21 February 2012

4QCY12 Results Update | Sector: Healthcare

GlaxoSmithKline Pharmaceuticals

BSE SENSEX

S&P CNX

18,429

5,607

CMP: INR2,088

TP: INR2,272

Buy

Bloomberg

GLXO IN

Equity Shares (m)

84.7

52-Week Range (INR) 2,475/1,830

1,6,12 Rel. Perf. (%)

-4/-11/-5

M.Cap. (INR b)

176.9

M.Cap. (USD b)

3.6

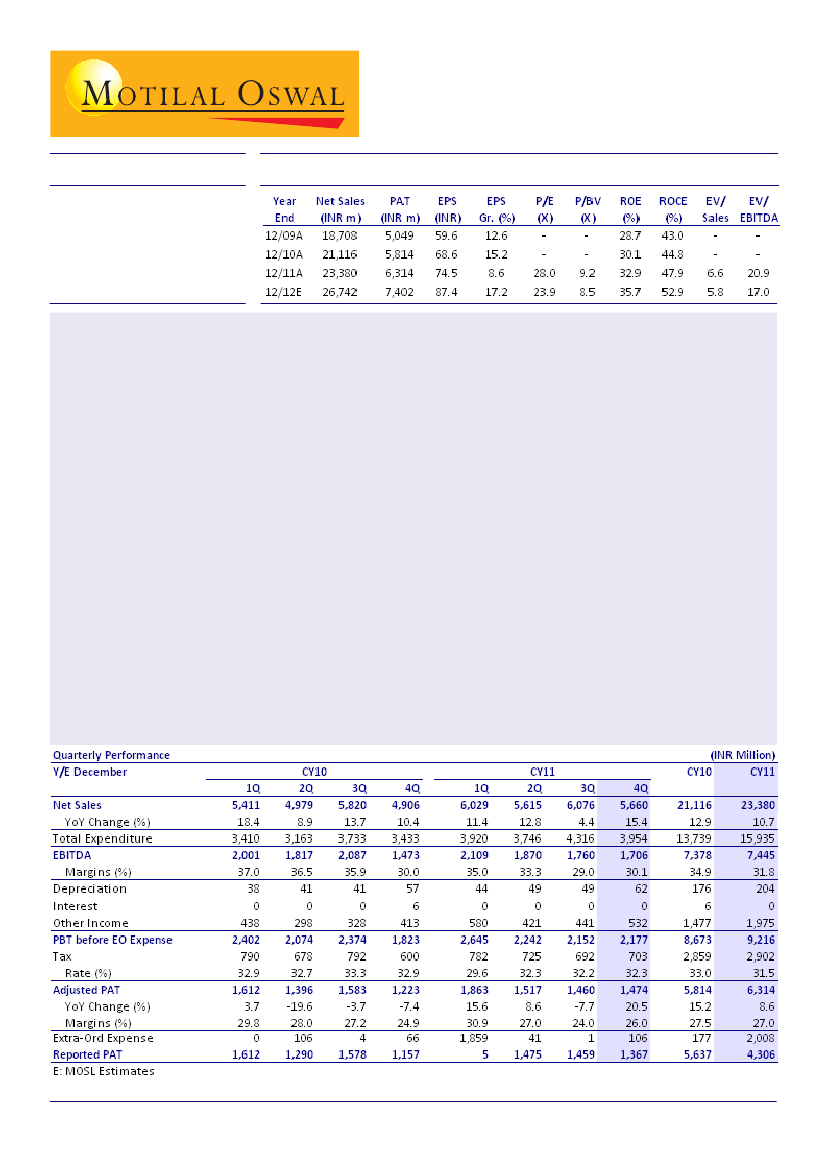

GlaxoSmithKline Pharmaceuticals (GLXO) posted net sales of INR5.66b (v/s our estimate of INR5.43b) for

4QCY12, up 15.4% YoY. EBITDA grew 15.8% YoY to INR1.71b (v/s our estimate of INR1.62b) while adjusted PAT

increased 20.5% YoY to INR1.47b (v/s our estimate of INR1.3b).

While overall revenue growth was 15.4% YoY, revenue from the core pharmaceuticals business grew by an

impressive 18.2% YoY. Topline growth was led by revival in the Mass Market business and Anti-infectives

segments. Vaccines and Specialty segments including Oncology, Dermatology, Cardiovascular and Metabolics

reported robust double-digit growth, driven by new product launches.

EBITDA grew 15.8% YoY to INR1.71b; EBITDA margin remained flat YoY at 30.1% (v/s our estimate of 29.8%).

EBITDA was higher than estimated, primarily led by better than estimated topline growth.

Adjusted PAT increased by 20.5% YoY to INR1.47b (v/s our estimate of INR1.3b), led by higher than estimated

other income and lower effective tax rate. GLXO has declared INR45/share as dividend.

We believe GLXO is one of the best plays on the IPR regime in India, with aggressive plans to launch new products

in the high-growth lifestyle segments. These launches should bring in long-term benefits. While we expect

double-digit topline growth to sustain over the next few years, the growth trajectory should improve further

post CY13, as new launches start contributing meaningfully. This growth is likely to be funded through miniscule

capex and negative net working capital. GLXO deserves premium valuations due to strong parentage (giving

access to large product pipeline), brand-building ability and likely positioning in the post-patent era. It is one of

the very few companies, with the ability to achieve reasonable growth without any major capital requirement,

leading to high RoCE of over 45%. We expect GLXO to record an EPS of INR87.4 (up 17.2%) in CY12. The stock

currently trades at 23.9x CY12E EPS. Maintain

Buy,

with a target price of INR2,272 (26x CY12E EPS).

Nimish Desai

(NimishDesai@MotilalOswal.com); Tel: +91 22 39825406

Amit Shah

(Amit.Shah@MotilalOswal.com); Tel: + 91 22 3982 5423