8 May 2012

4QFY12 Results Update | Sector: Financials

Andhra Bank

BSE SENSEX

S&P CNX

16,564

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

M.Cap. (INR b)

M.Cap. (USD b)

5,000

ANDB IN

559.6

148/79

1/5/-7

65.5

1.2

CMP: INR117

TP: INR150

Buy

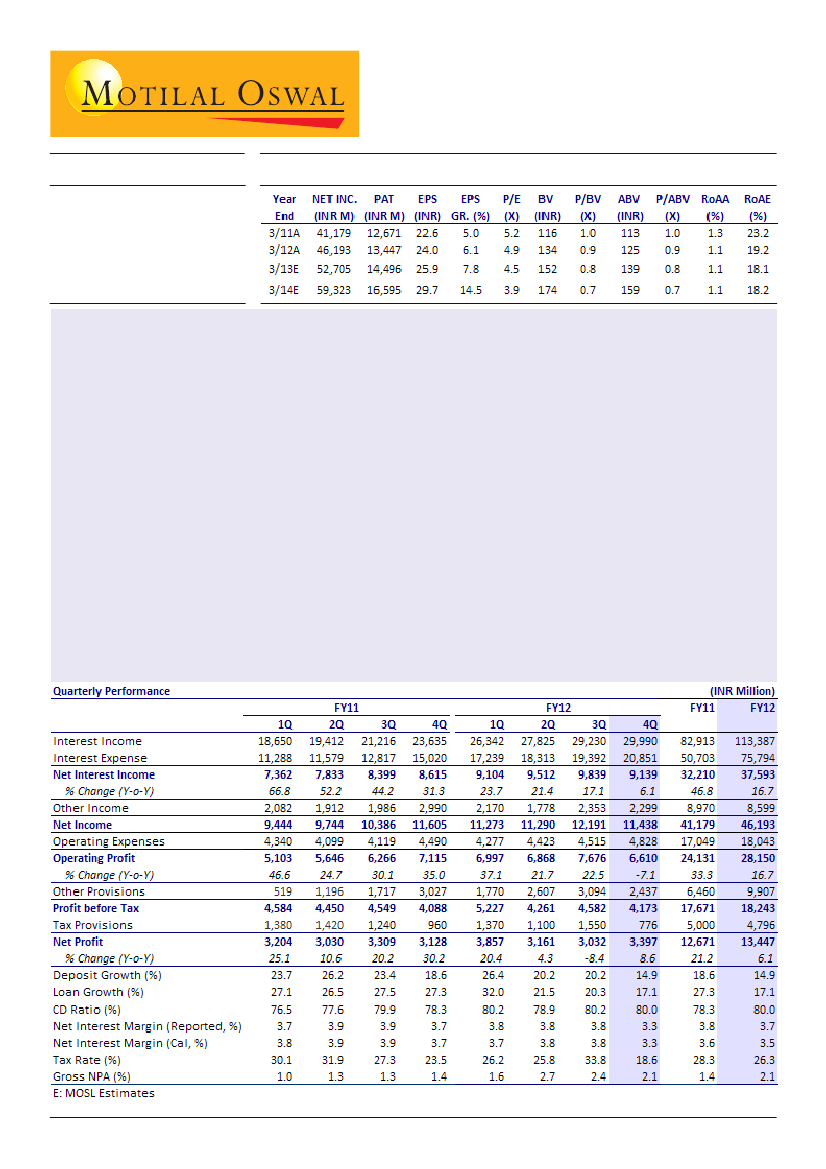

Andhra Bank (ANDB) reported PAT growth of ~9% YoY and 12% QoQ to INR3.4b, 26% higher than our estimate of

INR2.7b. While operating profit was 6% lower than our estimate, lower provisions (INR2.4b v/s our estimate of

INR3b) and tax rate (19% v/s our estimate of 33%) boosted profitability.

Key highlights:

Margins impacted by one-offs:

Reported margins declined ~45bp QoQ to 3.3%, led by (1) higher interest

income reversals of ~INR1b on restructured loans and agricultural loans, and (2) 8bp QoQ increase in cost of

funds. Adjusted for one-off interest income reversal, margin decline would have been lower at 10bp QoQ.

Strong recoveries leading to negative net slippages - a positive surprise:

In 4QFY12, net slippages were a

negative INR791m (v/s negative net slippages of INR1b in 3QFY12), led by strong recoveries from system-

based NPAs. Despite this strong performance, ANDB made aggressive NPA provisions (INR1b in 4QFY12 v/s

INR395m in 3QFY12). As a result of which PCR (cal) improved to 58% (~50% in 3QFY12).

Healthy business growth:

On a sequential basis, both loans and deposits grew 7%. On a YoY basis, loans grew

17% while deposits grew 15%. CD ratio remained elevated at 80%.

Sharp increase in restructured loans:

In 4QFY12, ANDB restructured loans of INR23b, of which two large accounts

formed INR18.3b.Net outstanding restructured loans stood at INR59.5b, 7% of overall loans.

Valuation view:

While the muted performance on core income in 4QFY12 was a negative surprise, strong

performance on asset quality partially negated the impact. Over past two quarters ANDB has been delivering

strong performance on asset quality led by strong upgrades and recoveries and continuous traction in the same

could lead to earnings upgrade. Stock is trading at an attractive valuation with a dividend yield of 4.7%.

Buy.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com) + 91 22 3982 5415

Sohail Halai

(Sohail.Halai@motilaloswal.com)+ 91 22 3982 5430