20 October 2012

2QFY13 Results Update | Sector: Consumer

ITC

BSE SENSEX

S&P CNX

18,682

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,684

ITC IN

7,738.1

299/189

16/14/34

2,306.0

42.8

CMP: INR298

TP: INR320

Buy

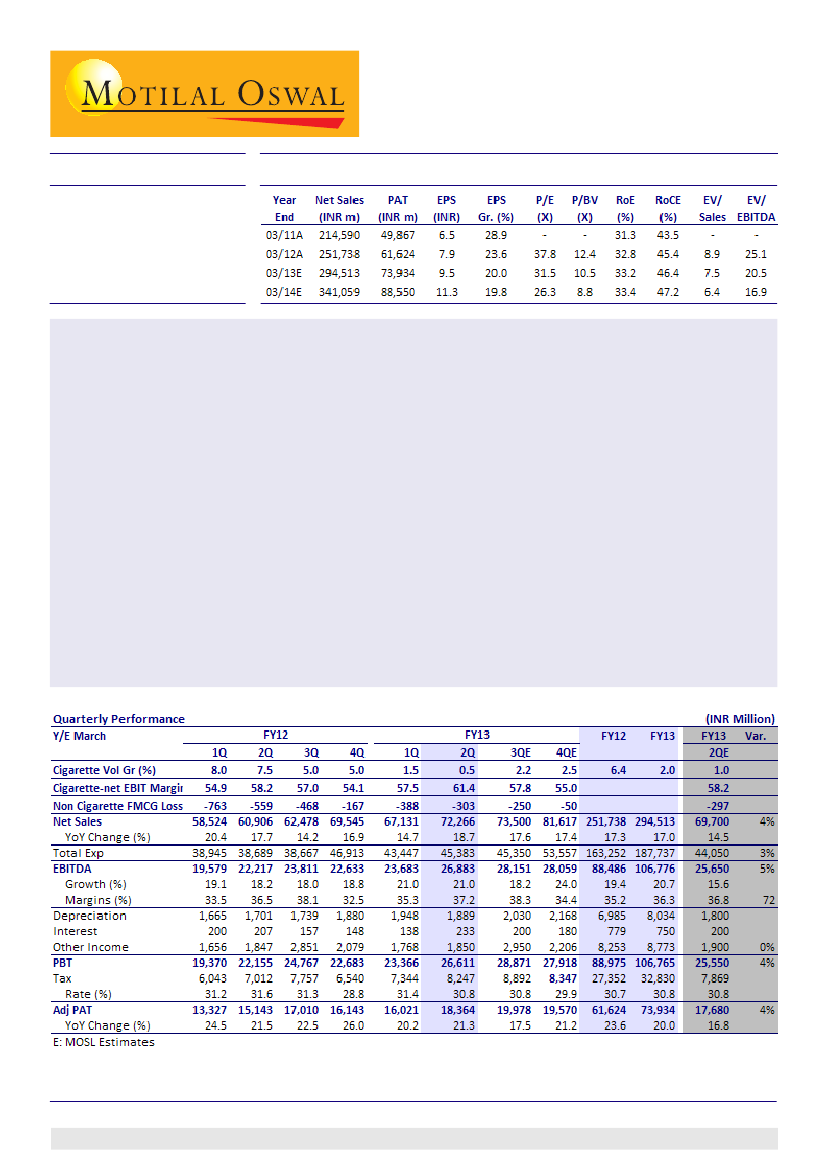

ITC’s 2QFY13 results exceeded expectations, with adjusted PAT growing 21.3% to INR18.3m (v/s our estimate

of INR17.6b). ITC has posted its 13th consecutive quarter of 20%+ PAT growth, demonstrating strong earnings

visibility with acceleration in earnings growth trajectory from 15%+ to 20%.

Cigarette volumes remained flat despite ~17% price hike YoY, underscoring ITC’s pricing power. We believe ITC

is gaining share from VST and GPI.

EBITDA margin expanded 73bp to 37.2% on account of 21% EBIT growth in Cigarettes, and reduction in staff

costs and other expenditure.

In line with our expectations, non-Cigarette FMCG losses declined to INR303m. Revenue grew 26%, led by

healthy volume growth and strong traction in Packaged Foods.

Notwithstanding the steep excise duty increase, ITC’s performance in Cigarettes remains robust. ITC has once

again delivered 20%+ EBIT growth in Cigarettes, with 320bp EBIT margin expansion.

We upgrade our EPS estimates for FY13 and FY14 by 2% and 4%, respectively to incorporate the higher than

expected sales and PAT for 2QFY13. We maintain our 2% Cigarette volume growth estimate for FY13, as we

expect further pick-up in the 64mm segment for ITC. We now forecast 20% PAT CAGR over FY12-14.

The stock trades at 31.5x FY13E and 26.3x FY14E EPS. Maintain

Buy

with a revised target price of INR320 (28x

FY14E EPS). We expect ITC to sustain premium valuations owing to strong earnings visibility, acceleration in

earnings growth trajectory to 20% and Cigarette volume outperformance v/s the industry.

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +9122 3982 5404

Sreekanth P V S

(Sreekanth.P@MotilalOswal.com); +9122 3029 5120

Investors are advised to refer through disclosures made at the end of the Research Report.

1