21 May 2012

4QFY12 Results Update | Sector: Financials

State Bank of India

BSE SENSEX

16,153

S&P CNX

4,891

CMP: INR1,942

TP: INR2,725

Buy

Bloomberg

SBIN IN

Equity Shares (m)

671.0

52-Week Range (INR) 2,530/1,576

1,6,12 Rel.Perf.(%)

-8/14/-7

M.Cap. (INR b)

1,303.2

M.Cap. (USD b)

23.9

* Valuation multiples are adjusted for SBI Life's value

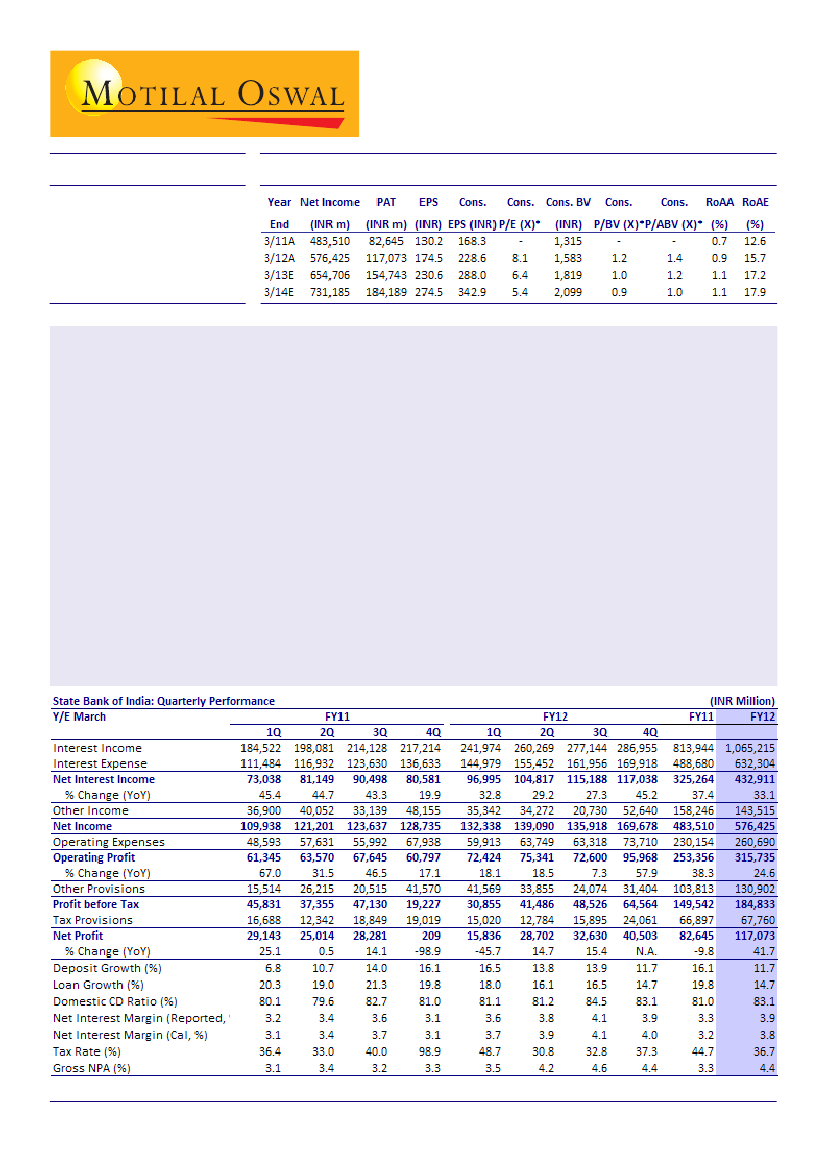

State Bank of India (SBIN) has posted a PAT of INR40.5b for 4QFY12, which is 19% higher than our estimate and an

all-time high quarterly profit. NII grew 45% YoY on a low base, while fee income grew 13% YoY – a positive

surprise. Strong improvement in asset quality was the highlight of the quarter.

Unlike its peers, SBIN’s asset quality improved QoQ, as net slippages were a negative INR3.4b – a big positive.

Fall in slippages across segments is comforting. SBIN prudently increased its PCR (including technical write-

offs) to 68% v/s 62% in 3QFY12.

In 4QFY12, fresh loans of INR51.3b (60bp of loans) were restructured, of which INR12b were on account of Air

India. Net of Air India, standard restructured loans stood at 3.5%, one of the lowest among PSBs.

Global margins declined 16bp QoQ to 3.9%, led by 11bp QoQ fall in domestic margins to 4.3% and 24bp QoQ

decline in international margins to 1.5%.

Gross loans grew 16% YoY and 3% QoQ, while deposits grew 12% YoY and 3% QoQ. Overall CD ratio moderated

to 83.1% from 84.5% in 3QFY12. CASA growth moderated to 6% YoY, led by CA declining 8% YoY. Reported CASA

ratio stood at 46.6% v/s 47.5% in 3QFY12.

Valuation and view:

We expect SBIN’s healthy margin performance to continue on the back of benefits related to

reduction in CRR and recent equity infusion. Sharp sequential decline in gross slippages across segments in

4QFY12 is comforting. Though we conservatively build in higher credit costs, earnings CAGR is likely to remain

strong at 25% over FY12-14. Continuous improvement in asset quality could lead to earnings upgrade.

Buy.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com) + 91 22 3982 5415

Sohail Halai

(Sohail.Halai@motilaloswal.com)+ 91223982 5430