22 October 2012

2QFY13 Results Update | Sector: Automobiles

Bajaj Auto

BSE SENSEX

S&P CNX

18,682

Bloomberg

Equity Shares (m)

1,6,12 Rel.Perf.(%)

M.Cap. (INR b)

M.Cap. (USD b)

5,684

BJAUT IN

289.4

0/-4/-1

512.2

9.5

CMP: INR1,770

TP: INR1,825

Buy

52-Week Range (INR) 1,850/1,410

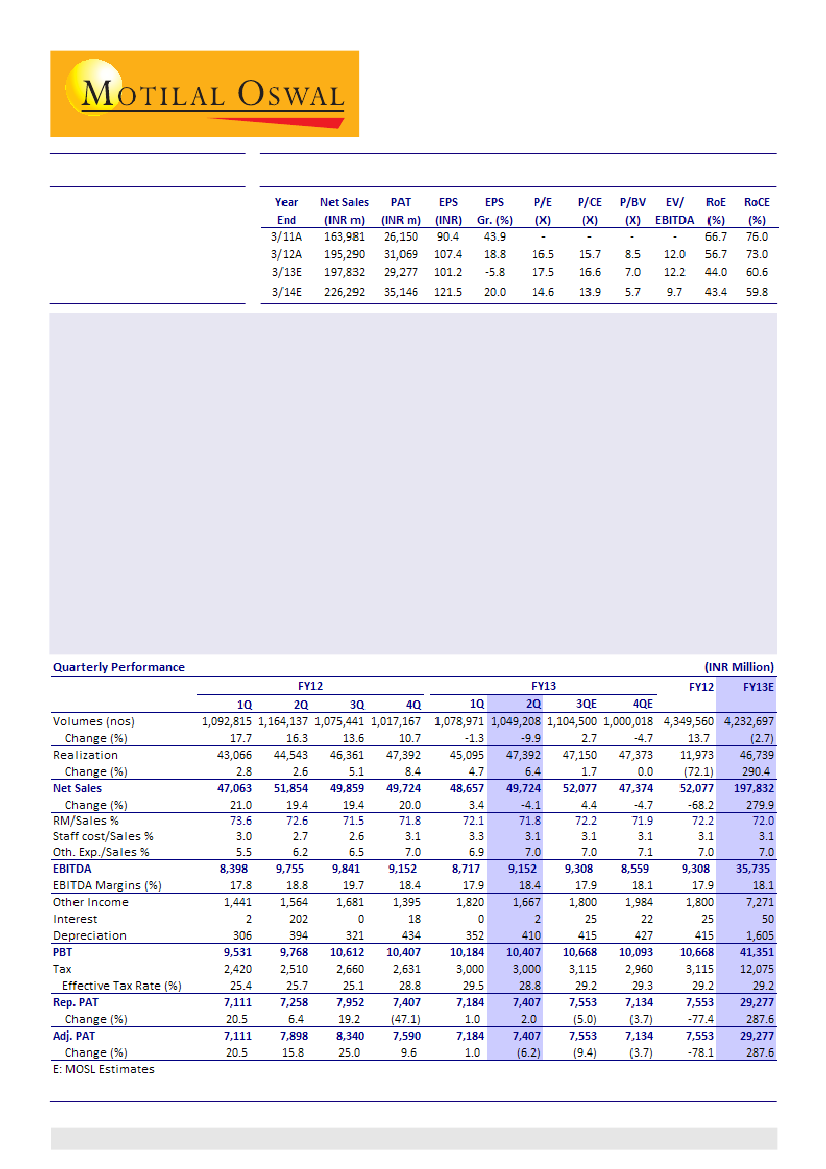

Bajaj Auto (BJAUT) posted better than expected results for 2QFY13, with EBITDA margin at 18.4% (v/s our estimate

of 17.8%) and adjusted PAT at INR7.4 (v/s our estimate INR7.05b), driven by higher domestic realizations (up 6.4%

YoY, 5.1% QoQ) on mix improvement .

Earnings call highlights:

(1) Domestic demand:

Flat/marginally positive during the first five days of the Navratri

festival; expects FY13 industry growth at 3-4%.

(2) New launches:

Pulsar 200NS

(8k/month) and

Discover 125ST

(34k/month) ramping up well;

New Discover 100

to be launched in January 2013; probable launch of four-

wheeler,

RE60

in 1QFY14.

(3) Demand in Africa remains healthy,

with 10-15% growth; ex-Africa and Sri Lanka,

demand largely flat, in line with global weakness.

(4) FY14 forex hedge:

USD600m (~40%) hedged at INR53/

USD (v/s our assumption of INR52.5/USD).

(5) Duty drawback cut:

To increase export prices by ~2.5% from

November 2012.

Successful ramp-up of recent motorcycle launches and opening-up of three-wheeler permits would be key

drivers for the stock over the next 6-9 months.

We upgrade our FY13/FY14 EPS estimates by 4.7%/3.3% to factor in higher realizations on better product mix.

We build-in partial pass through (2.5%) of the impact of recent cut in duty drawback rates by 3.5%, with

consequent impact on export volume growth for FY14. For FY13/FY14, we expect volumes to decline 2.7% /

grow 11.9% and estimate EBITDA margin at 18.1% / 18.8%. Maintain

Buy

with a target price of INR1,825.

Jinesh Gandhi

(Jinesh@MotilalOswal.com) + 91 22 3982 5416

Chirag Jain

(Chirag.Jain@MotilalOswal.com) + 91 22 3982 5418

Investors are advised to refer through disclosures made at the end of the Research Report.

1