15 November 2012

2QFY13 Results Update | Sector: Financials

Power Finance Corporation

BSE SENSEX

S&P CNX

18,670

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

M.Cap. (INR b)

M.Cap. (USD b)

5,684

POWF IN

1319.9

224/131

-8/19/6

250.8

4.7

CMP: INR190

TP: INR220

Buy

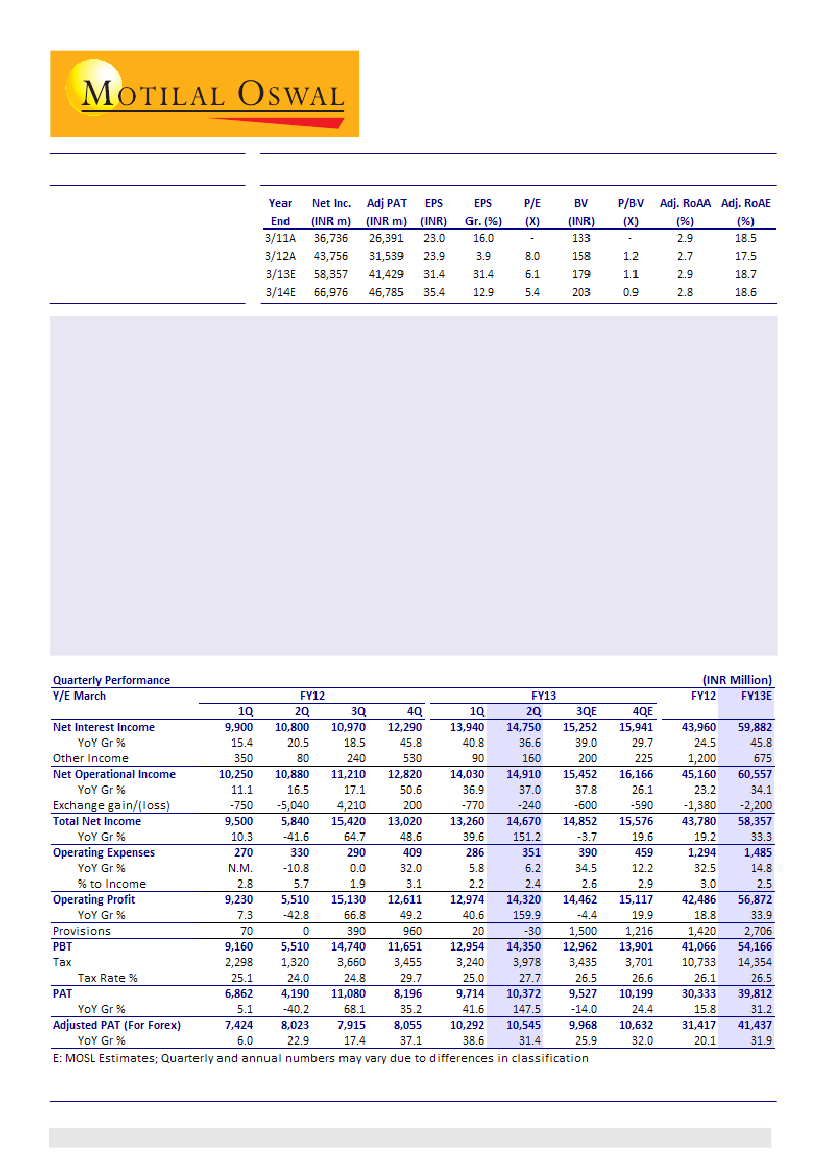

Power Finance Corp's (POWF) 2QFY13 reported PAT grew 147% YoY (lower base due to high forex loss in 2QFY12)

and 7% QoQ to INR10.4b (12% above est of INR9.3b), led by healthy asset growth and better than expected

margin performance. Asset quality remained stable.

Key highlights:

NII grew by 37% YoY and 6% QoQ to INR14.8b (5% above est) as reported NIMs improved 9bp QoQ to 4.28%.

Loans offered to discoms (as Transitional Finance) are at higher lending rates, thereby boosting yields (+27bp

QoQ), which outpaced a 16bp QoQ increase in the cost of funds during the quarter.

Loans grew 27% YoY and 4% QoQ to INR1.4t driven by generation segment loans, which too grew at a similar

pace, contributing 84% of incremental loans YoY . Loans to private sector grew much faster (+77% YoY and +9%

QoQ) resulting in an increase in the share of private sector loans to 12.2% from 11.7% QoQ, 8.7% YoY.

Asset quality remained stable QoQ, with %GNPAs at ~1% levels and provision coverage steady QoQ at ~11%.

With the intent to adhere to prudential NBFC norms, company has planned to make standard asset provisions

from 3QFY13 onwards. POWF plans to make 8bp provision in 2HFY13 and FY14 each, followed by remaining

9bp provision in FY15 to achieve cumulative 25bp standard asset provisioning.

Valuation and view:

POWF continues to grow at a rapid pace despite challenging macro environment in general

and multiple headwinds for the power sector in specific. Though the asset quality remained healthy so far, we

believe it will remain a key monitorable in the current environment. Stock trades at 0.9x FY14E BV.

Buy.

Umang Shah

(Umang.Shah@MotilalOswal.com) + 9122 3982 5521

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com) + 91 22 3982 5415

Investors are advised to refer through disclosures made at the end of the Research Report.