16 February 2012

5QSY12 Results Update | Sector: Sugar

Shree Renuka Sugars

BSE SENSEX

S&P CNX

18,202

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,532

SHRS IN

671.0

87/23

14/-39/-51

27.3

0.6

CMP: INR41

TP: INR50

Buy

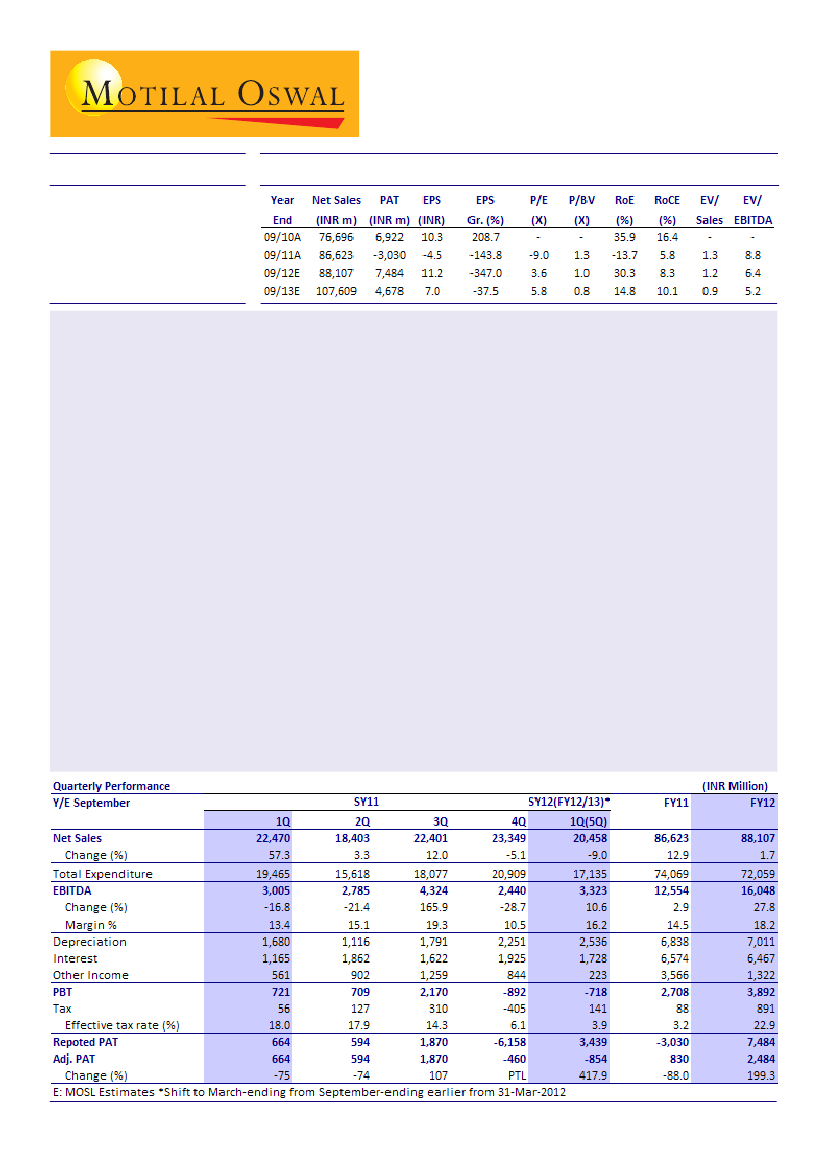

Shree Renuka Sugars' (SHRS) reported 11% YoY growth in EBIDTA to INR3.3b for 5QFY12 (change in accounting

year to April-March from October-September). Revenue declined 9% YoY to INR20.5b, while PAT surged 4x to

INR3.4b due to forex gain of INR4.3b on USD/Real dominated liabilities. The forex gain was due to adoption

of revised accounting standard to amortize change in long term foreign exchange liabilities over the tenor of

the liability.

Standalone EBITDA slipped by just 3% YoY, despite the huge 37% YoY decline in revenue (on account of lower

sugar sales and trading revenue). Expansion in EBITDA margin is attributed to the improvement in realizations

across all segments. The company expects its refinery business to improve over next couple of quarters due

to (1) favorable sugar spread; and (2) substantial availability of domestic raw sugar.

In Brazil, numbers remained steady on a YoY basis, although margins improved on account of higher sugar

realization. However, higher realization was offset by lower volumes on account of adverse weather that

impacted crushing volume of Renuka do Brasil (RDB). After the severe impact on cane yield in 4QSY11, the

management expects yields to recover to ~65t/ha going forward.

During 5QFY12, SHRS has achieved its plantation target of ~25,000 ha (20,045ha at RDB and 5,136ha at VDI). We

expect re-plantation to lower average age of crops and improve productivity/yield.

The company's net debt increased by ~INR7b to ~INR90b due to the increase in working capital debt in Indian

operations. The management guided the divestment of co-gen business (138MW at Equipav) to be concluded

by Feb-end. We believe this event would be a key trigger for the company's re-capitalization target.

Going forward, key triggers for the stock's would be: (1) turnaround in volumes and cane yield of its Brazilian

operations, (2) upswing in international sugar prices, and (3) reduction in debt.

The stock trades at 5.8x FY13E EPS of INR7, and EV/EBITDA of 5.2x FY13E. We continue to value SHRS at 6x EV/

EBITDA, leading to a lower target price of INR50. Maintain

Buy.

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); Tel: +91 22 3982 5436