30 November 2012

Update | Sector: Capital Goods

Larsen & Toubro

BSE SENSEX

S&P CNX

19,171

5,825

CMP: INR1,662

TP: INR1,795

Buy

Gearing up the overseas juggernaut

Overseas business at inflexion point; could contribute 1/3rd of FY14 PAT

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

M.Cap. (INR b)

M.Cap. (USD b)

LT IN

608.9

1,720/971

-3/24/11

1,011.9

18.9

Stock performance (1 year)

We expect FY13/FY14 to be an inflexion point in Larsen and Toubro's (L&T) attempt

to diversify geographically and thus reduce the concentration risk of depending on

the domestic economy. We estimate the overseas business would contribute ~28%/

32% of profits in FY13/FY14 respectively, up significantly from ~21% in FY12.

This shall be driven by: i) increased contribution of overseas service business from

10% of consolidated profits in FY12 to 14% in FY14 and ii) incremental growth from

new geographies (Middle East, Australia, SE Asia)/new segments (hydrocarbons, large-

sized projects).

L&T has continuously adapted and evolved across economic cycles, which led to a

strong 'delivery', even in a turbulent environment. In this note, we analyze the

possible inflexion point in overseas business.

L&T is exposed to several levers across business/geographic segments and has

emerged as the E&C partner of choice in India, which provides a solid foundation to

capitalize on the next leg of investment cycle. Thus, despite a very strong near term

performance, we remain positive on L&T and believe triggers still exist to accumulate

the stock on declines.

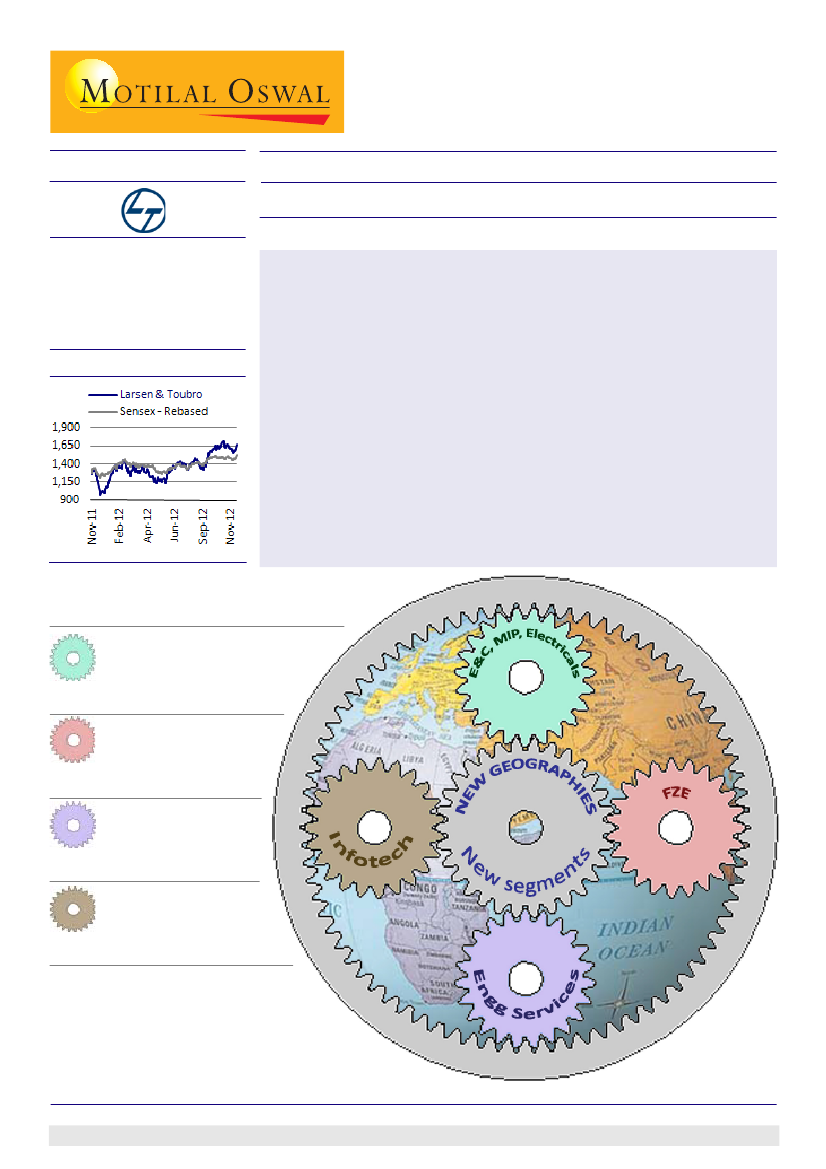

L&T's overseas business:

At an inflexion point

#1

#2

#3

#4

E&C, MIP, Electricals

Share in Cons PAT

FY12

8%

| FY14

12%

PAT CAGR 37%

(FY12-14)

FZE

Share in Cons PAT

FY12

3%

| FY14

6%

PAT CAGR 56%

Engineering Services

Share in Cons PAT

FY12

2%

| FY14

5%

PAT CAGR 66%

Infotech

Share in Cons PAT

FY12

9%

| FY14

9%

PAT CAGR 16%

#1

#4

#2

NOTE:

To accelerate growth in the technology

space, L&T has restructured the businesses:

L&T Infotech

has been reorganized around two

clusters, "Industrial" and "Services".

L&T Integrated

Engineering Services

has been rebranded as

L&T Technology

Services.

#3

Satyam Agarwal

(AgarwalS@MotilalOswal.com); +91 22 3982 5410

Deepak Narnolia

(Deepak.Narnolia@MotilalOswal.com); +91 22 3029 5126

Investors are advised to refer through disclosures made at the end of the Research Report.

1