23 May 2012

4QFY12 Results Update | Sector: Metals

Godawari Power & Ispat

BSE SENSEX

S&P CNX

16,026

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD m)

4,861

GODPI IN

31.8

187/70

-2/-5/-26

3.5

65.7

CMP: INR112

TP: INR210

Buy

Consolidated

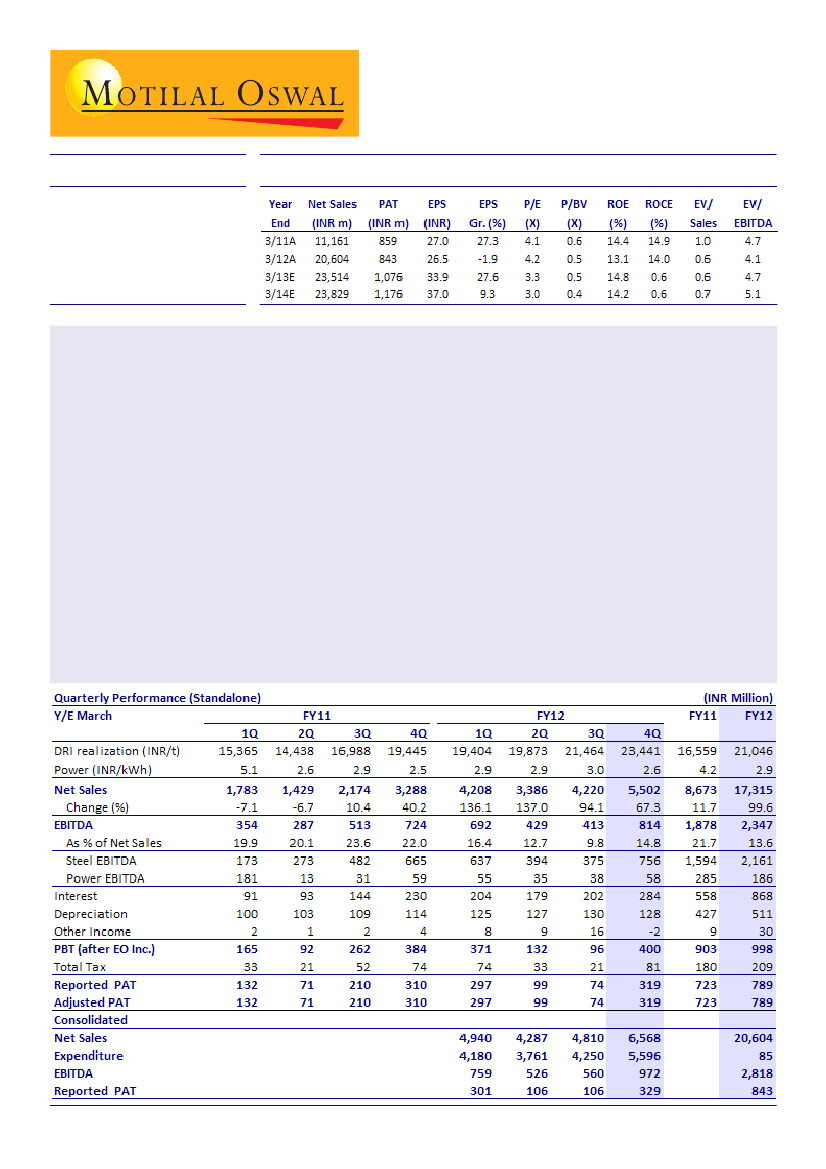

Godawari Power and Ispat (GODPI) posted 328% QoQ growth in adjusted standalone PAT for 4QFY12 to INR319m

(v/s our estimate of INR223m) on higher production, sales and realization. Consolidated PAT increased 210%

QoQ to INR329m.

Iron ore production increased 7x QoQ to 183k tons, as production returned to normal levels. In 3QFY12,

production was impacted by extended monsoon.

Sponge iron production increased 24% QoQ to 95k tons, while billet production increased 14% QoQ to 57k

tons, aided by improved captive iron ore production. For billets, realization improved 5% QoQ to INR33,731/

ton, while for sponge iron, realization improved 9% QoQ to INR23,441/ton.

Pellet production grew 12% QoQ to 168k tons, with capacity utilization at 112%. Pellet realization increased

11% QoQ to INR9,955/ton.

Other expenditure increased 58% QoQ, partly due to year-end provisions and adjustment of forex loss of

INR139m for the full year in 4Q.

For FY12, consolidated PAT declined 2% to INR843m. Subsidiaries and associates contributed INR53m to PAT.

The company has declared a dividend of INR2.5/share for FY12. It will issue 5m warrants to the promoters at

INR130/share, leading to equity base expansion of 15.7%. Promoter stake will go up by 4.9% post execution

of warrants.

The stock is trading at 3.3x FY13E EPS, 0.5x FY13E BV, and at an EV of 4.7x FY13E EBITDA. Maintain

Buy.

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 39825412/

Pavas Pethia

(Pavas.Pethia@MotilalOswal.com); +9122 39825413