DAILY METALS & ENERGY REPORT

September 6, 2012

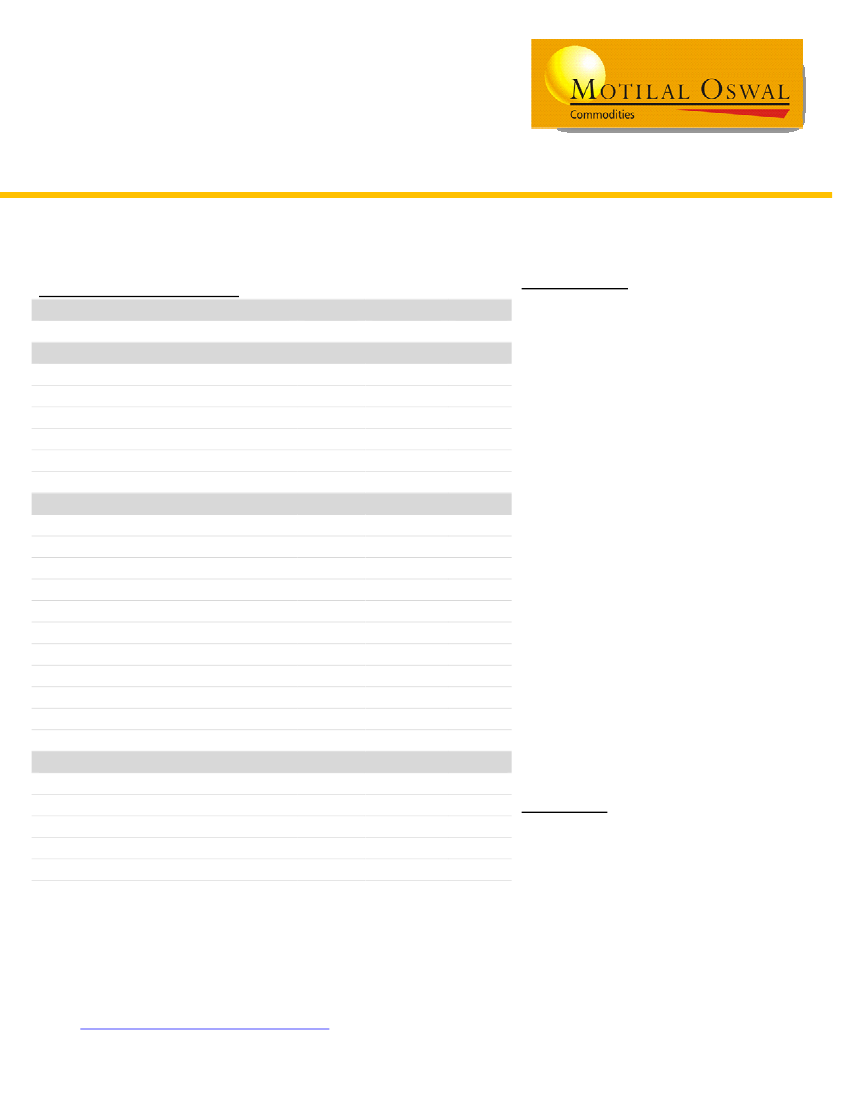

FINANCIAL MARKET OVERVIEW

Asset

Last

Chg

% Chg

GLOBAL UPDATE

•

Copper futures rose to a seven-

week high on Wednesday, while

gold, which set a six-month high

this week, inched down ahead of

the European Central Bank's (ECB)

meeting on Thursday when it is

expected to announce a program to

ease the region's debt crisis.

Markets have been expecting ECB

President Mario Draghi to unveil, at

a policy meeting on Thursday, a

bold plan of bond buying, which

caused the euro to rally.

The

19-commodity

Thomson

Reuters-Jefferies CRB index inched

down 0.17 percent to settle at

308.28, extending the previous

session's losses that occurred after

it hit a five-month high that day of

310.59.

Commodity

Gold / US Dollar FX Spot

Silver / US Dollar FX Spot

Crude oil $ Spot

COMEX Copper $

CRB Index

1693.04

32.25

95.37

352.9

308.28

-1.36

-0.07

0.03

6.00

-0.53

-0.08%

-0.22%

0.03%

1.73%

-0.17%

Equity

BSE Sensex Index

S&P CNX NIFTY

Hang Seng Index

Shanghai SE Composite Index

Nikkei 225 Index

DAX Index

CAC 40 Index

Dow Jones Industrial Average Index

NASDAQ 100 Index

Sao Paulo SE Bovespa Index

17313.34

5225.7

19145.07

2037.681

8679.82

6964.69

3405.79

13047.48

2766.95

56863.91

-127.53

-48.30

-284.84

-5.97

-95.69

32.11

6.75

11.54

-5.08

630.01

-0.73%

-0.92%

-1.47%

-0.29%

-1.09%

0.46%

0.20%

0.09%

-0.18%

1.12%

•

•

Forex

US Dollar / Indian Rupee FX Spot Rate

ICE Dollar Index

Euro / US Dollar FX Spot

US Dollar / Japanese Yen FX Spot Rate

UK Pound Sterling / US Dollar FX Spot Rate

Data’s are as per previous day's close

Data sources can & do produce bad ticks. Verify before use.

55.905

81.235

1.2599

78.37

1.5899

0.295

-0.077

0.0035

-0.01

0.0031

Source: Reuters

0.53%

-0.09%

0.28%

-0.01%

0.20%

Market Focus

Major market focus for the day would be

the ECB meeting as the investors are

expecting ECB president to unveil a solid

bond buying program.

Commodity Research, Motilal Oswal Commodities Broker Pvt. Ltd.

Email:

commoditiesresearch@motilaloswal.com