DAILY FUNDAMENTAL REPORT - AGRO

Feb 23

rd

, 2012

Market Overview:

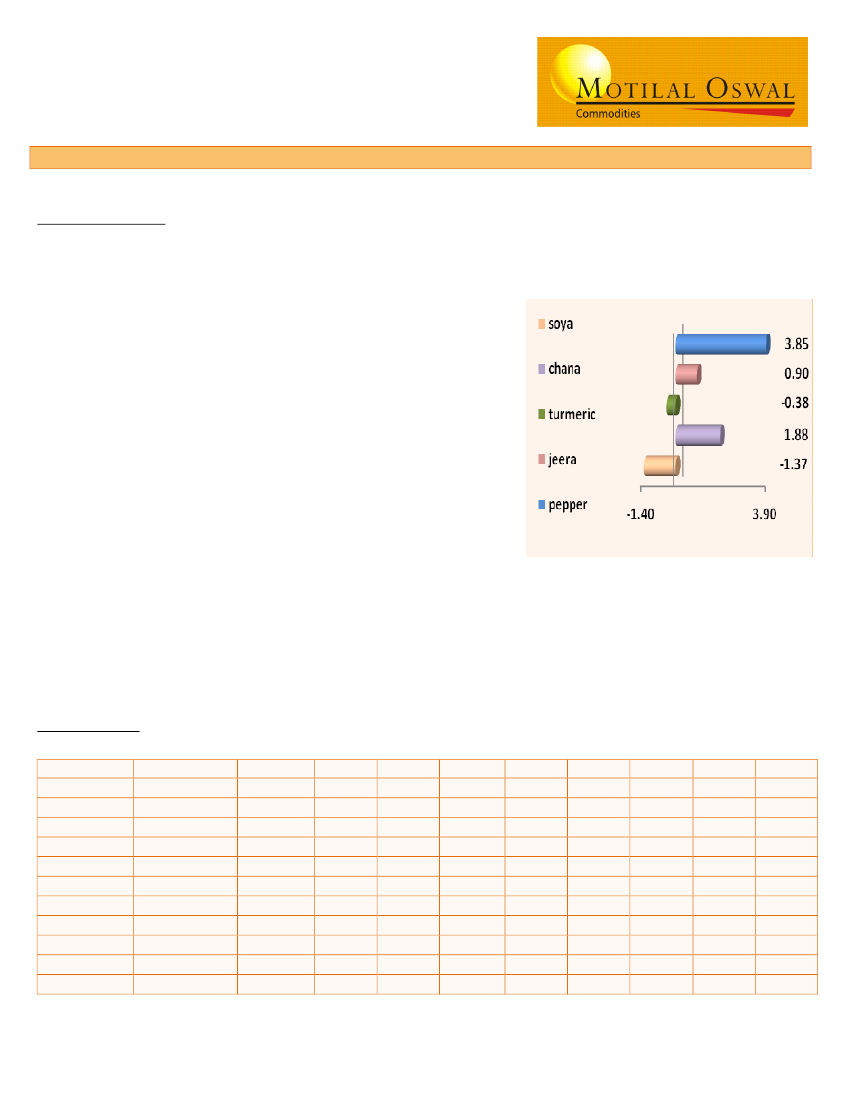

Turmeric Improved fresh arrivals from the domestic market

led Spot and Futures prices to move towards south Prices

overlooked buying by the overseas buyers mainly influenced

the prices here.

Supported by a firming trend at spot market on rising

demand, pepper prices extended gains for the second straight

session by adding in futures trade. Trading sentiment further

strengthened on estimates of lower output this season. Rising

demand in the spot market and reports of lower output

mainly supported the prices here.

Chana futures expected to continue uptrend on lower supplies

amidst negligible carryover stocks. Lower output concerns

and firm domestic demand also supported the chana futures

to trade higher.

Jeera prices traded on positive note consecutive for second

session in unjha markets of India due to strong domestic

demands amid dull arrivals in the market from the producing

regions.

Watch

Market Watch

AGRO

CHANA

CHILLY

GUAR GUM

GUAR SEED

JEERA

PEPPER

R M SEED

SOYA BEAN

SOYA OIL

TURMURIC

WHEAT

CONTRACT

NCDEX March

NCDEX March

NCDEX March

NCDEX March

NCDEX March

NCDEX March

NCDEX April

NCDEX March

NCDEX March

NCDEX April

NCDEX March

OPEN

3547

5320

49300

15580

13838

32100

3604

2637

716.9

4670

1230

HIGH

3668

5420

49899

15690

14022

33375

3615

2642

719.8

4764

1233

LOW

3547

5270

48870

15300

13740

32000

3535

2585

712.1

4660

1227

CLOSE

3609

5420

49150

15432

13930

33375

3545

2595

713.5

4686

1230

CHG

68

188

-196

-67

126

1285

-48

-35.5

-1.65

-18

-2

% CHG

1.920

3.59

-0.40

-0.43

0.91

4.00

-1.34

-1.35

-0.23

-0.38

-0.16

OI

63260

3740

4465

25900

12099

4534

213310

164450

129790

16125

7490

CHG

29850

1550

3040

9500

2751

1047

33170

24100

37680

2940

2760

%CHG

47.2

41.4

68.1

36.7

22.7

23.1

15.6

14.7

29.0

18.2

36.8