23 July 2012

1QFY13 Results Update | Sector: Media

Zee Entertainment Enterprises

BSE SENSEX

S&P CNX

17,158

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,205

Z IN

958.8

152/110

9/25/28

143.8

2.6

CMP: INR150

TP: INR154

Neutral

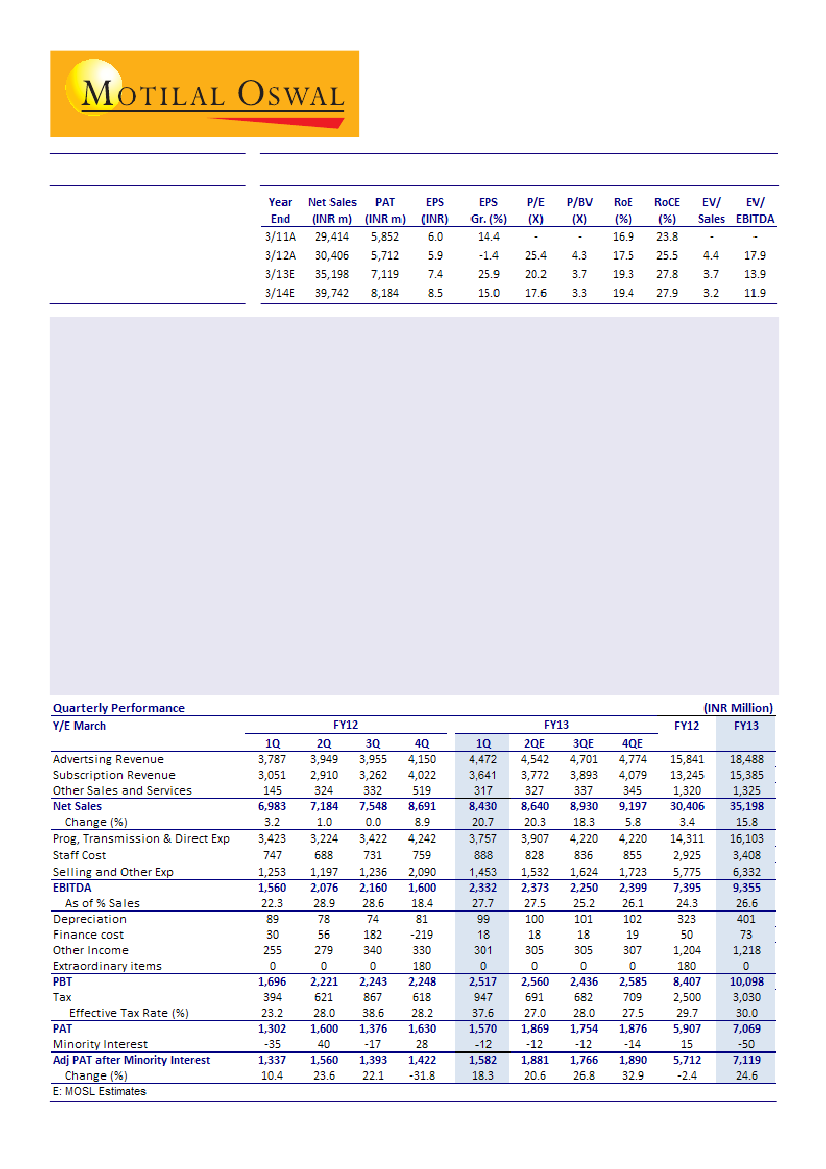

Zee Entertainment's 1QFY13 PAT grew 18% YoY and 11% QoQ to INR1.58b, above our estimate of INR1.5b.

While EBITDA and PBT were 17-20% above our estimate, PAT was dragged down by higher effective tax rate

of 38%. However, full year tax rate is expected to remain at ~30%.

Key positives: 1) Ad growth bounce-back and 2) Superior margin performance led by cost cutting (selling and

other exp down ~0.4b QoQ like-to-like).

Revenue grew 21% YoY to INR8.4b. Ad revenue grew 18% YoY and 8% QoQ to INR4.47b largely led by improved

ratings performance.

Flagship Zee TV's average GRPs improved from 158 in 3QFY12 to 215 in 1QFY13. Zee has largely introduced

replacement programs and would be increasing programming hours in coming quarters.

On a reported basis, subscription revenue grew 19% YoY to INR3.6b driven by domestic as well as international

growth. However, proforma domestic subscription revenue was largely flat QoQ.

EBITDA grew 49% YoY to INR 2.3b (v/s est of INR1.94b). Margin expanded 5pp YoY to 27.7%.

Zee reported sports business operating loss of INR210m (our est ~INR200m loss). Core (non-sports) EBITDA

margin declined 60bp YoY but grew 470bp QoQ to 34.2% (est of 29.7%).

We upgrade earnings by 13% on higher ad growth and ex-sports margin estimates. We model in 17%/14% ad

growth in FY13/14, stable ex-sports margin at 34%/33%, and sports loss of INR1b/0.8b.

The stock trades at P/E of 20.2x FY13E and 17.6x FY14E. Maintain

Neutral

with a revised target price of INR154

(INR120 earlier) based on 18x FY14E EPS.

Shobhit Khare

(Shobhit.Khare@MotilalOswal.com); +91 22 3982 5428

Investors are advised to refer through disclosures made at the end of the Research Report.

1