23 October 2012

2QFY13 Results Update | Sector: Financials

Bank of Baroda

SENSEX

S&P CNX

18,710

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

M.Cap. (INR b)

M.Cap. (USD b)

5,691

BOB IN

412.4

881/606

0/-5/-7

323.1

6.0

CMP: INR783

TP: INR835

Neutral

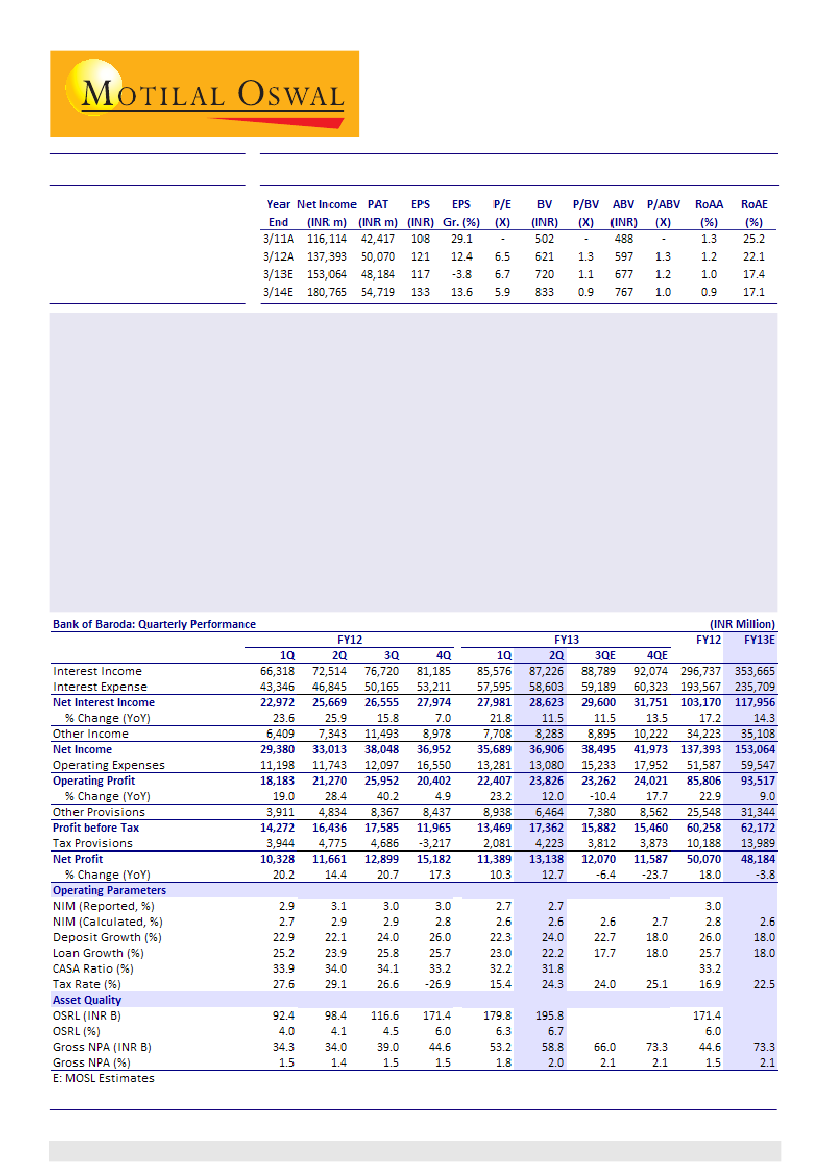

Bank of Baroda reported 2QFY13 PAT grew 13% YoY to INR13.1b (21% above est.) driven by write-back of INR1.3b

on investment, lower coverage (down 330bp QoQ) and lower than expected opex (11% below est.).

Key highlights:

Slippages for 2QFY13 were at an elevated level of INR14.2b (annualized slippage ratio of 2.4%) and recoveries

and up-gradation were largely stable QoQ at INR2.8b. Bank restructured ~INR16b during the quarter, thereby

net stress addition for 2QFY13 increased to INR27.3b as compared to INR18.9b in 1QFY13.

Global and domestic NIMs were stable QoQ at 2.7% and 3.2%. Improvement in domestic yield was off-set by

higher cost of deposits (+6bp QoQ to 7.36%) and 270bp QoQ fall in domestic CD ratio.

Global loans grew 22% YoY, of which domestic loan growth was at 17%. Growth in overseas loans was strong at

33% YoY, however adjusted for currency depreciation growth would have been at 24-25%.

Other highlights:

(1) Domestic CASA declined further by 50bp QoQ to 31.75%. (2) Tax rate at 24.3% v/s expectation of

26% and (3) Trading gains were strong at INR1.1b v/s INR815m in 1QFY13 and INR102m in 2QFY12 - helping PAT growth.

Valuation and view:

While valuations are reasonable, it needs to be seen in context of expected fall in RoA / RoE

in FY13/FY14. Near term headwinds are (a) Top management change in CY12 and (b) Challenging macros leading

to higher slippages. Maintain

Neutral.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); + 91 22 3982 5415

Sohail Halai

(Sohail.Halai@motilaloswal.com); + 91 22 3982 5430

Investors are advised to refer through disclosures made at the end of the Research Report.

1