17 August 2012

1QFY13 Results Update | Sector: Healthcare

Opto Circuits

BSE SENSEX

S&P CNX

17,657

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,363

OPTC IN

242.3

225/133

-9/-33/-39

34.7

0.6

CMP: INR143

TP: INR173

Neutral

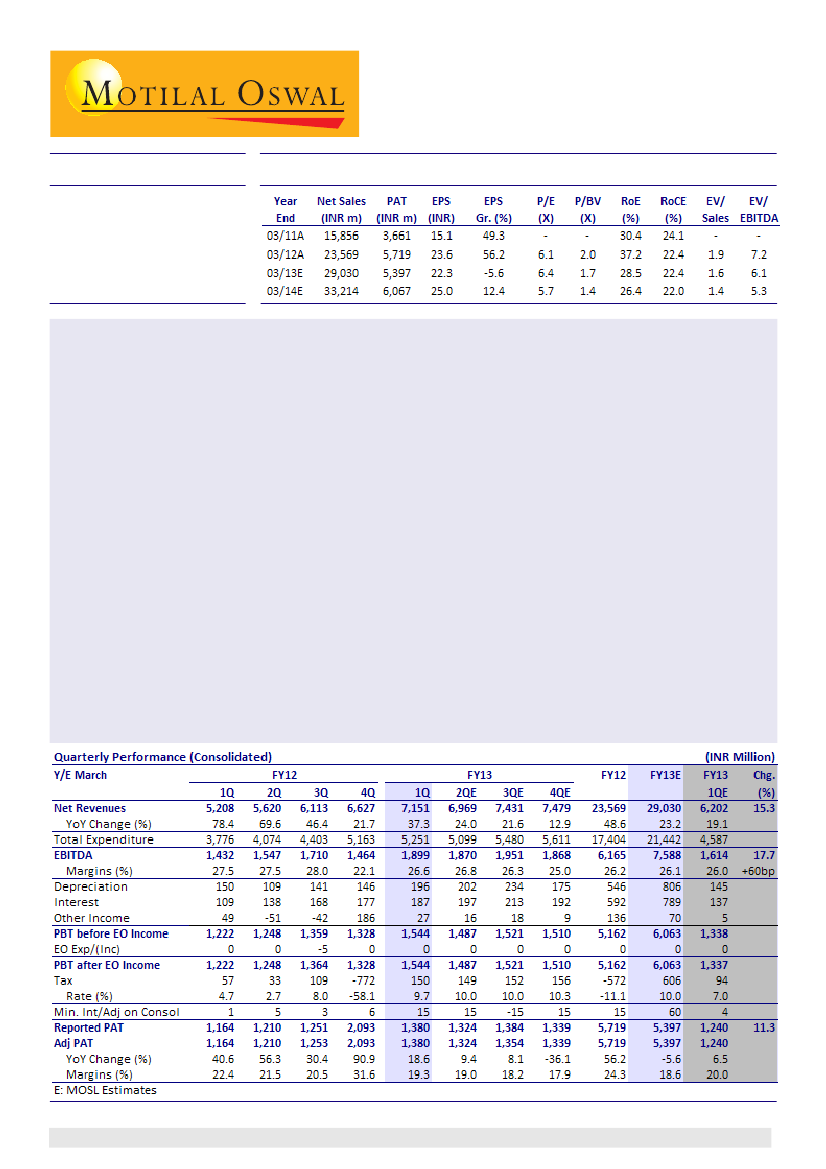

Opto Circuits' 1QFY13 performance was above our estimates.

Key highlights:

Net sales were up 37% to INR7.15b (vs est of INR6.2b), EBITDA up 33% to INR1.9b (vs est of INR1.6b) and EBITDA

margins were at 26.6% vs our est of 26%. A favorable currency has partly driven topline growth with constant

currency growth at 18-20%. Topline growth was led primarily by non-invasive segment which reported growth

of 38% YoY to INR5.8b. Invasive business reported 33% revenue growth to INR1.25b. PAT was up 18.6% to

INR1.38b (vs our est of INR1.24b).

Management has retained it topline growth guidance of 15-20% (excl benefits of favorable currency) and

EBITDA margins at 26-27%. Management is targeted a reduction in overall working capital by 10 days from the

current 180 days. R&D accounting policy has changed with future R&D expenses being routed through the P&L

compared to the previous practice of capitalizing them.

OPTC has delivered strong revenue and earnings growth over the last few years coupled with high return ratios.

Despite rapid growth, the company still remains a marginal player in the global medical devices industry, which

gives OPTC the opportunity to sustain its high revenue growth rate for the next couple of years. However, large

accumulated goodwill in the books (on account of past acquisitions), high working capital requirements leading

to high debt, inadequate free cash flow generation remain our major concerns. We note that management is

targeting reduction in working capital. We believe it is imperative for the company to deliver this without diluting

the overall growth for the business. Potential fund raising in Eurocor could dilute earnings, with the commensurate

benefits from the equity dilution accruing only over the long-term (since the funds are likely to be utilized for

financing clinical trials for key products which could be time-consuming). Based on our revised EPS estimates, the

stock trades at 6.4x FY13E and 5.7x FY14E EPS. We maintain

Neutral

with target price of INR173 (7x FY14E EPS).

Nimish Desai

(NimishDesai@MotilalOswal.com); +91 22 39825406

Investors are advised to refer through disclosures made at the end of the Research Report.

1