6 November 2012

2QFY13 Results Update | Sector: Technology

Tech Mahindra

BSE SENSEX

S&P CNX

18,763

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

5,704

TECHM IN

127.6

1,043/537

2/29/46

121.9

2.2

CMP: INR955

TP: INR1,150

Buy

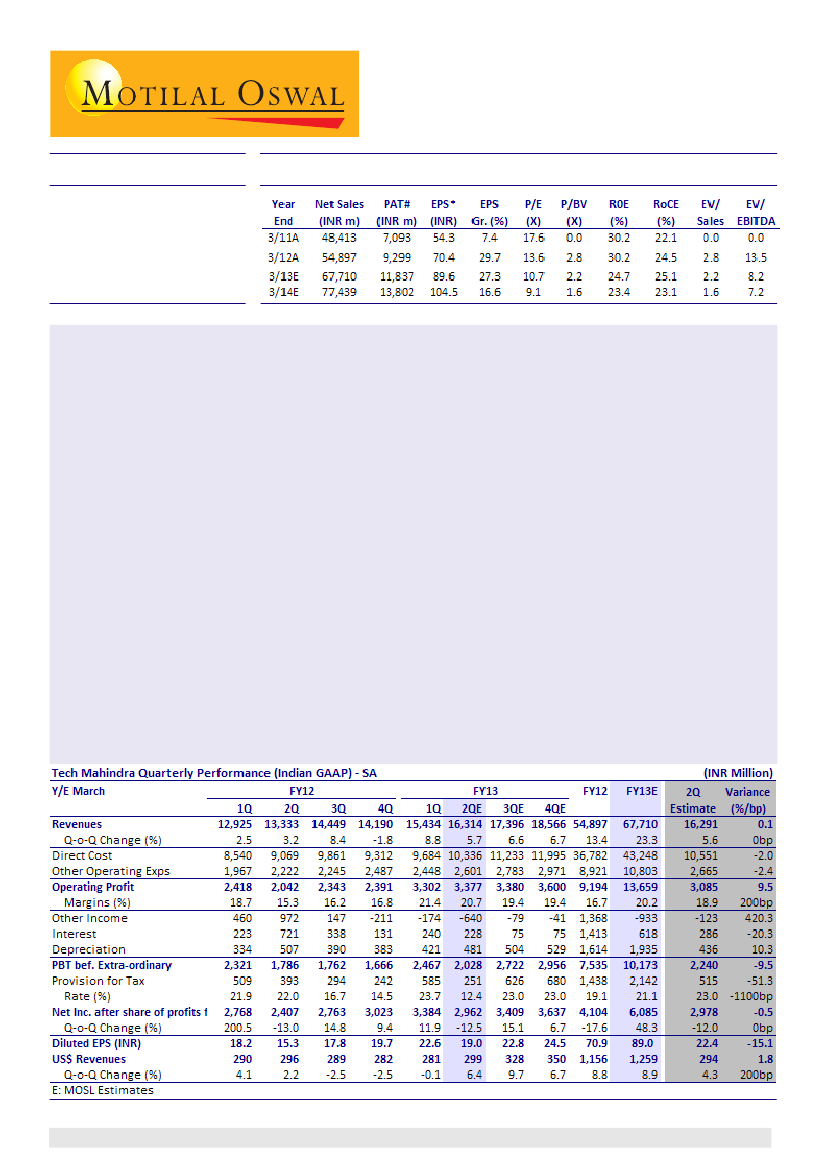

# Reported PAT incl Satyam; * EPS incl profits from Satyam, adjusted for restructuring charge

2QFY13 operating performance better than expected:

Tech Mahindra (TECHM) posted better than expected

operating results for 2QFY13 on strong traction in non-BT revenue, though BT revenue declined 3.8% QoQ.

Revenue grew 6.4% QoQ to USD299m (v/s our estimate of USD294m). Organic growth in non-BT business was

4.8% QoQ, while the acquisition of Hutchison Global Services (HGS) contributed USD13.3m.

EBITDA margin at 20.7%, higher than our estimate of 18.9%:

EBITDA margin contracted 70bp QoQ to 20.7%,

higher than our estimate of 18.9% despite headwinds from salary hikes (-150bp impact) and HGS integration

(-30bp impact). PAT was largely in-line at INR17.7b, as higher operating margin and lower tax rate (12% v/s our

estimate of 23%) were offset by higher forex losses.

Further declines possible in BT revenue:

The management cited possibility of further declines in BT on

continued restructuring activity. Outside BT, TECHM closed two large deals in Europe during the quarter, and

is chasing a few more (TCV of USD50m-150m each). However, deal closures are taking longer than it expected.

Cutting USD revenue estimates:

We have moderated our USD revenue assumptions for FY13 / FY14 by 3% /

5.7% after factoring in: [1] some declines in the BT account, going forward, and [2] delay in the integration of

Comviva acquisition (impacting FY13 revenue).

Upgrading consolidated EPS estimates:

Sustaining current margins will be challenging post full quarter revenue

from HGS, and stronger growth from lower-margin emerging geographies. Accordingly, we have modeled

lower margins but our revised estimates are still higher by 127bp / 116bp for FY13 / FY14, after lower-than-

expected wage hike and higher-than-anticipated gains from cost optimization. This, along with 3.3% / 2.2%

upgrade in our EPS estimates for Satyam drives 2.8%/3.5% upgrade in our consolidated EPS estimates.

Buy with a target price of INR1,150:

We expect TECHM to post USD revenue CAGR of 12% and EPS CAGR of 22%

over FY12-14.

Buy

with a target price of INR1,150 (11x FY14E EPS).

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Investors are advised to refer through disclosures made at the end of the Research Report.