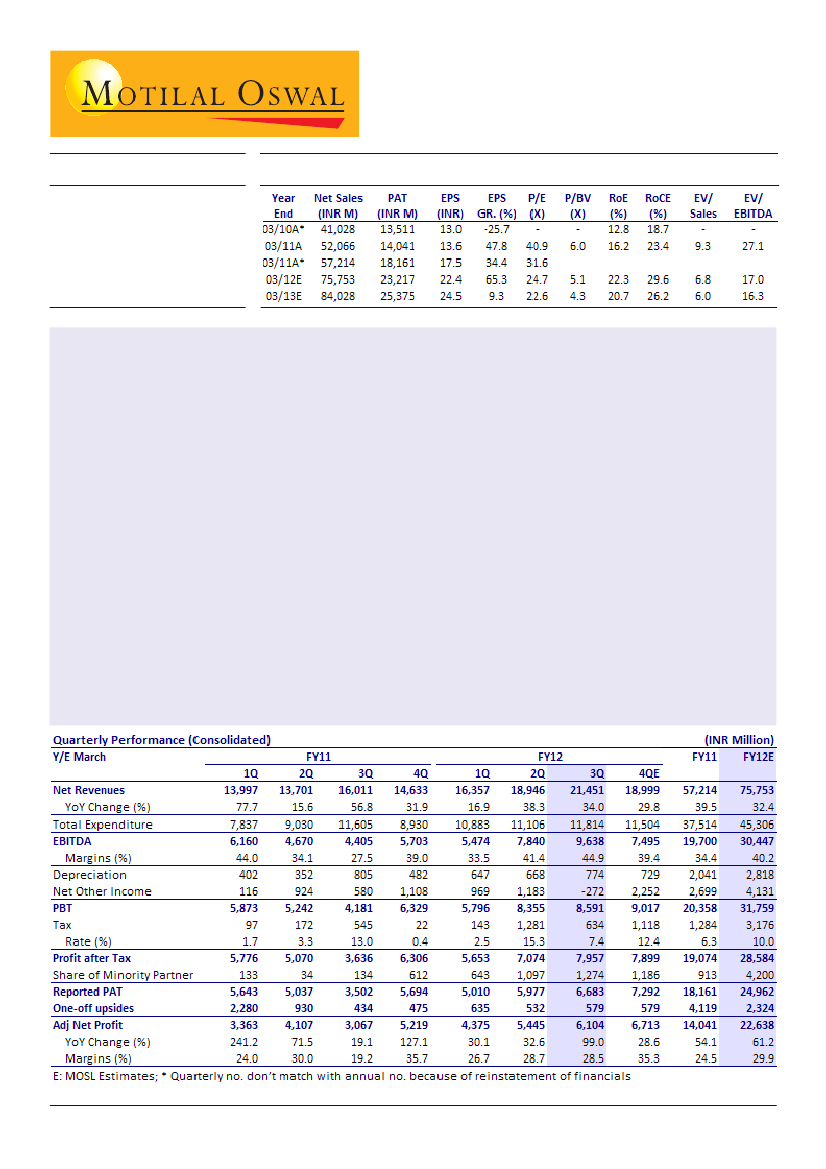

Results beat estimates:

Sun Pharma's (SUNP) 3QFY12 performance was significantly better than our

expectations. Net sales grew 34% YoY to INR21.45b partly driven by Taro's strong performance and favorable

currency. EBITDA surged 119% YoY to INR9.64b with EBITDA margin at 44.9% compared to 27.5% for 3QFY11.

Reported PAT (including one-offs) increased 91% YoY to INR6.68b, higher than our estimate of INR5.1b.

US formulations business boosts core topline:

Core topline growth was driven mainly by the robust

performance in US formulations business (up 63% YoY) led by Taro and favorable currency. Domestic formulation

revenues grew 8.6% YoY. Excluding the one-off upsides, core US formulation business is estimated to have

grown by a healthy 77.6% YoY. Formulation exports to RoW markets grew 27% YoY.

Better operational performance:

Core EBITDA (excl. one-offs) is estimated to have grown 137% YoY to INR8.9b

(v/s est. of INR5.7b), while core EBITDA margin is estimated at 43.7% (v/s est. of 33.5%). Excluding one-offs,

adj. PAT at INR6.1b (up 99% YoY) was higher than estimate of INR4.78b due to better operational performance.

Outlook and view:

An expanding generic portfolio, coupled with sustained double-digit growth in high-

margin life-style segments in India, is likely to translate into long-term benefits for SUNP.

Key drivers for

future:

(1) Ramp-up in US business and resolution of Caraco's cGMP issues; (2) Monetization of the Para-IV

pipeline in the US; (3) Launch of controlled substances in the US and (4) Sustaining Taro's high profitability.

Valuations:

The stock is valued at 24.7x FY12E and 22.6x FY13E core earnings. While we are positive on SUNP's

business outlook, stiff valuations have tempered down our bullishness. Maintain

Neutral

rating with a TP of

INR614 (25x FY13E EPS), despite the robust strong 3QFY12 performance. Inorganic initiatives (SUNP has cash

of ~USD1b) would be the key risk to our rating.

Nimish Desai

(NimishDesai@MotilalOswal.com); Tel: +91 22 3982 5406

Amit Shah

(Amit.Shah@MotilalOswal.com); Tel: + 91 22 3982 5423