25 October 2012

3QFY12 Results Update | Sector: Consumer

Castrol India

BSE SENSEX

S&P CNX

18,710

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel.Per. (%)

M.Cap (INR b)

M.Cap (USD b)

5,691

CSTRL IN

494.6

338/193

9/19/23

159.7

3.0

CMP: INR323

TP: INR315

Downgrade to Neutral

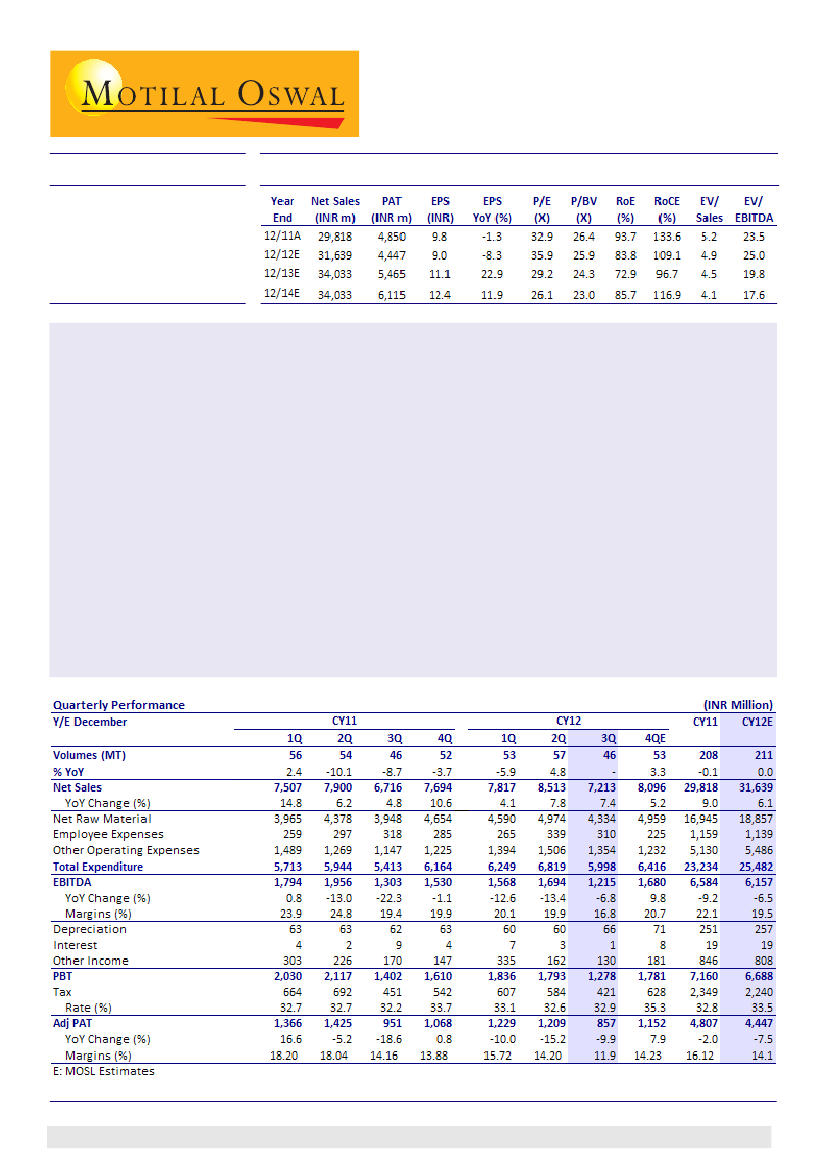

Castrol India (CSTRL) posted lower than expected numbers for 3QCY12. Net sales grew 7.4% YoY to INR7.2b

(v/s our estimate of INR7.7b) and EBITDA declined 6.8% YoY to INR1.2b (v/s our estimate of INR1.5b). EBITDA

margin declined 256bp YoY to 16.8%, negatively impacted by forex loss of INR580m due to INR depreciation.

Automotive volumes grew ~3% YoY, but this was offset by decline in industrial and marine volumes. Overall

volumes were flat. In value terms, automotive sales grew 11% YoY, while non-automotive sales declined 11%

YoY. The automotive segment constitutes ~13% of CSTRL's total sales.

Net profit declined 10% YoY to INR857m (v/s our estimate of INR1b) and net margin dropped to 11.9%, the

lowest since 4QCY08.

We have cut our volume growth assumption for CY12 from +2.1% to +1.5%, but maintain our CY13 volume

growth estimate of +2.4%. We have also cut our CY12/CY13 net profit estimates by 2.5% / 2.7% to INR4.4b /

INR5.5b.

We expect CSTRL to post earnings CAGR of 17% and FCF CAGR of 11% over CY12-14. The stock trades at 29.2x /

26.1x CY13E / CY14E EPS. Our DCF-based price target is INR315. Though we remain positive on CSTRL's long-

term prospects, given that the stock is currently trading above our target price, we downgrade CSTRL from Buy

to

Neutral.

Siddharth Bothra

(Siddharth.Bothra@MotilalOswal.com); +91 22 3029 5127

Investors are advised to refer through disclosures made at the end of the Research Report.

1