3 November 2012

2QFY13 Results Update

Multi Commodity Exchange

BSE SENSEX

S&P CNX

18,755

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,698

MCX IN

51.0

1,446/838

14/29/-

72.2

1.3

CMP: INR1,417

Buy

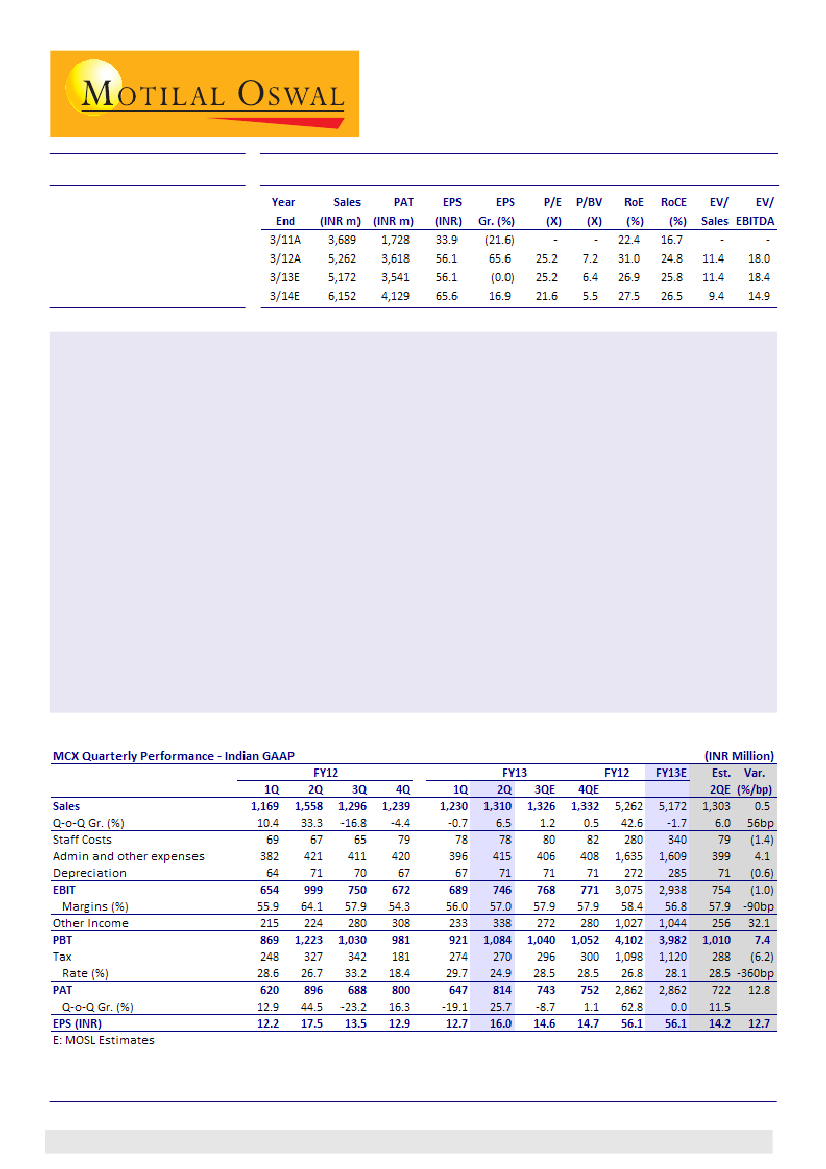

Multi Commodity Exchange of India Ltd's (MCX) 2QFY13 results were operationally in line, while PAT at INR814m

was above estimate of INR722m due to higher other income and lower tax rate (24.9% v/s estimate of 28.5%).

Revenues were INR1,310m (v/s estimate of INR1,303m), up 6.5% QoQ but down 18% YoY. Lower revenues YoY

was due to a decline in traded volumes to INR39.3t in 2QFY13 (18% YoY). EBIT was INR746m, in line with our

estimate of INR754m. Implied EBIT margin was 57% (excluding other income and other operating income),

v/s our estimate of 57.9%.

The exchange's market share in 1HFY13 is 86.4%, thus sustaining its near-monopolistic hold. Average daily

turnover at the exchange in 1HFY13 was INR495b, down from INR529b in 1HFY12.

We expect MCX to grow transaction fees at a CAGR of 12.6% over FY12-15E and EPS at a CAGR of 17% during this

period.

Our FY14 standalone EPS estimate for MCX's exchange business is INR65.6. We currently value the standalone

exchange business at 20x FY14E earnings.

We separately value MCX's stake (including warrants) in MCX-SX. With the launch of MCX-SX's equity operations

following a successful membership drive, we expect significant upward revision in potential value unlocking

for MCX. Maintain

Buy.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Investors are advised to refer through disclosures made at the end of the Research Report.

1