September 2012

monthly round-up of power utilities

mPower

In this edition

Special

Report

(page 2)

Statistical

Review

August-12

(page 5)

July-12

CAG Report on Captive coal block:

Negligence of MoC

Power Generated

PLF

Short Term Prices

73BUs (up 2% YoY)

57.9% (down 353bp YoY)

Avg prices muted at INR2.5/unit,

led by uptick in monsoon

Capacity Addition

July-12 addition at ~1GW

(Excl RES)

(achieved ~34% of FY13 target)

Base Deficit

9.1% (down 407bp YoY)

Peak Deficit

8.1% (down 180bp YoY)

Company/

Forward Curve (July-12):

Maintained at INR4/unit+,

Industry

Re-iterate our positive stance on JSW Energy

Analysis

CERC MMC Report (June-12):

ST Power volume record 2-digit

(page 12) growth, prices firming up; Punjab/UP remains leading procurer

Update Coal India:

Challenges being addressed, operating

performance strong

Results Update:

1) Coal India (in-line) 2) NHPC (above estimate)

3) Tata Power (below estimate) 4) Rinfra (above estimate) 5)

PTC (above estimate)

News and

Government moots compulsory 25-year power purchase

Events

pacts for new projects

(page 21)

Govt has ruled out blanket de-allocation of coal blocks

Valuation

The power sector has seen significant valuation de-rating due

(page 24) to concerns over delayed capacity additions, merchant prices,

lower demand and fuel supply issues. We are positive about

companies that are relatively better positioned on these fronts.

Our top picks in the sector are

NTPC, Powergrid

and

JSW Energy.

Comparative valuations

Recom Mkt Cap

(INR b)

CPSUs

NTPC

PGCIL

Coal India *

NHPC

Private Sector

Tata Power

Adani Power

JSW Energy

Lanco Infra

Reliance Infra

CESC

PTC

* RoE Adjusted

Buy

Buy

Buy

Neutral

1,390

568

2,263

216

CMP

(INR)

169

123

358

18

AT A GLANCE

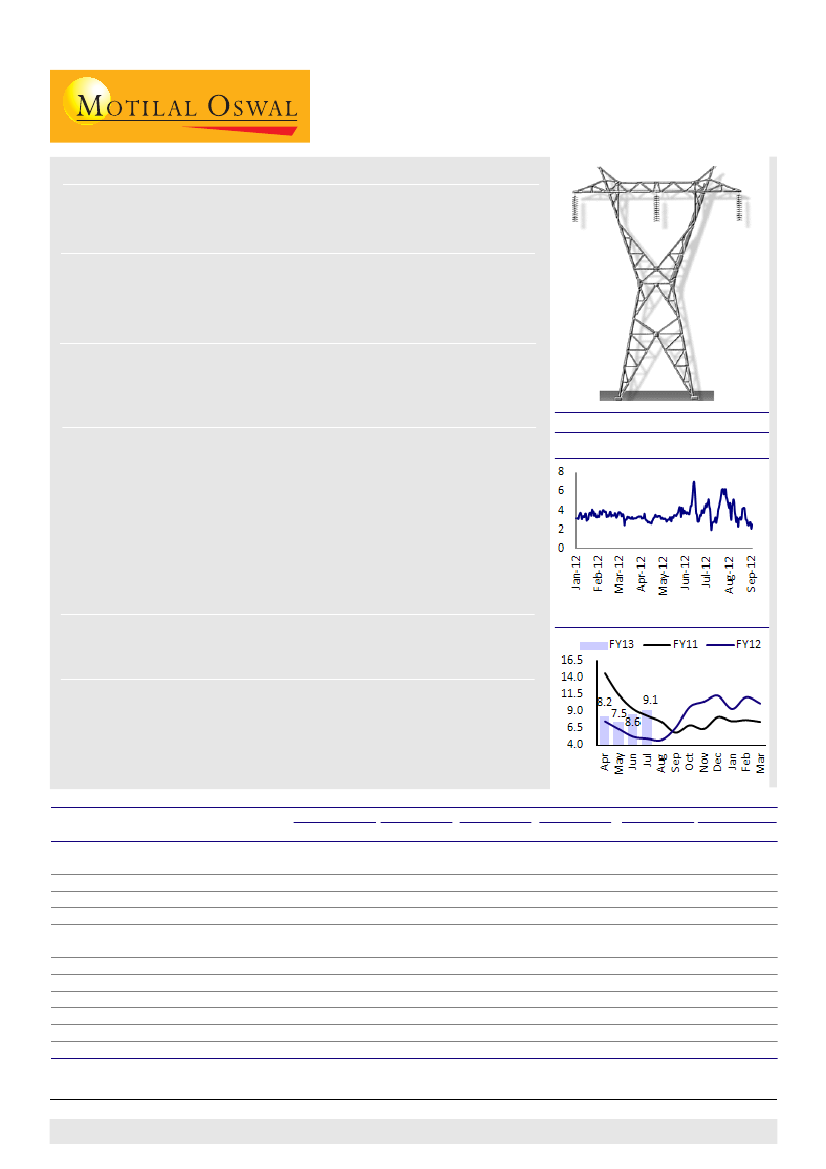

ST Price: Aug Avg at INR2.5/unit

(INR/unit)

Base Deficit (July12): Stood at 9.1%

EPS (INR)

EPS Gr. (%)

RoE (%)

P/BV (x)

P/E (x)

EV/EBITDA (x)

FY13E FY14E FY13E FY14E FY13E FY14E FY13E FY14E FY13E FY14E FY13E FY14E

11.7

8.6

28.3

1.9

5.5

2.2

3.8

1.1

44.2

47.5

7.4

14

10

30

2

4

4

6

2

49

53

9.4

16

19

11

-5

-27

-615

88

302

-42

8

7

20

20

7

8

-25

79

68

85

10

12

26

13

16

28

8

8

8

11

15

6

12

4

14

17

25

8

7

12

16

12

7

12

6

1.8

2.2

4.4

0.7

1.9

1.4

1.2

0.5

0.6

0.7

0.7

1.6

1.9

3.6

0.7

1.8

1.2

1.1

0.5

0.6

0.6

0.7

14

14

13

9

18

19

12

10

10

6

17

12

12

12

8

24

11

7

5

9

6

12

11.1

10.5

8.4

7.6

9.2

9.5

7.4

7.1

Neutral

233

98

Neutral

91

42

Buy

75

46

Buy

26

11

Buy

119

445

Buy

38

299

Buy

16

55

for OB reserves provisions

17.1 15.7

0.3

0.0

7.3

5.5

9.2

9.1

1.8

1.0

4.8

4.5

7.4

5.9

Source: MOSL

1

Nalin Bhatt

(NalinBhatt@MotilalOswal.com) +91 22 3982 5429

Satyam Agarwal

(AgarwalS@MotilalOswal.com) /

Vishal Periwal

(Vishal.Periwal@MotilalOswal.com)

Investors are advised to refer through disclosures made at the end of the Research Report.