16 February 2012

3QFY12 Results Update | Sector: Infrastructure

Simplex Infrastructure

BSE SENSEX

S&P CNX

18,202

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,532

SINF IN

49.5

366/157

-2/-29/-33

10.9

0.2

CMP: INR221

TP: INR290

Buy

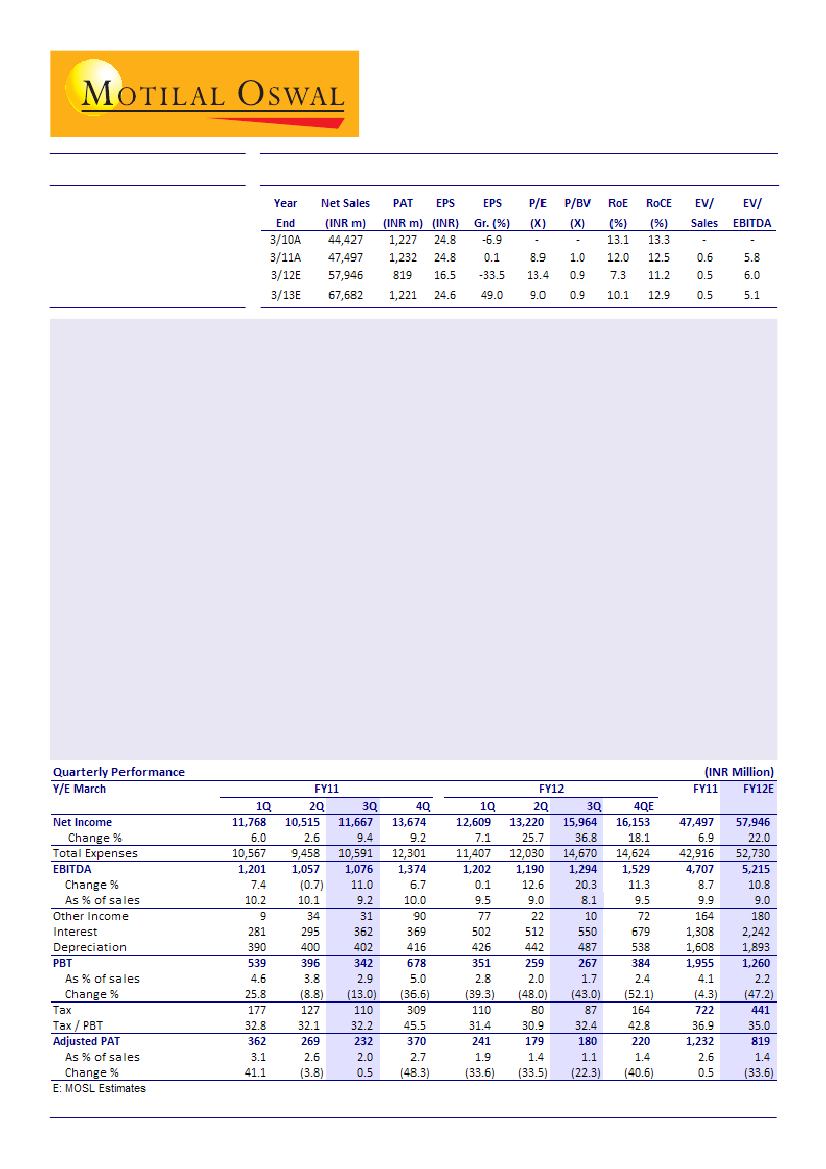

Simplex Infrastructure (SINF) reported revenue of INR16b (up 37% YoY) for 3QFY12, significantly higher than

our estimate of INR13.2b. Execution picked up both on the domestic front as well as on overseas business.

Domestic revenue grew 40% YoY to INR14.2b and overseas revenue increased 17% YoY to INR1.3b, as countries

like Ethiopia, Qatar and Bangladesh started contributing.

EBITDA at INR1.26b (up 20.3% YoY) was in-line with our estimate. EBITDA margin stood at 8.1% (down 110bp

YoY) v/s our estimate of 9.5%. The management attributed the decline in EBITDA margin to the initial start-up

cost in certain projects. A lot of new projects are in the initial phases as the order book was ramped up during

the last two quarters. However, blended margin on the order book is still 10.5%+, which the management

expects to achieve in a couple of quarters. PAT declined 22.3% YoY to INR180m v/s our estimate of INR157m.

Net margin stood at 1.1% v/s 2% in 3QFY11, dragged by high net interest cost of INR550m (v/s INR362m in

3QFY11). Debt as at end-December 2011 stood at INR20.5b v/s INR16b as at March 2011.

Order book during the quarter remained stable at INR144b, up 4% YoY. Order intake declined 52% YoY to

INR10b. Intake during Jan-Feb 2012 stood at INR20.9b. So the total intake in 9MFY12 stood at INR59b v/s

INR79b in FY11. Further, SINF has bagged L1 projects worth INR50b. Of the current order book, power segment

contributes 49% (v/s 24% in Dec-10). Share of buildings increased to 30% from 20% in Dec-10. Of this, real

estate forms 16%, where execution is a concern. Share of industrial declined to 3% (v/s 15% in Dec-10).

According to the management, easing interest rate scenario should revive industrial investment.

We have increased our revenue estimates by 6% for FY12 and by 9% for FY13 and PAT estimates by 2% for both

FY12 and FY13 on account of the revival in YTD order intake and better-than-expected execution. To factor in

increased raw material prices, we have lowered our EBITDA margin estimates by 40bp. The stock trades at 9x

FY13E EPS and 5.1x FY13E EV/EBITDA. We maintain

Buy

with a target price of INR290 (6x FY13E EV/EBITDA).

Dhirendra Tiwari

(Dhirendra.Tiwari@motilaloswal.com ) +91 22 3029 5127

Pooja Kachhawa

(Pooja.Kachhawa@MotilalOswal.com) +91 22 3982 5585