2 August 2012

1QFY13 Results Update | Sector: Retail

Titan Industries

BSE SENSEX

S&P CNX

17,257

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (Rs b)

M.Cap. (US$ b)

5,241

TTAN IN

887.8

255/154

-1/13/3

197.1

3.6

CMP: INR222

TP: INR220

Neutral

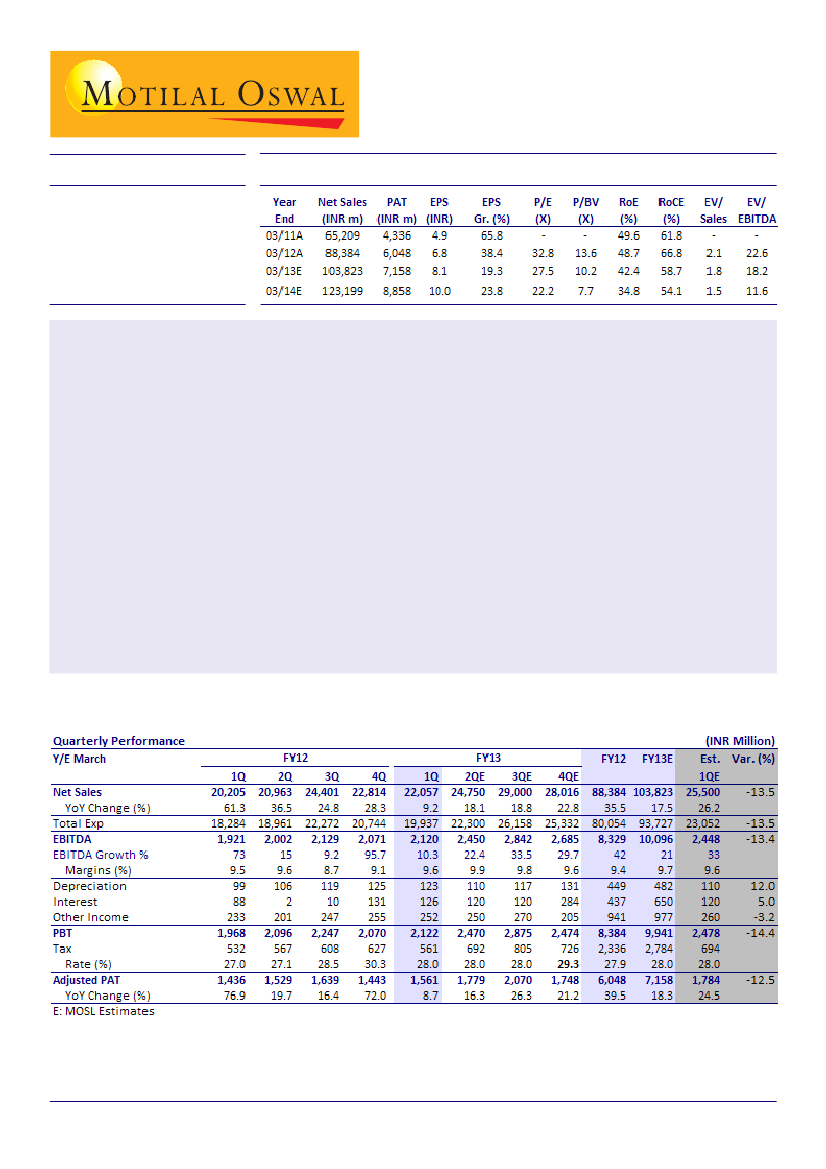

Titan Industries (TTAN) posted lower than expected numbers for 1QFY13. Performance was weak for both

Jewelry and Watches. Adjusted PAT for the quarter was INR1.6b against our estimate of INR1.8b.

Jewelry volumes declined 21% due to high gold prices and slowdown in consumer demand. Sales grew 8%

and EBIT grew 9%; margins remained flat YoY at 10.2%.

Watch business reported 14% sales growth (3% decline in volumes) while Eyewear sales grew 6% though like-

to-like (LTL) sales growth was just 1%. PE (Precision Engineering) business continued to be profitable.

The management indicated aggressive store expansion plan for FY13 - 100 Fastrack stores and 35 Helios

stores.

Jewelry volumes have suffered due to high gold prices and weak consumer sentiment due to high inflationary

environment.

We have been cautious on the volume growth scenario in the Jewelry business. However, we are positive on

TTAN's store expansion strategy to drive volumes. This will work in favor of the company due to the franchisee

model. Our estimates are under review.

The stock trades at 27.5x FY13E and 22.2x FY14E EPS. Maintain

Neutral.

Sreekanth P.V.S.

(Sreekanth.P@MotilalOswal.com); +9122 3029 5120

Investors are advised to refer through disclosures made at the end of the Research Report.

1