2 August 2012

1QFY13 Results Update | Sector: Healthcare

Dishman Pharma

BSE SENSEX

S&P CNX

17,224

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,228

DISH IN

81.3

87/33

13/46/-5

6.2

0.1

CMP: INR76

TP: INR103

Neutral

Dishman's 1QFY13 performance was above estimates. Key highlights:

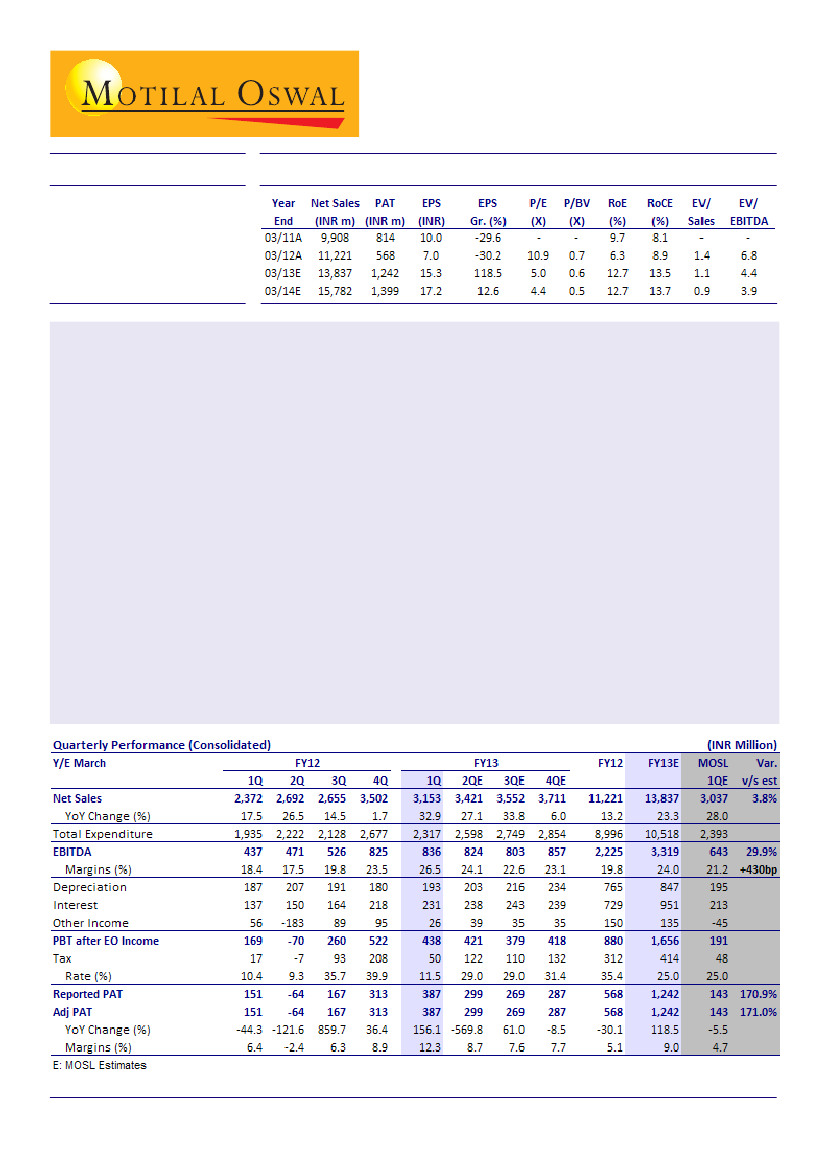

Dishman's 1QFY13 performance was above our estimates. It reported 32.9% YoY growth in revenues to INR3.15b

(v/s est INR3.04b). EBITDA grew 91.3% YoY to INR836m (v/s est INR643m) while Adj PAT increased 156% YoY to

INR387m (v/s est of INR143m).

EBITDA grew 91.3% YoY to INR836m (v/s est INR643m) on a low base led by healthy topline growth and

favorable currency. EBITDA margin improved 810bp YoY to 26.5% (v/s est 21.2%).

The company reported 156% YoY growth in Adjusted PAT to INR387m (v/s est of INR143m) led by strong

operational performance and lower than estimated tax expense during the quarter.

Outlook and view:

The macro environment for CRAMS business remains favorable given India's inherent cost

advantages and chemistry skills. We believe Dishman's India operations will benefit from increased outsourcing

from India, given its strengthening MNC relations and expansion of some of the existing customer relationships.

However, the company needs to ramp-up its contracts with innovators to take advantage of the macro opportunity.

We expect revenue CAGR of 18.6%, EBITDA CAGR of 27% and earnings CAGR of 56.9% over FY12-14. Earnings

growth is led by robust operational performance and lower tax expense. Low asset utilization, high debt and

delayed ramp-up of CRAMS contracts remain our main concern. We have upgraded our earnings estimates for

FY13 and FY14 by 15.6% and 4.1% respectively. Based on our revised estimates, the stock currently trades at 5x

FY13E and 4.4x FY14E earnings. RoCE will continue to be subdued till new facilities and CRAMS contracts ramp up.

We maintain

Neutral

rating with price target of INR103 (6x FY14E EPS).

Nimish Desai

(NimishDesai@MotilalOswal.com); +91 22 3982 5406

Investors are advised to refer through disclosures made at the end of the Research Report.

1