18 July 2012

1QFY13 Results Update | Sector: Financials

Axis Bank

BSE SENSEX

S&P CNX

17,105

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

M.Cap. (INR b)

M.Cap. (USD b)

5,193

AXSB IN

413.2

1,367/785

-2/2/-11

422.7

7.7

CMP: INR1,023

TP: INR1,260

Buy

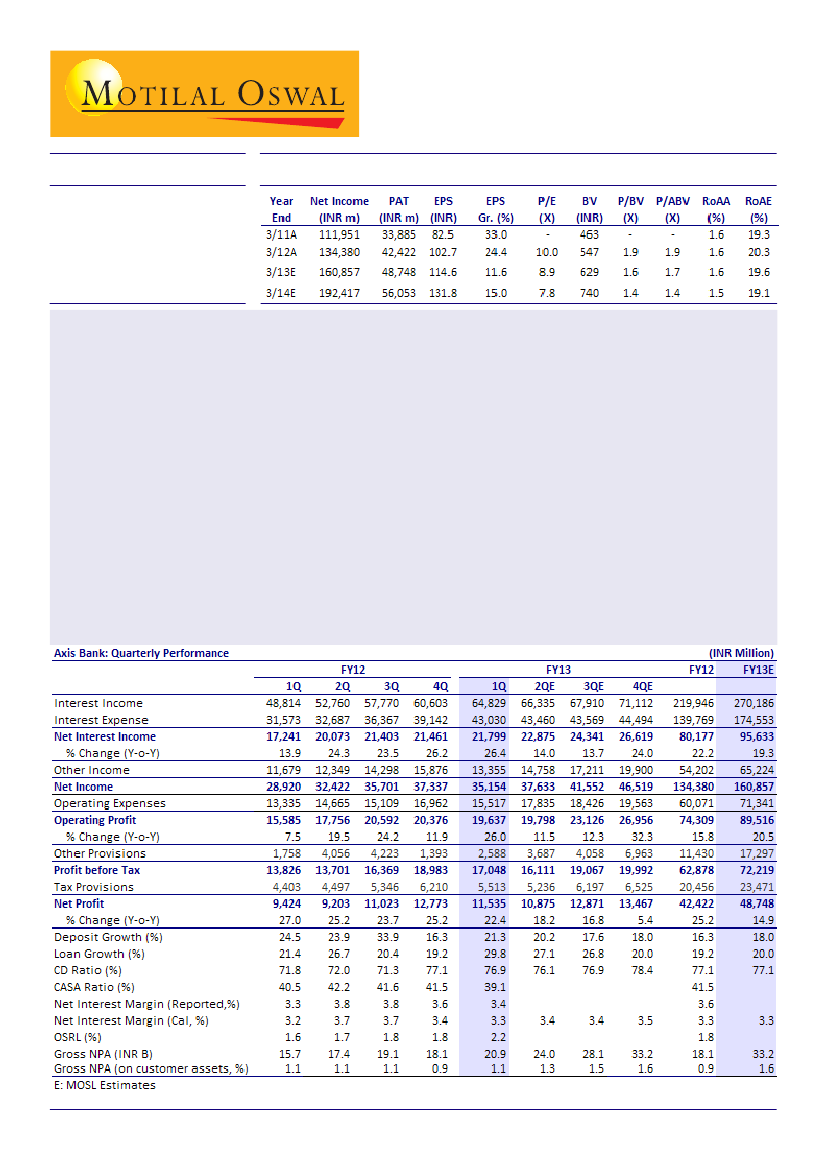

Axis Bank’s 1QFY13 PAT grew 23% YoY to INR11.5b, in line with our estimate of INR11.2b. Lower than estimated

opex growth compensated for the muted fee income growth. Key highlights:

Daily average CASA ratio declined to 36% from 38% in FY12 and 37% in 1QFY12, led by continued moderation

in average current account (CA) deposit growth. Daily average savings account (SA) growth (+22% YoY) remained

healthy, with strong customer acquisitions (+26% YoY).

Fee income growth continued to moderate (less than 10% YoY growth in the last two quarters). Fee income as

a percentage of average assets declined 30bp QoQ, leading to RoA contraction of 24bp QoQ.

Reported loan growth was strong at 30% YoY. However, loan growth was 25% YoY, adjusted for INR depreciation,

and 21% YoY, adjusted for lower base (on account of repayment of short-term loans).

Margin decline of ~18bp QoQ to 3.37%, slippages of INR4.6b, and addition of INR6.3b to restructured loans

were largely on anticipated lines. However, muted recoveries and upgradations were disappointing.

Valuation and view:

Axis Bank’s key strength has been its ability to grow CASA deposits (~35% CAGR over

FY06-12). Given its strong and rapidly growing liability franchise, we expect SA growth to remain healthy (with

strong customer acquisitions). While pressure on asset quality has increased, it still remains under check. Healthy

NII and fee income growth coupled with stable cost to income ratio should lead to 19% and 15% CAGR in core

operating profit and PAT over FY12-14. Maintain

Buy.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); + 91 22 3982 5415

Sohail Halai

(Sohail.Halai@motilaloswal.com); + 91 22 3982 5430

Investors are advised to refer through disclosures made at the end of the Research Report.