17 May 2012

4QFY12 Results Update | Sector: Media

Dish TV

BSE SENSEX

S&P CNX

16,030

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

4,858

DITV IN

1,064

94/52

-2/-11/-7

58.5

1.1

CMP: INR55

TP: INR58

Neutral

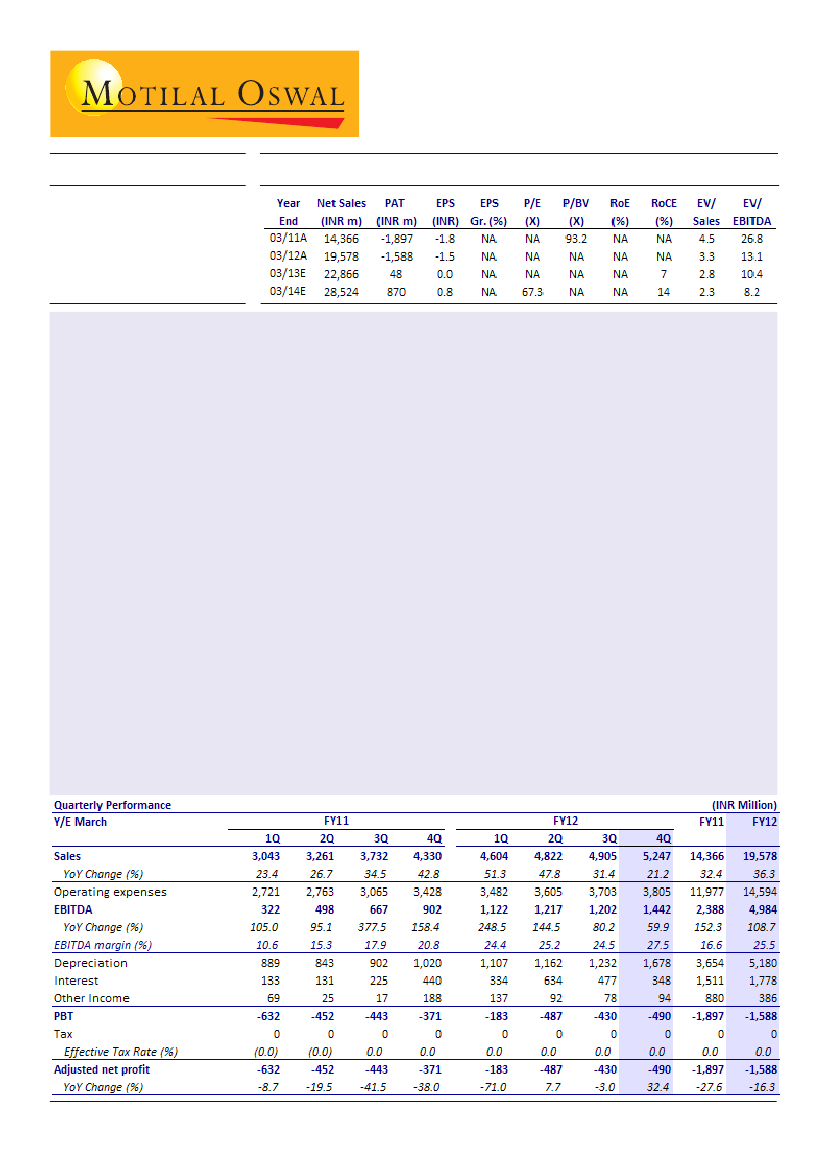

Dish TV’s 4QFY12 EBITDA grew 60% YoY and 20% QoQ to INR1.44b. While subscription revenue growth (+2%

QoQ) remained muted for second consecutive quarter, EBITDA growth was largely driven by higher lease

rental and other revenues.

EBITDA margin improved 300bp QoQ to 27.5%. EBITDA ex lease rental grew 4% QoQ to INR0.78b (15% of rev).

Net loss increased 32% YoY and 14% QoQ to INR490m despite lower forex loss (INR65m in 4QFY12 v/s INR156m

in 3QFY12) as there a one-time additional depreciation costs of ~INR300m booked during the quarter.

Revenue grew 7% QoQ to INR5.25b, primarily led by higher lease rental income (+47% QoQ to INR660m) and

“other” revenues (+26% QoQ).

Subscription revenue grew 2% QoQ (likely lowest ever) to INR4.3b largely led by 2% increase in net subscriber

base to 9.6m and flat ARPU at INR151.

Gross adds at 0.42m declined 44% QoQ - lowest in ten quarters. Gross sub base increased ~3% QoQ to 12.9m.

Monthly churn rate (based on net subscribers) declined to ~0.9% per month (~0.27m subscribers churned

during the quarter) vs 1.1-1.6% in previous three quarters.

Weak macro environment has been impacting subscriber additions as well as ARPU (due to continued down-

trading by subscribers) for DITV.

Management expects FY13 gross adds for the DTH industry at 8-9m excluding the impact of digitization.

Digitization opportunity in phase I is estimated at ~7m of which DTH operators could gain upto 50%.

Meaningful uptick in ARPU is unlikely in the current environment given that most DTH operators/MSOs will

focus on “subscriber grab” to take advantage of the mandatory digitization schedule.

We are downgrading our revenue and EBITDA estimates by 2-4% and TP by ~10% given weak subscriber

additions and ARPU outlook.

The stock trades at EV/EBITDA of 10.4x FY13E and 8.2x FY14E. Maintain

Neutral

with a target price of INR58/sh

(INR65/sh earlier).

Shobhit Khare

(Shobhit.Khare@MotilalOswal.com); +91 22 3982 5428