26 July 2012

2QCY12 Results Update | Sector: Healthcare

Sanofi India

BSE SENSEX

S&P CNX

16,846

Bloomberg

Equity Shares (m)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,110

SANL IN

23.0

3/-3/15

50.7

0.9

CMP: INR2,200

TP: INR1,848

Neutral

52-Week Range (INR) 2,430/1,980

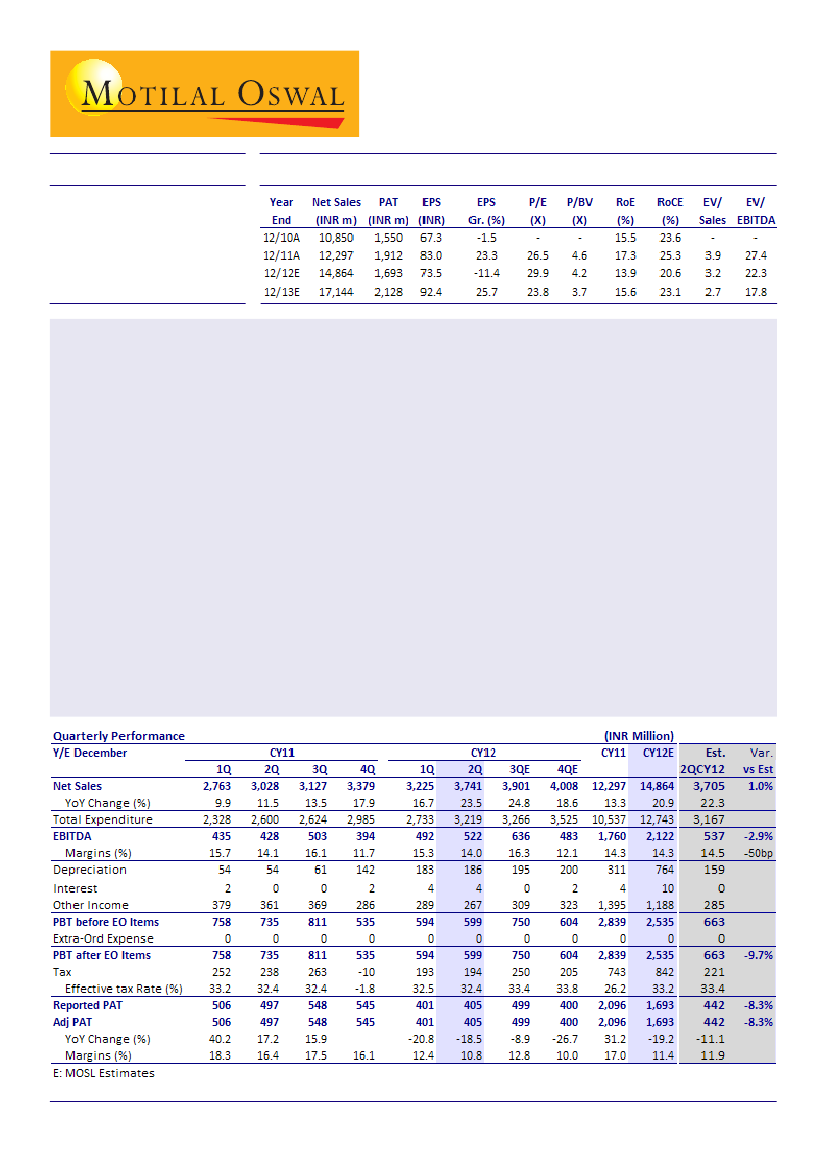

Sanofi India's (SANL) 2QCY12 operational performance was in line with our expectations. Key highlights:

Net sales grew 23.5% YoY to INR3.74b v/s our estimate of INR3.7b. We believe topline growth has been led by

strong growth in domestic revenue on consolidation of Universal Medicare acquisition. Exports are also likely

to have grown during the quarter.

EBITDA grew 22% YoY to INR522m v/s our estimate of INR537m. EBITDA margin contracted 10bp to 14% v/s our

estimate of 14.5%.

Adjusted PAT declined 18.5% YoY to INR405m and was lower than our estimate of INR442m due to higher

amortization cost relating to the brands and technical knowhow acquired from Universal Medicare in 2011.

SANL has, in the past, indicated that for the domestic business, the rural and OTC segments will be the key

growth drivers, and that it is likely to incur extra expenditure to establish its presence in these segments. This

is likely to pressurize short-term profitability.

We believe SANL will be one of the key beneficiaries of the patent regime in the long-term. The parent has a

strong R&D pipeline with a total of 61 products undergoing clinical trials, of which 18 are in Phase-III or pending

approvals. Some of these are likely to be launched in India. However, SANL's profitability has declined significantly

in the last five years, with EBITDA margin declining from 25% in CY06 to 14.3% in CY11, mainly impacted by

discontinuation of Rabipur sales in the domestic market, lower export growth and higher staff & promotional

expenses. RoE has declined from 28.6% to 17.3% during the period. The stock trades at 29.9x CY12E and 23.8x

CY13E EPS. We believe that the stock performance will remain muted in the short term until clarity emerges on

future growth drivers. Maintain

Neutral.

Nimish Desai

(NimishDesai@MotilalOswal.com); +91 22 3982 5406

Amit Shah

(Amit.Shah@MotilalOswal.com); + 91 22 3982 5423

Investors are advised to refer through disclosures made at the end of the Research Report.