3 August 2012

1QFY13 Results Update | Sector: Capital Goods

Cummins India

BSE SENSEX

17,198

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

S&P CNX

5,216

KKC IN

277.2

505/322

4/8/11

128.6

2.3

CMP: INR464

TP: INR442

Neutral

Robust operating performance:

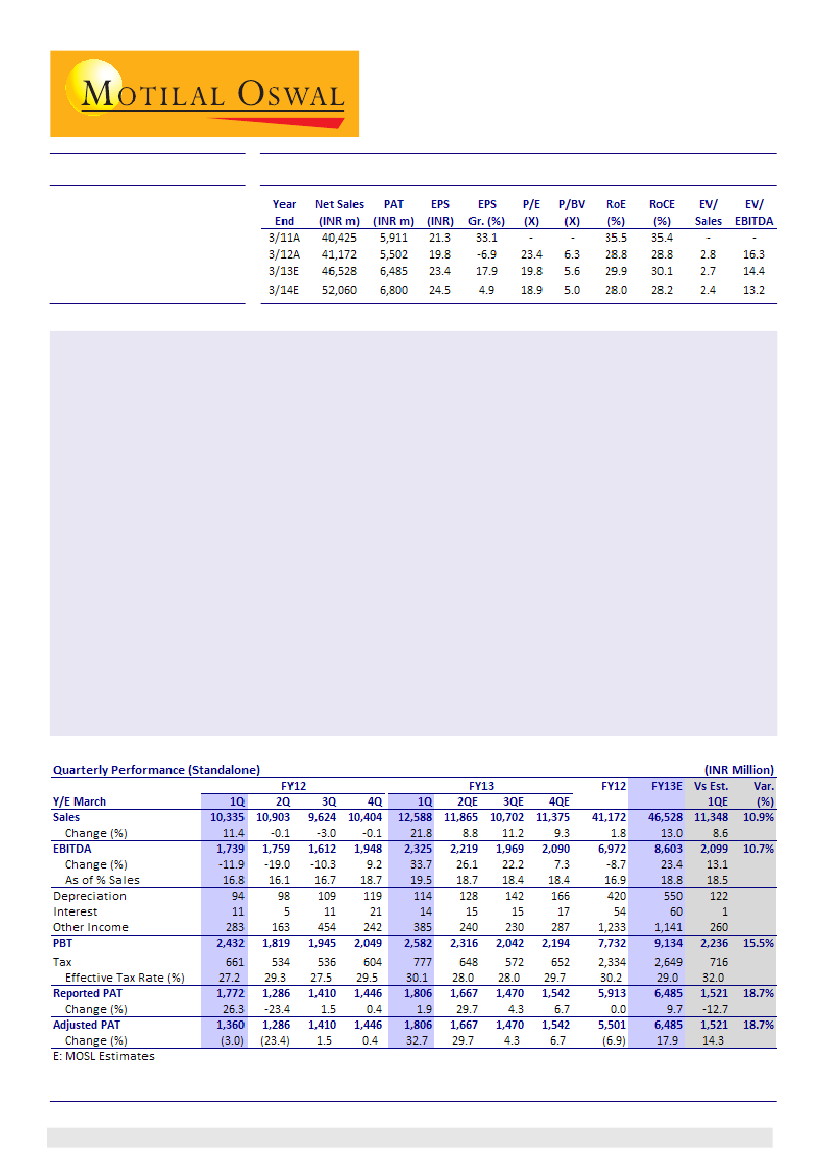

Cummins India (Bloomberg: KKC IN) 1QFY13 revenues at INR12.6b (up 20%

YoY) were significantly above our estimates of INR11.3b. Adj EBITDA margin stood at 19.5%, up 260bp YoY,

above our estimates of 18.5%. PAT stood at INR1.8b up 36% YoY, above our estimate of INR1.5b (up 14% YoY).

Exports up 56% YoY, domestic power gen revenues up 27% YoY:

Revenue growth is led by exports (up 56% YoY)

and domestic powergen revenues (up 27% YoY). Growth in exports was supported by new products and

favorable currency movement. Management expects 20% YoY growth in exports in FY13 on the back of INR2b

sales from new products. In domestic market, a large part of the growth was from MHP / HHP segments, which

increased by 25-40% across segments. EBITDA improvement is being driven by: i) Product mix change towards

HHP segment as a large part of the exports and domestic growth in 1QFY13 was from HHP engines, ii) Currency

depreciation, iii) Operating leverage associated with 22% revenue growth, and iv) 2.5% price increase in the

domestic market w.e.f. June 2012.

Guidance:

Management expects FY13 growth of 20% in exports (constant currency) and 10% in domestic

revenues. EBIT margins are expected at ~20%. We have upgraded our earnings estimate by 7%/2% for FY13/

FY14 driven by improved margin assumptions and higher export sales. We model exports growth of 14% and

domestic at 8% for residual 9MFY13.

Maintain Neutral:

Our estimates factor in FY13 revenue growth at 13% (guidance 13-15%) and EBIT margins at

20.8% (guidance 20%). On our current estimates, KKC trades at 19.8x FY13E and 18.9x FY14E EPS. We believe

that Indian DG set market continue to witness structural headwinds. Maintain

Neutral

with price target of

INR442 (18x FY14E, downside of 5%).

Satyam Agarwal

(AgarwalS@MotilalOswal.com); +91 22 3829 5410

Deepak Narnolia

(Deepak.Narnolia@MotilalOswal.com); Tel: +91 22 3029 5126

Investors are advised to refer through disclosures made at the end of the Research Report.

1