2 May 2012

4QFY12 Results Update | Sector: Consumer

Dabur India

BSE SENSEX

S&P CNX

17,319

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,248

DABUR IN

1,740.7

122/92

5/13/20

195.0

3.7

CMP: INR112

TP: INR104

Neutral

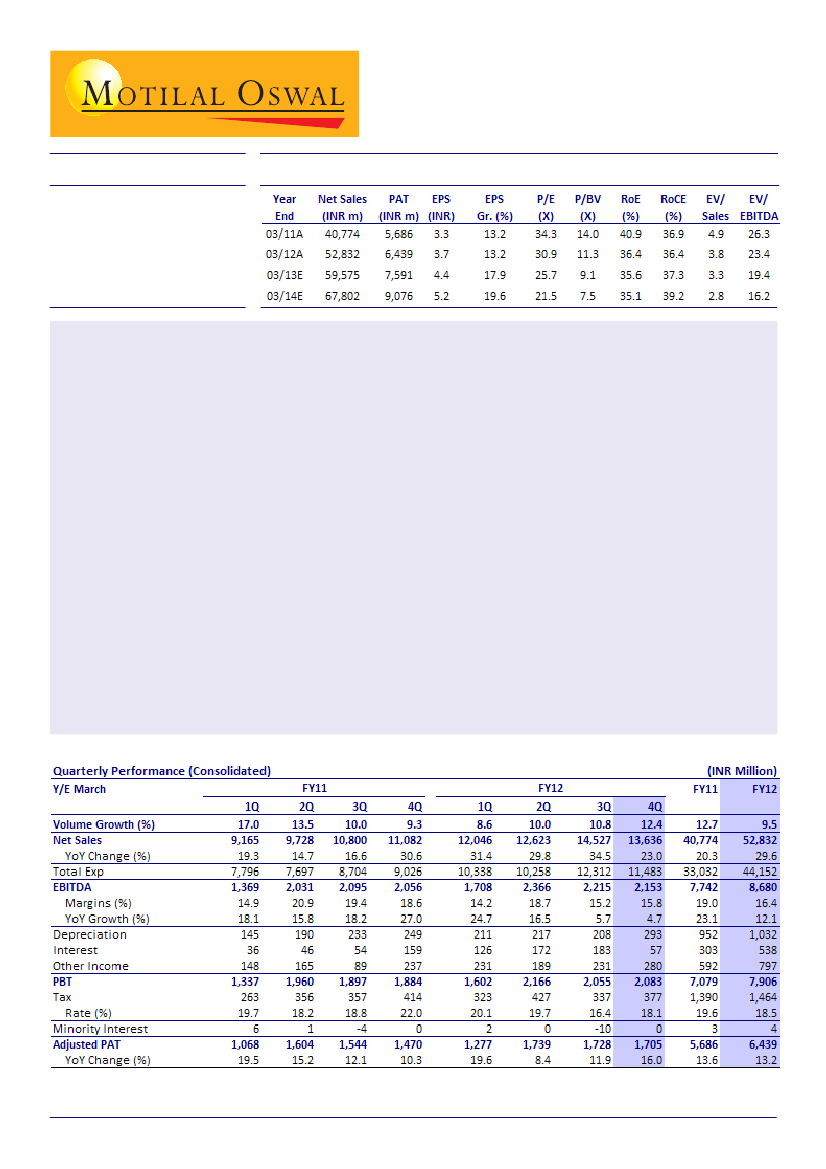

Dabur India (DABUR) reported better than expected results for 4QFY12. Adjusted PAT grew 16% to INR1.7b

(v/s our estimate of INR1.56b), led by lower interest and lower tax rates. Sales growth was 23%, higher than

our estimate, led by strong recovery in both domestic and international markets - volumes increased 12.4%.

Gross margin contracted 320bp to 49.8%, as steep inflation and lag in price increases continued to impact

profitability.

EBITDA margin declined 276bp to 15.8% owing to higher ad expenses (up 190bp). EBITDA grew just 1.9% to

INR2,153m (v/s our estimate of INR2,105m). Interest cost declined 64% due to INR70m forex gain during

4QFY12. A 26% increase in other income and lower tax rate (down 390bp) boosted PAT by 16% to INR1,705m

(v/s our estimate of INR1,567m).

The management had indicated volume growth focus in the previous quarter and the company has been able

to achieve that. We note that Dabur has been slow in raising prices and this has impacted margins. The

management is contemplating increasing prices gradually to recover profit margins.

Dabur is expanding its rural distribution meaningfully. This will enable it to grow faster than the market and

to increase its market share even if rural growth slows down.

We expect higher growth in international business, as the GCC region recovers; the success of Namaste

products in Africa will hold the key to any meaningful increase in growth rates, in our view. We marginally

tweak our estimates by factoring in 100bp lower tax rate and INR1b capex in Sri Lanka. We estimate 18.7% PAT

CAGR over FY12-14.

The stock trades at 25.7x FY13E EPS of INR4.4 and 21.5x FY14E EPS of INR5.2. Maintain

Neutral.

Amnish Aggarwal

(AmnishAggarwal@MotilalOswal.com); +9122 39825404