24 July 2012

1QFY13 Results Update | Sector: Consumer

Dabur India

BSE SENSEX

S&P CNX

16,877

Bloomberg

Equity Shares (m)

52-Week Range (Rs)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,118

DABUR IN

1,740.7

120/92

6/23/16

205.8

3.7

CMP: INR118

TP: INR113

Neutral

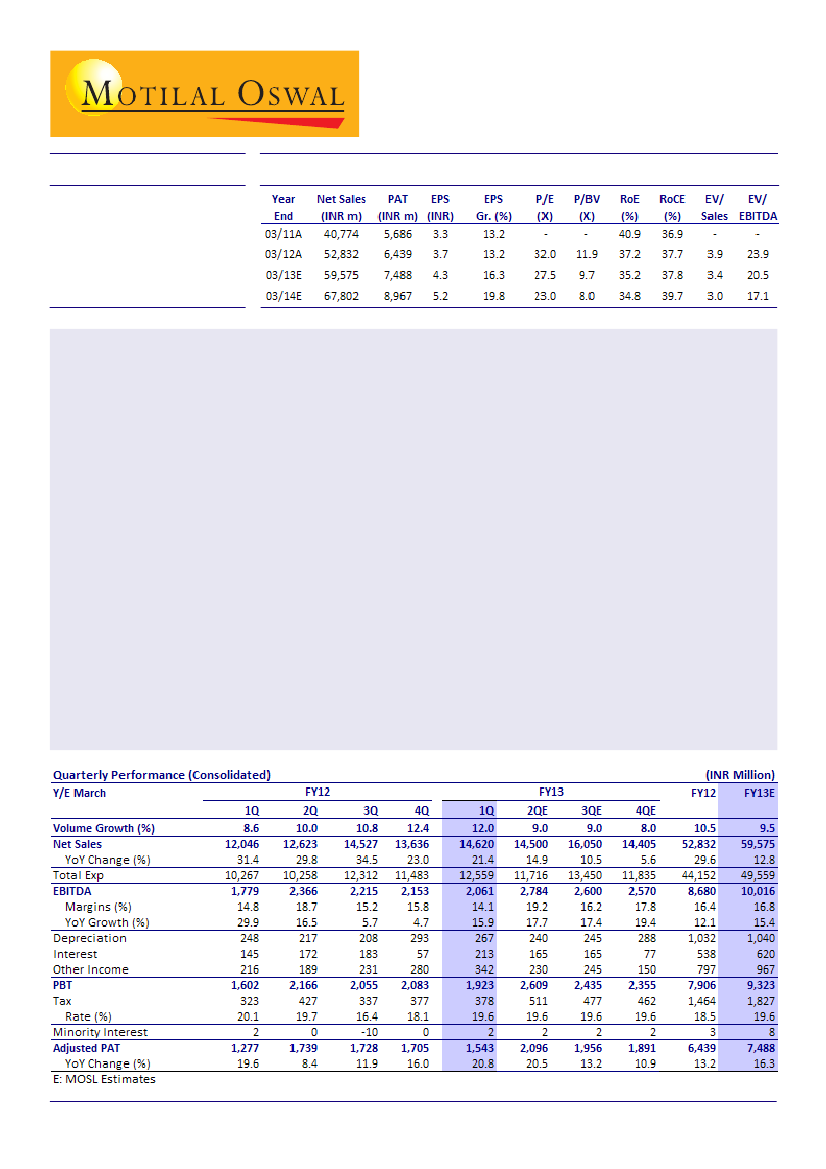

Dabur India has posted in-line results for 1QFY13, with adjusted PAT at INR1.54b against our estimate of

INR1.52b.

Sales growth at 21.4% was higher than we had expected; volumes grew 12%. Gross margin expanded 217bp to

50% on the back of easing input costs and price hikes. EBITDA margin declined 70bp to 14.1% owing to higher

advertising expenses (up 300bp). EBITDA grew 16% to INR2.1b against our estimate of INR2b. Interest cost

increased 47% due to MTM loss on INR1.5b forex debt. A 58% increase in other income and lower tax rate

(down 50bp) led to 21% PAT growth to INR1.54b.

Domestic sales grew 20% to INR10.1b; gross margin expanded 150bp to 45.6%; EBITDA margin remained flat

at 14.3% due to 200bp increase in ad spend. EBITDA grew 18.6%; 46% growth in other income enabled 30.5%

growth in adjusted PAT to INR1.2b.

All key geographies performed well, resulting in healthy 24% growth in International Business Division (IBD).

Dabur has integrated Namaste and Hobi into Dabur International.

The management has indicated high single-digit volume growth for FY13. It expects competitive intensity to

sustain in major businesses, including shampoos and skin care.

We expect Dabur to continue with aggressive pricing and higher ad spends, which will continue to impact

profit margins. We estimate PAT CAGR of 18% over FY12-14. The stock trades at 27.5x FY13E and 23x FY14E EPS.

Maintain

Neutral.

Sreekanth P.V.S.

(Sreekanth.P@MotilalOswal.com); +9122 3029 5120

Investors are advised to refer through disclosures made at the end of the Research Report.

1